Trade Alert - (TSLA) August 17, 2020 - SELL-STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) – STOP LOSS

SELL the Tesla (TSLA) August 2020 $1,700-1,750 in-the-money vertical Bear Put spread at $32.00 or best

Closing Trade

8-17-2020

expiration date: August 21, 2020

Portfolio weighting: 10%

Number of Contracts = 2 contracts

When you issue 300 trade alerts a year, you can count on getting snake bit at least once. This is one of those occasions.

A day after I added this short position, Tesla announced a 5:1 share split, a development which is always positive for the stock, at least for the short term.

Further complicating matters is the announced ex-dividend day in the August 21 option expiration this coming Friday when our positions expire. Elon Musk no doubt did this to maximize confusion among the shorts, with which he has been fighting a long-running battle.

If you have a large legal department good at reading fine print, I would tell you to tough it out, as this position is still in-the-money. Since you probably don’t, the wise thing to do here is to stop out for a small loss. In any case, you have substantial profits to protect. There is no point in getting greedy here.

This brings to an end my incredible streak of 31 consecutive profitable trade alerts.

I am therefore selling the Tesla (TSLA) August 2020 $1,700-1,750 in-the-money vertical Bear Put spread at $32.00 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by $1.00 cents with a second order.

This was a bet that Tesla (TSLA) would not trade above $1,700 by the August 21 option expiration day in 9 trading days. We have 4 days left.

Here are the specific trades you need to exit this position:

Sell 2 August 2020 (TSLA) $1,750 puts at………….........………$90.00

Buy to cover short 2 August 2020 (TSLA) $1,750 puts at…...$58.00

Net Proceeds…………………..…….………..………….............….....$32.00

Loss: $45.00 - $32.00 = -$13.00

(2 X 100 X -$13.00) = -$2,600 or -28.88%.

Got Hosed This Time

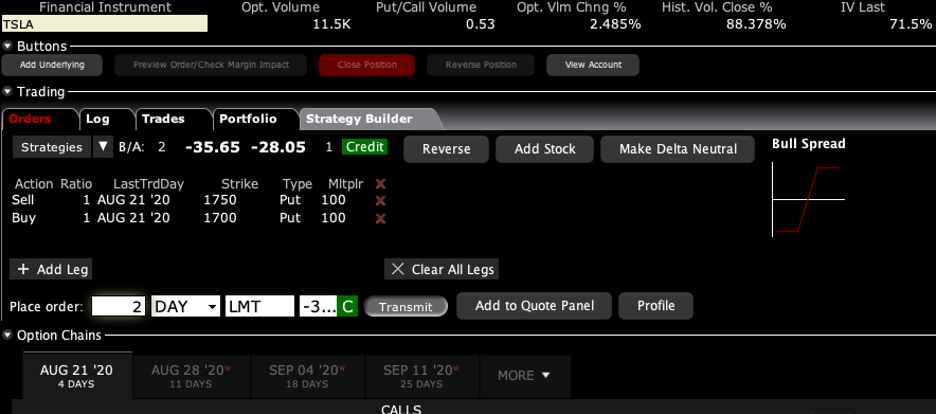

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.