Trade Alert - (V) April 5, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (V) –BUY

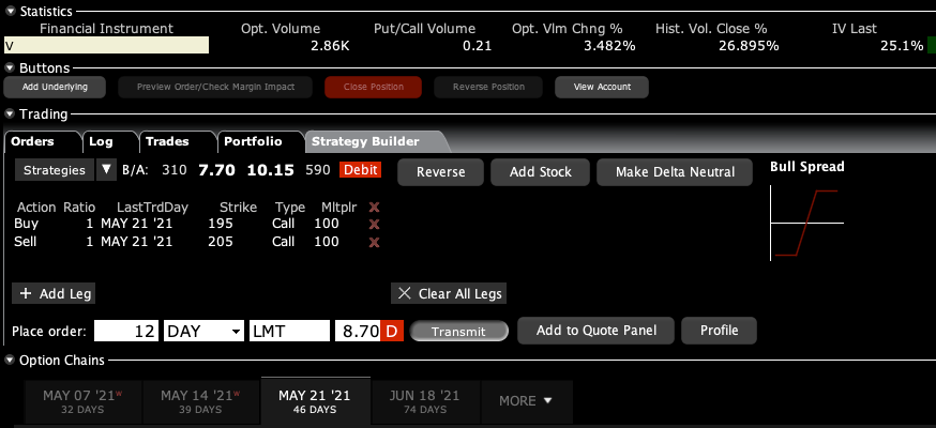

BUY the Visa (V) May 2021 $195-$205 in-the-money vertical Bull Call spread at $8.70 or best

Opening Trade

4-5-2021

expiration date: May 21, 2021

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Stock players should go ahead and buy the shares, which probably have a double in them over the next three years.

When the government spends money, you spend more money, most likely with a credit card.

When the economy digitizes, a greater share of your spending goes online via credit cards.

Planning a trip for the first time in a year? Chances are you’ll buy those tickets also with a credit card.

That makes the credit card companies one of the best plays out there on the infrastructure budget.

I am therefore buying the Visa (V) May 2021 $195-$205 in-the-money vertical Bull Call spread at $8.70 or best.

Don’t pay more than $9.50 or you’ll be chasing.

This position also gets huge downside protection from downside support by the 200-day moving average at 203.88.

Visa is the quality play in the credit card area, recently growing at the expense of Master Card and American Express. The world is rushing into an all-digital economy and (V) is a major beneficiary.

They also have profited hugely from the move to “touchless” transactions where people are afraid of using physical cash for fear of contracting Covid-19.

This cycle of Covid-19 infections has peaked out and has declined by 80%, at least for the short term.

As a result, I believe the core long FANG trade is long overdue for a break. Instead, I think we are about to witness a major rotation into domestic economic “recovery” stocks like Visa. Stocks will keep going up, but the leadership will change. Bonds and gold are also due for profit-taking.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and increase your bid by 10 cents with a second order.

This is a bet that Visa (V) will not trade below $205 by the May 21 option expiration day in 28 trading days.

Here are the specific trades you need to enter this position:

Buy 12 May 2021 (V) $195 calls at………..….………$26.00

Sell short 12 May 2021 (V) $205 calls at……….…..$17.30

Net Cost:……………………..…….………..………….….....$8.70

Potential Profit: $10.00 - $8.70 = $1.30

(12 X 100 X $1.30) = $1,560, or 14.94% in 28 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.