As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (USO)- BUY

Buy the United States Oil Fund (USO) May, 2016 $11.50-$12.50 in-the-money vertical bear put spread at $0.83 or best

Opening Trade

5-9-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 120 contracts

This is an aggressive high-risk trade with a very large payoff, some 20.48% in 9 trading days.

You can pay all the way up to $0.90 for this spread and it still makes sense.

If you can?t do the options, buy outright the ProShares Ultra Short Bloomberg -2X ETF (SCO). For this funds prospectus and a fuller explanation, please click here at

http://www.proshares.com/funds/sco.htm

This is a bet that the United States Oil Fund (USO) will not rise above $11.50 over the next 9 trading days, a new high for 2016. For that to happen, crude oil would have to jump from the current $44.56 to over $47.00, a gain of $2.44, or 5.47%.

While not impossible, such a move is unlikely in the face of a rising US dollar, which is shaving points off the entire commodity and energy space by the day.

Saudi oil minister Ali bin Ibrahim Al- Naimi was fired over the weekend for being too dovish on oil production. The hawk that replaced him is expected to ramp up the Kingdom?s oil production from 10.5 to 11 million barrels a day by the summer.

This is in the face of rapidly rising production from Iraq and Iran. If Libya can get its act together, and it might, it would be the final nail in the coffin for oil.

May is also the weakest oil demand month of the year, when many refineries are down for maintenance.

It is an old trading nostrum that if you throw good news on a commodity and it fails to rise, you sell the heck out of it.

Over the weekend we also learned that the massive fires in Alberta have taken 1 million barrels a day of oil tar sands production off the market. To see oil prices fall against this backdrop is nothing less than amazing.

Keep in mind that low priced options like those for the (USO) generate large numbers of contracts to execute a trade, meaning that commissions are more important than usual.

Now would be a great time to ask your broker for a commission cut. If you are paying too much, it will eat up a good chunk of your profits on this position.

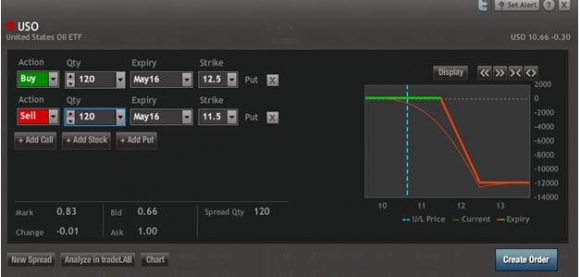

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/.

You must be logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 9 days to expiration.

Here are the specific trades you need to execute this position:

Buy 120 May, 2016 (USO) $12.50 puts at????.?.??$1.70

Sell short 120 May, 2016 (USO) $11.50 puts at.???.?..$0.87

Net Cost:???????????????????......$0.83

Potential Profit: $1.00 - $0.83 = $0.17

(120 X 100 X $0.17) = $2,040 or 20.48% profit in 9 trading days.