Trade Alert - (X) August 16, 2017

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (X) - BUY

BUY the US Steel (X) September, 2017 $21-$22 in-the-money vertical bull call spread at $0.86 or best

Opening Trade

8-16-2017

expiration date: September 15, 2017

Portfolio weighting: 10%

Number of Contracts = 116 contracts

I believe that while the stock market will keep going up for the rest of 2017, the sector leadership will change.

The FANG's will slowdown, while buying will rotate over to financials and industrials.

A recently strengthening US dollar confirms this trend.

I am therefore taking on a position in the US Steel (X) September, 2017 $21-$22 in-the-money vertical bull call spread.

This is a bet that (X) will not trade below $22 by the September 15 options expiration in 22 trading days.

Don't pay more than $0.90 for this position or you'll be chasing.

US Steel is the largest steel producer in the United States, and the fifteenth largest in the world.

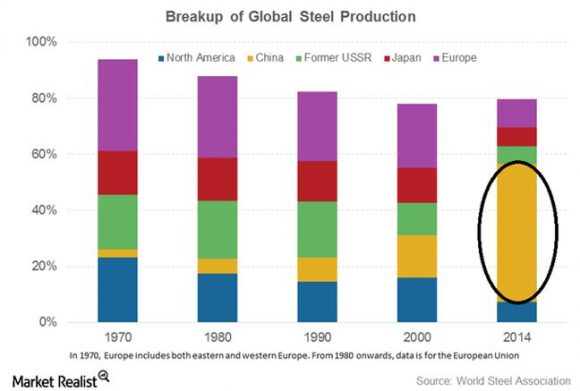

For the last three decades, it big headache has been China, which has rapidly taken over the bulk of the world steel market, thanks to a highly aggressive discount pricing strategy (see chart below).

Belief that harsh anti-Chinese policies would become the company's savior in the wake of the Trump election win caused the shares to more than double in November.

The shares then gave back the entire gain when it became clear than no Trump economic policies would be implemented in 2017.

In the meantime, China voluntarily cut its steel exports to the US by 29% YOY. The impact on US steel earnings will be dramatic.

Also making (X) attractive is the fact that the shares are moving off of very solid long-term support on the charts. Today is the upside breakout day.

So if we get another stock market correction, the downside risk in (X) shares will be very limited.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute a Vertical Bull Call Spread at

http://members.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Here are the specific trades you need to execute this position:

Buy 116 September, 2017 (X) $21 calls at..........................................................$4.10

Sell short 116 September, 2017 (X) $22 calls at....................................................$3.24

Net Cost: ..............................................................................................................

Potential Profit: $1.00 - $0.86 = $0.14

(116 X 100 X $0.14) = $1,624 or 16.27% in 22 trading days.