Trade Alert - (TSLA) October 4, 2024 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information on what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) - TAKE PROFITS

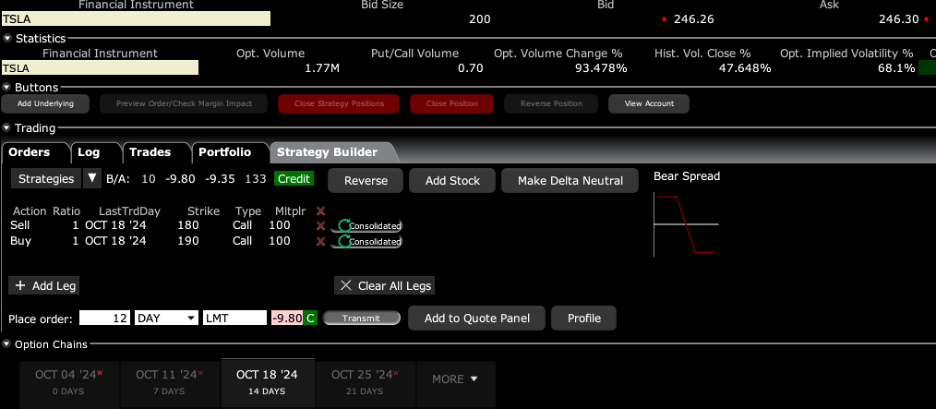

Sell the Tesla (TSLA) October 2024 $180-$190 in-the-money vertical bull call debit spread at $9.80 or best

Closing Trade

10-4-2024

expiration date: October 18, 2024

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

My bet that Tesla would keep rising into the October 10 Robotaxi event proved correct.

I don’t want to let double positions grow hair on them. With this position, we already have 86.67% of the maximum potential profit. The risk/reward of continuing ten more days until the October expiration is no longer favorable. Even though I am up a monster 50% so far this year, I don’t want to get too overconfident.

Therefore, I am selling the Tesla (TSLA) October 2024 $180-$190 in-the-money vertical bull call debit spread at $9.80 or best.

As a result, you get to take home $1,560 or 15.29% in 14 trading days. Well done and on to the next trade.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 2 cents with a second order.

For the first time ever, Tesla is not trading off their monthly vehicle sales, which this year have been flat. Instead, the stock is focusing on the company’s long-term goals, many of which are finally starting to kick off profits.

Those would include full self-driving software (FSD), the global electric charging network, rollout of the Cybertruck and semis trucks, lithium processing and recycling, solar energy, and industrial scale battery storage, and other moonshots we haven’t heard about. Wireless charging should go mainstream next year.

These were always the basis of my long-term forecast for the shares of $1,000.

We also have the enormous advantage with this trade in that the options are sporting a sky high 61% implied volatility.

Tesla’s big Robotaxi event will take place on October 10 and the stock usually rises going into these. Drones have spotted these vehicles racing around the Warner Brothers lot in Los Angles and there has been a very active mapping satellite in the neighborhood.

Elon Musk really checkmated the rest of the EV industry with his massive price cuts and buyer incentives, which is 35% after adding in newly qualifying government subsidies.

With this trade, I was willing to bet that Tesla shares would not fall below $190 by the October 18 option expiration in 12 trading days.

Tesla will remain the top EV maker for the next decade easily.

Here are the specific trades you need to execute this position:

Sell 12 October 2024 (TSLA) $180 calls at…........……..........…$67.00

Buy to cover short 12 October 2024 (TSLA) $190 calls at…….$57.20

Net Proceeds:…………………………….………..........................……$9.80

Profit: $9.80 - $8.50 = 1.30

(12 X 100 X $1.30) = $1,560 or 15.29% in 14 trading days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.