Trade Alert - (VEEV) August 28, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - Veeva Systems Inc. (VEEV) – BUY

BUY the Veeva Systems Inc. (VEEV) September 2019 $135-$140 in-the-money vertical BULL CALL spread at $4.10 up to $4.35

Opening Trade

8-28-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 23 contracts

We are diving back into Veeva Systems after the earnings announcement.

A few software companies downgraded guidance giving most enterprise cloud stocks a kick in the teeth this morning.

It’s time to roll down the strike prices and use this 5% drop in this morning’s prices as a short-term trade, the ironic part of this, Veeva had a good earnings report but that takes a backseat to any macro negatives in today’s headlines.

This sideways whipsawing moving market isn’t the best to just sit and wait until your strikes get cut down from underneath you.

The trade war has unfortunately scaled back earnings growth and turned the narrative into an earnings recession, meaning we won’t experience meaningful upside in the short-term.

If you thought there was no cloud stock for healthcare, then you thought wrong.

Veeva Systems offers cloud-based solutions for the pharmaceutical and life sciences industries.

Not only do they offer these cloud products, they are one of the best at what they do.

Veeva’s software-as-a-service model helps deliver industry-specific tools for customer relationship management, content management, and many other enterprise applications much like Salesforce.

Fiscal 2020 and 2021 are estimated to be homeruns too, so what’s not to like?

Don’t pay more than $4.35.

Execute limit order, prices are wilder than an angry bull.

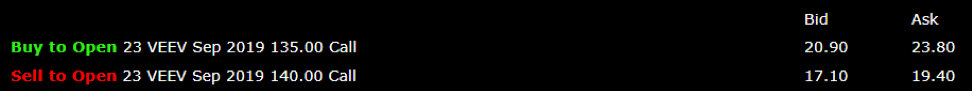

Here are the specific trades you need to execute this position:

Buy 23 September 2019 (VEEV) $135 calls at………….………$22.35

Sell short 23 September 2019 (VEEV) $140 calls at………….$18.25

Net Cost:……………………..…….………..……..............................$4.10

Potential Profit: $5.00 - $4.10 = $0.90

(23 X 100 X $0.90) = $2,070 or 20.70% in 24 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.