Trade Alert - (V) January 10, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (V) – BUY

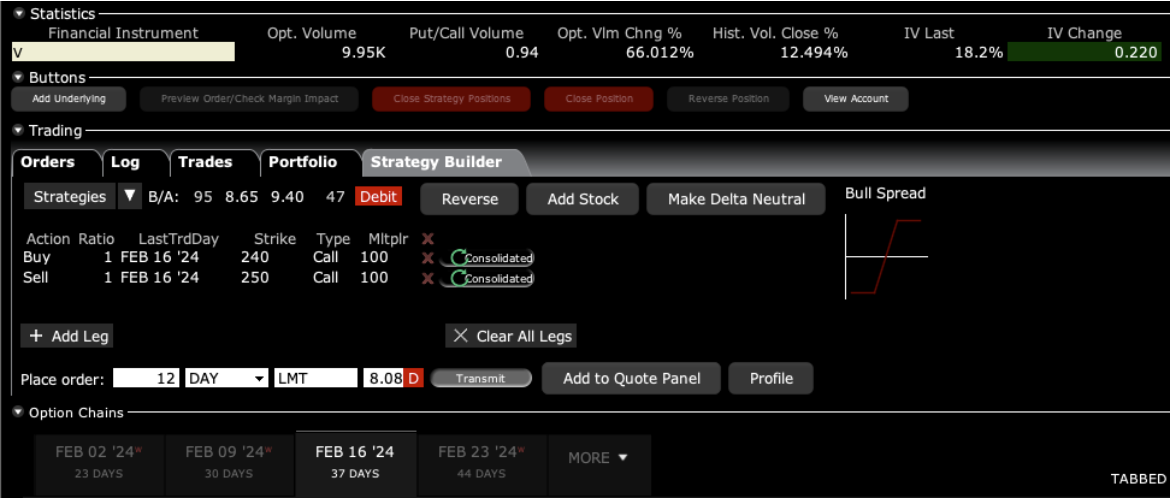

BUY the Visa (V) February 2024 $240-$250 in-the-money vertical Bull Call debit spread at $8.80 or best

Opening Trade

1-10-2024

expiration date: February 16, 2024

Number of Contracts = 12 contracts

Visa is the world’s largest credit card company. It is highly sensitive to any recovery in the economy, which feeds straight into more fee income.

To learn more about the company, please visit their website at https://usa.visa.com

I am therefore buying the Visa (V) February 2024 $240-$250 in-the-money vertical Bull Call spread at $8.80 or best.

Don’t pay more than $9.20 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

A classic example is Visa (V) which I’m liking more than ever right now, which I aggressively bought on the last two market downturns. The company has ample cash flow, carries no net debt, and with high inflation is a guaranteed double-digit sales and earnings compounder.

It clears a staggering $14.8 trillion worth of transactions a year. With $32.7 billion in net revenues in 2023 and $17.27 billion in net income, it has a technology-like 55% profit margin. Visa is also an aggressive buyer of its own shares, about 3% a year. That’s because it trades at a discount to other credit card processors, like Master Car (MA) and American Express (AXP).

The only negative for Visa is that it gets 55% of its earnings from aboard, which have been shrunken by the strong dollar. That is about to reverse.

It turns out that digital finance never made a dent in Visa’s prospects, as the dreadful performance of PayPal (PYPL) and Square (SQ) shares amply demonstrate.

This is a bet that Visa will not fall below $250 by the February 16 option expiration in 26 trading days.

Here are the specific trades you need to execute this position:

Buy 12 February 2024 (V) $240 calls at………….………$26.00

Sell short 12 February 2024 (V) $250 calls at……..……$17.20

Net Cost:………………………….........……...........…….….....$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(12 X 100 X $1.20) = $1,440, or 13.64% in 26 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.