Trade Alert - (UNP) April 19, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (UNP) – BUY

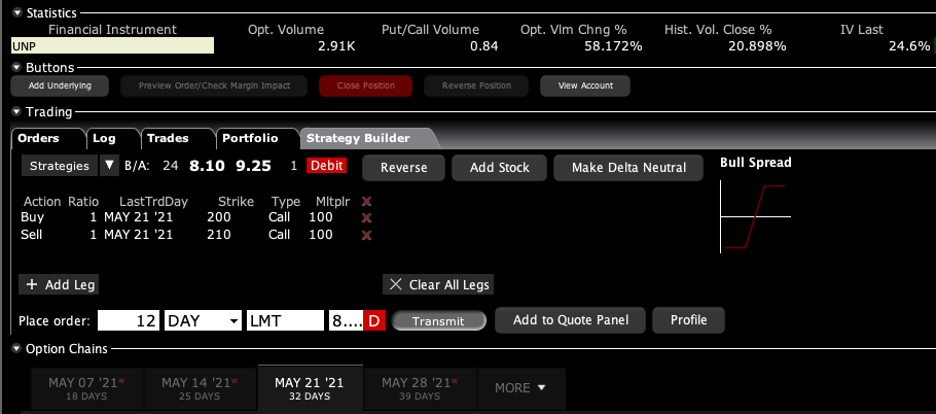

BUY the Union Pacific (UNP) May 2021 $200-$210 in-the-money vertical Bull Call spread at $8.70 or best

Opening Trade

4-19-2021

expiration date: May 21, 2021

Portfolio weighting: 10%

Number of Contracts = 12 contracts

If you can’t do options, buy (UNP) stock on the next big dip. I expect Union Pacific to make it to $300 this year.

When the US economy recovers, you suddenly have to move a lot more stuff. There is no better stuff moving industry than railroads, which can do it cheaper than anyone else.

Work out the price per pound for moving bulk freight and it works out to a car getting five miles per gallon.

You can subdivide railroads into north/south ones and east/west ones. A Biden administration will bring a revival of east-west trade, thanks to greater exports of commodities, coal, and agricultural goods to China. North/south rail lines do better, thanks to more trade with Mexico.

I am therefore buying the Union Pacific (UNP) May 2021 $200-$210 in-the-money vertical Bull Call spread at $8.70 or best

Don’t pay more than $9.30 or you’ll be chasing.

Please note that these strikes process benefit from enormous support from the 200-day moving average at $198.25.

For more about this amazing railroad, please see my special report below.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

This is a bet that Union Pacific (UNP) will not fall below $210 by the May 21 options expiration day in 19 trading days.

Here are the specific trades you need to execute this position:

Buy 12 May 2021 (UNP) $200 calls at………….………$24.00

Sell short 12 May 2021 (UNP) $210 calls at……….....$15.30

Net Cost:……………………..…….………..……....…….….....$8.70

Potential Profit: $10.00 - $8.70 = $1.30

(12 X 100 X $1.30) = $1,560 or 14.94% in 19 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

The Case for Railroads

When copper and Freeport McMoRan (FCX) run up, there is one thing I always do automatically, reflexively, and without thinking about it.

I buy railroads.

This is because a revival of Chinese infrastructure building is driving the recent meteoric rise in the red metals.

The US is one of the largest producers of copper, fourth in the world after Chile, Peru, China, with 1,520 metric tonnes in annual output.

So how does the metal get to the Middle Kingdom?

It rides the Union Pacific Railroad (UNP).

(UNP) has predominantly East/West routes and will benefit the most from increasing trade with China that will come with a new Biden administration.

China will finance half of any US government debt going forward to finance the president’s substantial spending plans, so there isn’t going to be a trade war here.

If you want to reduce your risk, buy the iShares Transportation Average ETF (IYT). The two largest holdings here are (UNP) and Kansas City Southern (KSU).

Baskets of shares always have lower volatility than single stocks, but lower returns as well.

Buy the railroads. At least, if you are early, you still have a functioning, cash flow-positive business.

Railroads all look like ripe “buy on dips” low-hanging fruit to me.