Trade Alert - (WORK) January 28, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - Slack Technologies, Inc. (WORK) – SELL – TAKE PROFITS

SELL Slack Technologies, Inc. (WORK) February 2020 $25-$28 in-the-money vertical BEAR put spread at $2.95

Closing Trade

1-28-2020

expiration date: February 21, 2020

Portfolio weighting: 10%

Number of Contracts = 37 contracts

This was a short-term trade that Slack won’t rise 10% in 36 days and this trade worked out perfectly.

There are an extra 5 cents on the table that you can cash in if you hold until expiration, the odds of that happening is 87% even with today’s up move of 4%.

Coming out here means that we have harvested 85.3% of the maximum profit in this trade and if the virus suddenly gets contained, tech stocks could see a massive short-term rally.

I will seriously consider reestablishing another put spread if Slack Technologies moves back into the $23 range.

Good job and onto the next trade.

Why do we hate Slack?

Slack was a 2019 IPO tech company and is directly competing with Microsoft and this is a trade more about Microsoft than it is Slack.

The company offers a chat platform for employees to talk to each other.

They advertise that its better than email but isn’t email good enough already?

Well, Microsoft has collected its resources together and is squeezing out Slack with their own iteration of a work-based chat platform. The data is certainly ugly for Slack lately.

Slack is down over 2% on the news this morning that Microsoft is launching a major new ad campaign for Teams, its work-communication app, which has been duking it out with Slack for dominance in the workplace.

If anyone thinks Microsoft’s Slack is worse than Slack’s Slack, Microsoft will just turn on the marketing spigot and outspend Slack until they suffocate.

A new global ad campaign from Microsoft will aim to sell “The Power of Teams,” juxtaposing old-school conference room meetings, complete with packets of printed-out charts and spilled coffee as phones are passed, versus what the company pitches as a new way of working. The company worked with its agency, Interpublic’s McCann, on the campaign.

It will launch in the U.S. on Sunday during the NFL playoffs and will include TV ads, podcasts, digital and out-of-home placements. The campaign will launch in February in the U.K., France and Germany.

This certainly doesn’t help Slack’s share price or market share.

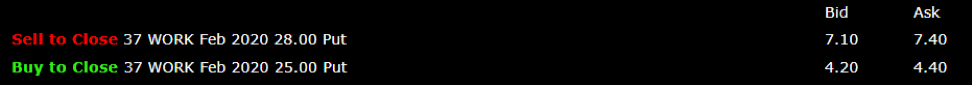

Here are the specific trades you need to execute this position:

Sell 37 February 2020 (WORK) $28 put at…………..........………$7.25

Buy to cover short 37 February 2020 (WORK) $25 put at…….$4.30

Net Proceeds:……………………..…….……...................…..…….....$2.95

Profit: $2.95 - $2.65 = $.30

(37 X 100 X $.30) = $1,110 or 11.10%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.