Trade Alert - (YELP) April 17, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - (YELP) - BUY

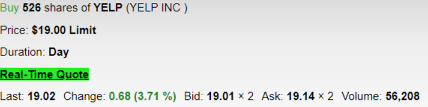

BUY Yelp Inc. (YELP) at $19.02

Opening Trade

4-17-2020

Portfolio weighting: 10% (EQUITY)

Number of Shares = 526

This is an equity position in business review tech company Yelp who is reliant on digital ads. I believe investors will be able to play from a $19.02 cost basis in Yelp equities.

Yelp’s ad revenue has dried up like the Sahara desert, most of the ad dollars they rely on are from local business and the 20 million unemployment number will throttle most of their customers.

This is a perfect example of a simultaneous demand and supply shock.

Look, I do not think highly in this company long-term, but this stock has been battered down so badly in the short term losing half of its value and has missed out on the catch-up trade that has seen many high quality tech stocks participate in a v-shaped price recovery.

Just look at shares of Microsoft (MSFT) and Veeva Systems Inc. (VEEV) that have shown a robust recovery.

The most explosive price action to the upside is when a company goes from awful to pretty bad and that is what I expect from Yelp as the U.S. administration spells out the rules for re-opening of the economy in selective locations.

Yelp is currently pricing in that restaurants and small business will never open again and as positive rhetoric coalesces around re-opening the economy, price action in Yelp should reflect these new developments.

Therefore, I feel that staking out an equity position in Yelp and allocating a 10% position to it is a favorable risk-reward short-term trade.

Then if you consider the recent news that Gilead Sciences, Inc. (GILD) has discovered evidence of a meaningful treatment and futures responded by lurching over 3% this morning.

Even though China posted a -6.8% 1st quarter growth rate from the prior year, investors must come to the conclusion that the tech market is looking past the bad news as Japanese equities finished the day up 3.15%.

If you don’t know about Yelp, keep reading.

Yelp's website, Yelp.com, is a crowd-sourced local business review and social networking site. The site has pages devoted to individual locations, such as restaurants or schools, where Yelp users can submit a review of their products or services using a one to five star rating system.

They have been trending lower because of stagnant revenue growth and negative EPS growth the past few years as they get squeezed out by Facebook and Google.

Yelp has encountered execution risk the past few years because of their complicated relationship with small businesses. Throughout much of Yelp's history, there have been allegations that Yelp has manipulated their website's reviews based on participation in its advertising programs.

Yelp had "materially lower" traffic in March that appeared to drop 50%+ from February's numbers due to the coronavirus and now I believe that number is even worse.

There is a high likelihood that Yelp and its ad business will relatively improve in the short-term.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES

Here are the specific trades you need to execute this position:

Buy 526 X (YELP)………….……………………...…….……$19.02

Net Cost:………………………….………..………….….....$10,004.52

dollar cost = (526 X $19.02) = $10,004.52

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.