Trade Alert - (VXX) November 16, 2016

When a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what security to buy, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

?

Trade Alert - (VXX)- BUY

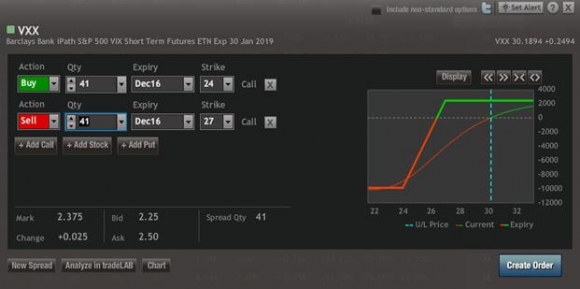

Buy the iPath S&P 500 Short-Term Futures ETN (VXX) December, 2016 $24-$27 in-the-money vertical bull call spread at $2.37 or best

Opening Trade

11-16-2016

Expiration Date: December 16, 2016

Portfolio weighting: 10%

Number of Contracts = 41 contracts

You can pay up to $2.50 and this trade still makes sense.

This is a bet that the iPath S&P 500 Short-Term Futures ETN (VXX) won?t trade below the $27 level by the December 16th expiration date in 21 trading days.

If you can?t do the options trade, stand aside. Time decay is a big part of this trade.

The Volatility Index (VIX) kissed the $13 handle this morning, which has been a great entry point on the long side for the past year. The (VXX) has just plunged 20.55% in the past 10 days.

Long volatility ahead of the recent monster moves in all asset classes sounds like a great idea.

This position will also act as a nice hedge against our existing short positions in the US Treasury bond (TLT) market.

The nice thing about a spread like this is that it largely mitigates the huge contango working against the (VXX).

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of OptionsHouse.

If you are uncertain about how to execute this options spread, please watch my training video ?How to Execute a Bull Call Spread?

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Paid subscribers, be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

Here Are the Specific Trades You Need to Execute This Position:

Buy 41 December, 2016 (VXX) $24 calls at????.?.??$6.40

Sell short 41 December, 2016 (VXX) $27 calls at.????..$4.03

Net Cost:???????????????????........$2.37

Potential Profit: $3.00 - $2.37 = $0.63

(41 X 100 X $0.63) = $2,583 or 26.58% in 21 trading days