Trade Alert - (TSLA) July 21, 2023 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

(TSLA) - EXPIRATION AT MAX PROFIT

EXPIRATION of the Tesla (TSLA) July 2023 $180-$190 in-the-money vertical bull call debit spread at $10.00

Closing Trade

7-21-2023

expiration date: July 21, 2023

Portfolio weighting: 10%

Number of Contracts = 12 contracts

With the stock now an eye-popping $80.02 or 44.46% above its farthest strike price, you get to take home $1,080, or 9.89% in 18 trading days.

Well done and on to the next trade!

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, July 24 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

After markets have big moves like we saw since January, you tend to get no moves for a couple of months. Too much performance and market action was pulled forward in H1.

Among the highest implied volatility in the market at 64.5%, a deep in-the-money call spread strategy is the best way to play this.

Tesla is now the most widely owned stock in the world and accounts for a staggering 6% of the options market.

If you don’t do options, buy the stock on a bigger dip. Even if the (SPY) revisits its 2022 low at $355, I doubt that Tesla falls much from here.

An onslaught of new Tesla positives is hitting the market in 2023. The new Cybertruck comes out and there is a two-year waiting list out the gate and deposits in hand for 1.5 million vehicles.

The company is generating such enormous cash flows that it is like to carry out $10 billion in share buybacks, especially with the price this low. There are no real competitors on the horizon, except for a handful with big losses outside of China.

All the new negatives are now in the price, the China lockdowns, the product recalls, the Shanghai shutdown, recession fears, and even Elon Musk himself going from a premium to a discount are now in the price. At the end of the day, Tesla really is a consumer discretionary stock.

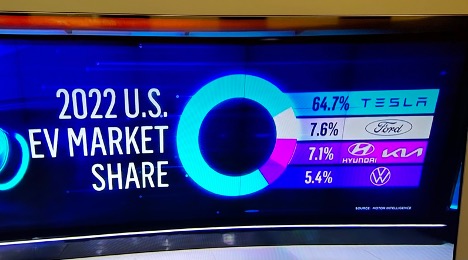

Tesla will remain the top EV maker for the next decade easily.

This was a bet that the Tesla (TSLA) would not trade below $190 by the July 21 option expiration day in 18 trading days.

Here is the specific accounting you need to close out this position:

EXPIRATION of 12 July 2023 (TSLA) $180 calls at……...….…$80.02

EXPIRATION of short 12 July 2023 (TSLA) $190 calls at…….$70.02

Net Proceeds:…………………........................……….……….………$10.00

Profit: $10.00 - $9.10 = $0.90

(12 X 100 X $0.90) = $1,080, or 9.89% in 18 trading days.