Trade Alert - (WYNN) February 24, 2020 - CANCEL IF NOT YET EXECUTED

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (WYNN) - CANCEL

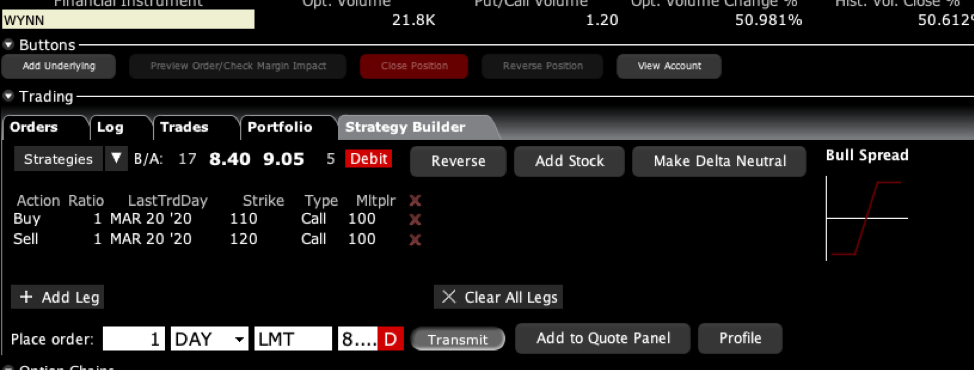

BUY the Wynn Resorts (WYNN) March 2020 $110-$120 in-the-money vertical BULL CALL spread at $8.60 or best

IF YOU HAVE NOT YET EXECUTED THIS ORDER, PLEASE CANCEL IT IMMEDIATELY. MARKET CONDITIONS HAVE DRAMATICALLY WORSENED OVER THE WEEKEND.

Opening Trade

2-21-2019

expiration date: March 20, 2020

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Here are the specific trades you need to execute this position:

Buy 12 March 2020 (WYNN) $110 calls at…...….……$21.00

Sell short 12 March 2020 (WYNN) $120 calls at…….$12.40

Net Cost:………………………….………......…...…..….….....$8.60

Potential Profit: $10.00 - $8.60 = $1.40

(12 X 100 X $1.40) = $1,680 or 16.27% in 20 trading days.