Trade Alert - (TWLO) September 9, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - (TWLO) – BUY

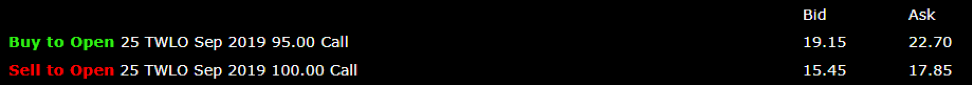

BUY Twilio Inc. (TWLO) September 2019 $95-$100 in-the-money vertical BULL CALL spread at $4.28 up to $4.40

Opening Trade

9-9-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Twilio opened up down more than 6% this morning and I am willing to bet that it can hold $100 level in the next 12 days.

Prices are all over the map and it's important to execute limit orders as prices duck and dive on the spike down.

I am infatuated with this company and its growth is really something to appreciate but this is simply a bet that Twilio will fall less than I expect in the short term.

Tech growth companies are getting battered around this morning and many companies of Twilio’s ilk are down big, I will be out of this stock on any meaningful move up.

Ironically, the FANGs are enjoying a rather stable morning with anti-trust concerns sliding off of their back like water.

The part of tech growth will go down the most in a global slowdown but there are opportunities from the short and long side here.

Anyone risk-adverse should just buy and hold Twilio, it’s a great company and please continue to read to understand why.

Twilio Inc. provides a cloud communications platform that enables developers to build, scale, and operate communications within software.

Twilio doesn’t get as much PR as it should because making sure the backend communication channels are executing at optimum levels is not exactly a sexy part of tech with shiny smartphones and wearable gadgets.

This company produces software and is good at what they do.

Many of you might not have even heard of them but I am sure you have heard of companies such as Uber, Lyft, and Airbnb.

This trio of unicorns is all powered by Twilio’s communication technology that is best of breed in their genre of cloud software.

More specifically, Twilio is a platform as a service (PaaS) firm offering programmatic phone call functions, can automate sending and receiving text messages, and performs other communication functions using its web service APIs.

When your shaggy-haired Uber driver calls asking you to reveal yourself out of a concrete apartment block or your lavish gated community, this is all facilitated by Twilio’s technology.

At the 2018 Twilio Signal Conference in San Francisco, Twilio indicated that its latest “call center in a box” product called Flex was up and running after announcing in March last year.

Prior to Twilio’s roll-out, this type of call center functionality was only reserved for the Fortune 500 companies that could afford expensive software to serve its minions of customers.

The small guy was left out in the cold as usual.

Twilio has reshaped the call center and, at $1 per hour or $150 per month, has made itself a gamechanger for SMEs who don’t have the manpower or capital to fund exorbitant backend operations.

Twilio is really going after anyone with a light or bulky-shaped wallet as you see from their all-star lineup of customers. U-Haul, real estate website Trulia, and data analytics firms Scorpion and Centerfield are just a few of their customers proving the incredible flexibility and inclusive nature of the software.

Buy 25 September 2019 (TWLO) $95 calls at……..…….………$20.93

Sell short 25 September 2019 (TWLO) $100 calls at………….$16.65

Net Cost:……………………..…….………..……...............................$4.28

Potential Profit: $5.00 - $4.28 = $0.72

(25 X 100 X $0.72) = $1,800 or 18.00% in 12 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.