Trade Alert - (USO) October 11, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (USO)- BUY

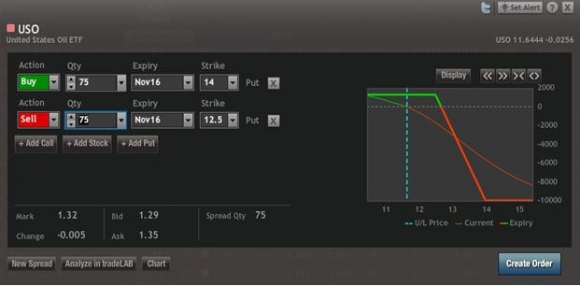

Buy the United States Oil Fund (USO) November, 2016 $12.50-$14.00 in-the-money vertical bear put spread at $1.32 or best

Opening Trade

10-11-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 75 contracts

You can pay all the way up to $1.40 for this spread and it still makes sense.

If you can?t do options, buy the ProShares Ultra Short Bloomberg Crude Oil ETF (SCO) for a quick trade.

The concept behind this trade is really very simple.

This is a bet that the United States Oil Fund (USO) will not rise above $12.50 by the November 18 expiration date, a new high for 2016.

An agreement to cap production at the Algiers OPEC meeting delivered a monster 20.40% short covering rally in oil. The quotas will be fixed at the next OPEC meeting in Vienna on November 30.

However, not a single person in the industry believes the agreement will be finalized, or if finalized, not honored. Cheating inside OPEC is legendary. The Saudis know this.

Therefore, I think oil will put in a short term top here, and then trade sideways to down for the next month.

In addition, the current $51/barrel I see on my screen is going to stimulate a ton of new production from US frackers. Thanks to rapidly accelerating technology, American drillers can turn oil production on and off faster than at any time in history.

Also to consider are Iraq?s military victories against ISIS and the outbreak of stability in Libya, both of which will generate substantial new oil supplies.

I think the bear market in oil is over, thanks to a recovering global economy. I intend to write a major research piece as to why in a few days.

I just don?t think we are blasting though to a new yearly high in oil in the next 28 trading days, given the OPEC dynamics. Hence, the trade alert.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video How to Execute a Vertical Bear Put Debit Spread.

Keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile across platforms.

Here are the specific trades you need to execute this position:

Buy 75 November, 2016 (USO) $14.00 puts at????.?.??$2.41

Sell short 75 November, 2016 (USO) $12.50 puts at.???.?..$1.09

Net Cost:????????????????????......$1.32

Potential Profit: $1.50 - $1.32 = $0.18

(75 X 100 X $0.18) = $1,350, or 13.64% profit in 28 trading days.