Trade Alert - (XOM) November 18, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (XOM) - BUY

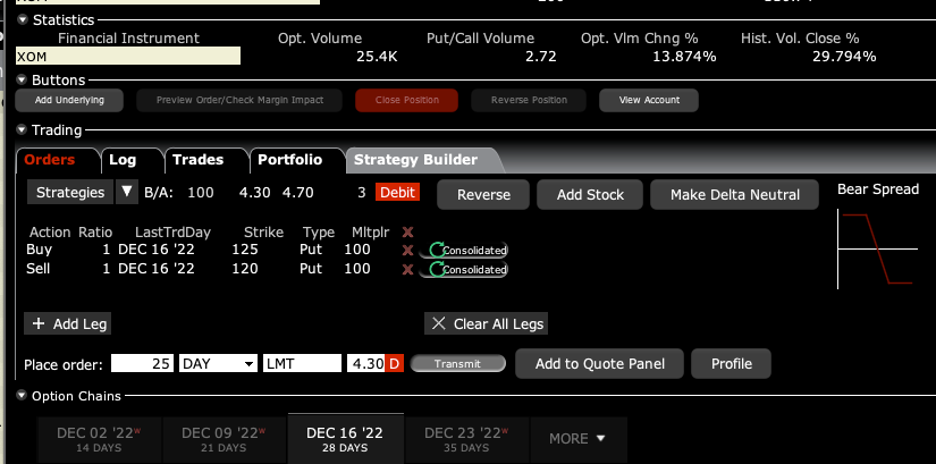

Buy the ExxonMobil (XOM) December 2022 $120-$125 in-the-money vertical bear put spread at $4.30 or best

Opening Trade

11-18-2022

expiration date: December 16, 2022

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Oil is breaking down here, losing the $80 handle this morning. This is despite the fact that we are entering peak demand.

This could be happening because Russia’s continuing retreat from Ukraine could lead to an eventual tsunami of Russian oil hitting the market in 2023. We also could finally be seeing EV make a dent in oil demand.

EV productions will top 1.5 million this year, and 20 million in 2032. Some 50% of US oil production now goes to automobiles and that market will eventually disappear.

And while oil prices have been flat-lining for months, the shares of ExxonMobil have been on an absolute tear, up some 38% since the September low.

Another nail in the coffin for the oil industry was the disastrous outcome of the midterms elections. No red wave means no congressional air cover, which is desperately needed during a period of accelerating climate change.

In addition, I know you all of substantial longs out there that we have been Hoovering up since the October low. This position would make a nice hedge against those longs, at least for a month.

Therefore, I am buying the ExxonMobil (XOM) December 2022 $120-$125 in-the-money vertical bear put spread at $4.30 or best.

Don’t pay more than $4.60 or you will be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

If you don’t do options, stand aside. This is a short-term options play only.

This is a bet that the ExxonMobile (XOM) will not trade above $120.00 by the December 16 options expiration day in 20 trading days.

Here are the specific trades you need to execute this position:

Buy 25 December 2022 (XOM) $125 puts at………...…$14.00

Sell short 25 December 2022 (XOM) $120 puts at…….$9.70

Net Cost:………………………….………......................………$4.30

Potential Profit: $5.00 - $4.30 = $0.70

(25 X 100 X $0.70) = $1,750, or 16.28% in 20 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.