Trade Alert - (TSLA) December 14, 2022 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) – TAKE PROFITS

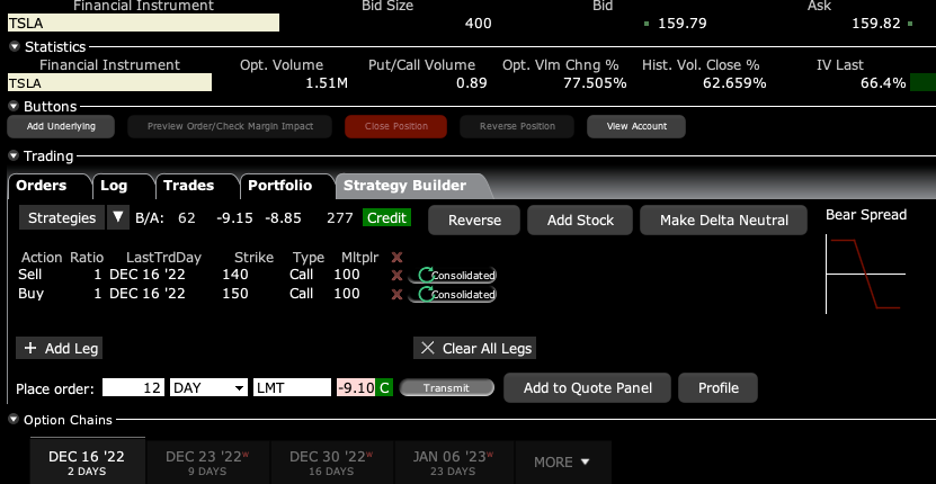

SELL the Tesla (TSLA) December 2022 $140-$150 in-the-money vertical bull call spread at $9.10 or best

Closing Trade

12-14-2022

expiration date: December 16, 2022

Portfolio weighting: 10%

Number of Contracts = 12 contracts

We are clearly in the capitulation phase of this selloff in Tesla shares and there is absolutely no way of knowing where it will stop. Human emotion is a completely unquantifiable element.

This is not the time to be greedy. With Tesla now trading at $159 and dropping 5% a day, the risk reward of continuing with this position is no longer favorable, even though we only have two more days until the December 16 option expiration.

The combined profit of the short Tesla strangle is already an impressive $1,860 and worth taking right now. The $4.00 rally that just happened is worth taking.

All the new negatives are now in Tesla’s price, the China lockdowns, the recalls, and recession fears. At the end of the day, Tesla really is a consumer discretionary stock.

Tesla is now trading at a price earnings multiple of 27X, the lowest in its history, and on par with Apple (AAPL) at 24X. I am also betting that a company that is growing at 50% a year will see its share price fall only 65% from its all-time high, which seems reasonable. If I am wrong, it is growing at a 40% rate.

Twitter will remain a distraction, but only so much of a distraction. A now $10 billion company can only drag down a former $365 billion company so much. Elon Musk has been chastised severely. But fear of Musk selling more Tesla shares to bail out Twitter is clearly driving Tesla shares down.

Tesla will remain the top EV maker for the foreseeable future.

Therefore, I am selling the Tesla (TSLA) December 2022 $140-$150 in-the-money vertical bull call spread at $9.10 or best.

As a result, you get to take home $360, or 3.41% in 15 trading days. On top of this, you can add the additional $1,500 profit you earned on the Tesla (TSLA) December 2022 $225-$230 in-the-money vertical bear put spread, which we closed out on Monday.

The short strangle worked!

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 10 cents with a second order.

This was a bet that the Tesla (TSLA) would not trade below $150 by the December 16 option expiration day in 17 trading days.

Here are the specific trades you need to close out this position:

Sell 12 December 2022 (TSLA) $140 calls at…….............….…$20.00

Buy to cover short 12 December 2022 (TSLA) $150 calls at….$10.90

Net Proceeds:…………………………...........................……….………$9.10

Profit: $9.10 - $8.80 = $0.30

(12 X 100 X $0.30) = $360, or 3.41% in 15 trading days.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.