Trade Alert - (XOM) December 6, 2022 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (XOM) – TAKE PROFITS

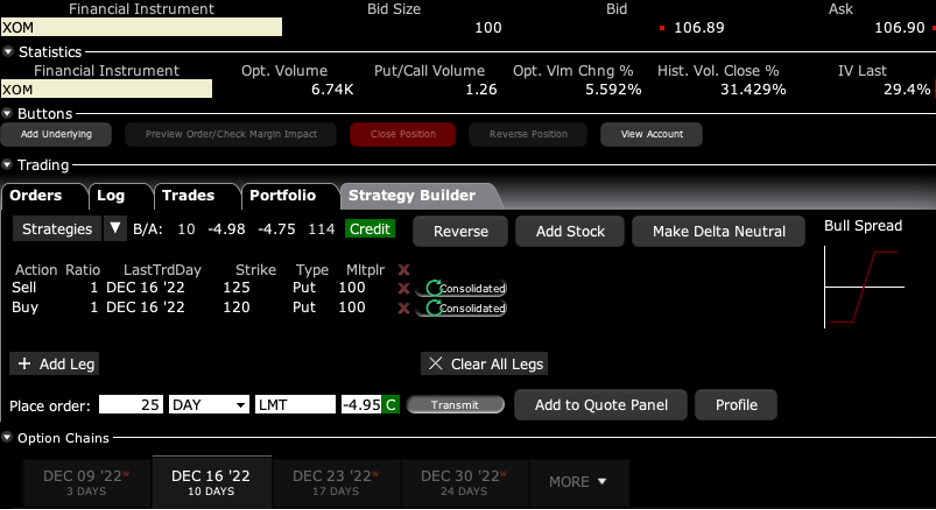

SELL the ExxonMobil (XOM) December 2022 $120-$125 in-the-money vertical bear put spread at $4.95 or best

Closing Trade

12-6-2022

expiration date: December 16, 2022

Portfolio weighting: 10%

Number of Contracts = 25 contracts

As I expected, oil prices completely fell to pieces going into the OPEC Plus meeting. Oil is the last thing in the world you want to own going into a recession unless you want to store 100,000 barrels in your backyard.

We got an extra bonus from Russia’s failing Ukraine War. We just learned that Moscow bought 57 aging tankers, many diverted from the scrapyards, to front run the $60 cap in oil prices.

This sets up the best-case scenario for oil bears. Not only has the $60 cap gone global, we now have several million barrels of Russian oil at sea waiting to snuff out any rally.

Therefore, I am selling the ExxonMobil (XOM) December 2022 $120-$125 in-the-money vertical bear put spread at $4.95 or best.

As a result, you get to take home $1,625, or 15.12% in 10 trading days. Well done and on to the next trade.

I believe that Russia’s continuing retreat from Ukraine could lead to an eventual tsunami of their oil hitting the market in 2023. We also could finally be seeing EV make a dent in oil demand.

EV productions will top 1.5 million this year, and 20 million in 2032. Some 50% of US oil production now goes to automobiles and that market will eventually disappear.

And while oil prices have been flat-lining for months, the shares of ExxonMobil have been on an absolute tear, up some 38% since the September low.

Another nail in the coffin for the oil industry was the disastrous outcome of the midterm elections. No red wave means no congressional air cover, which is desperately needed during a period of accelerating climate change.

In addition, I know all of the substantial longs out there that we have been hoovering up since the October low. This position would make a nice hedge against those longs, at least for a month.

This was a bet that the ExxonMobile (XOM) would not trade above $120.00 by the December 16 options expiration day in 20 trading days.

Here are the specific trades you need to exit this position:

Sell 25 December 2022 (XOM) $125 puts at……….........…..…$18.00

Buy to cover short 25 December 2022 (XOM) $120 puts at…$13.05

Net Proceeds:………………………........................….……….………$4.95

Profit: $4.95 - $4.30 = $0.65

(25 X 100 X $0.65) = $1,625, or 15.12% in 10 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.