Not All Ad Tech Firms Are In The Doghouse

Some of the digital ad tech stocks have had a rough go of it lately.

There was Google (GOOGL), whose stock has been threatened because of the new artificial intelligence chat box technology that was debuted by OpenAI called ChatGPT.

Meta (META) has rebounded but the initial sell-off last year was cringe-worthy.

As we see the light at the end of the tunnel, it’s time to explore where to deploy funds to invest in tech, and one option is The Trade Desk (TTD).

The advertising-technology company issued a stronger-than-expected outlook and unveiled a $700 million stock buyback program.

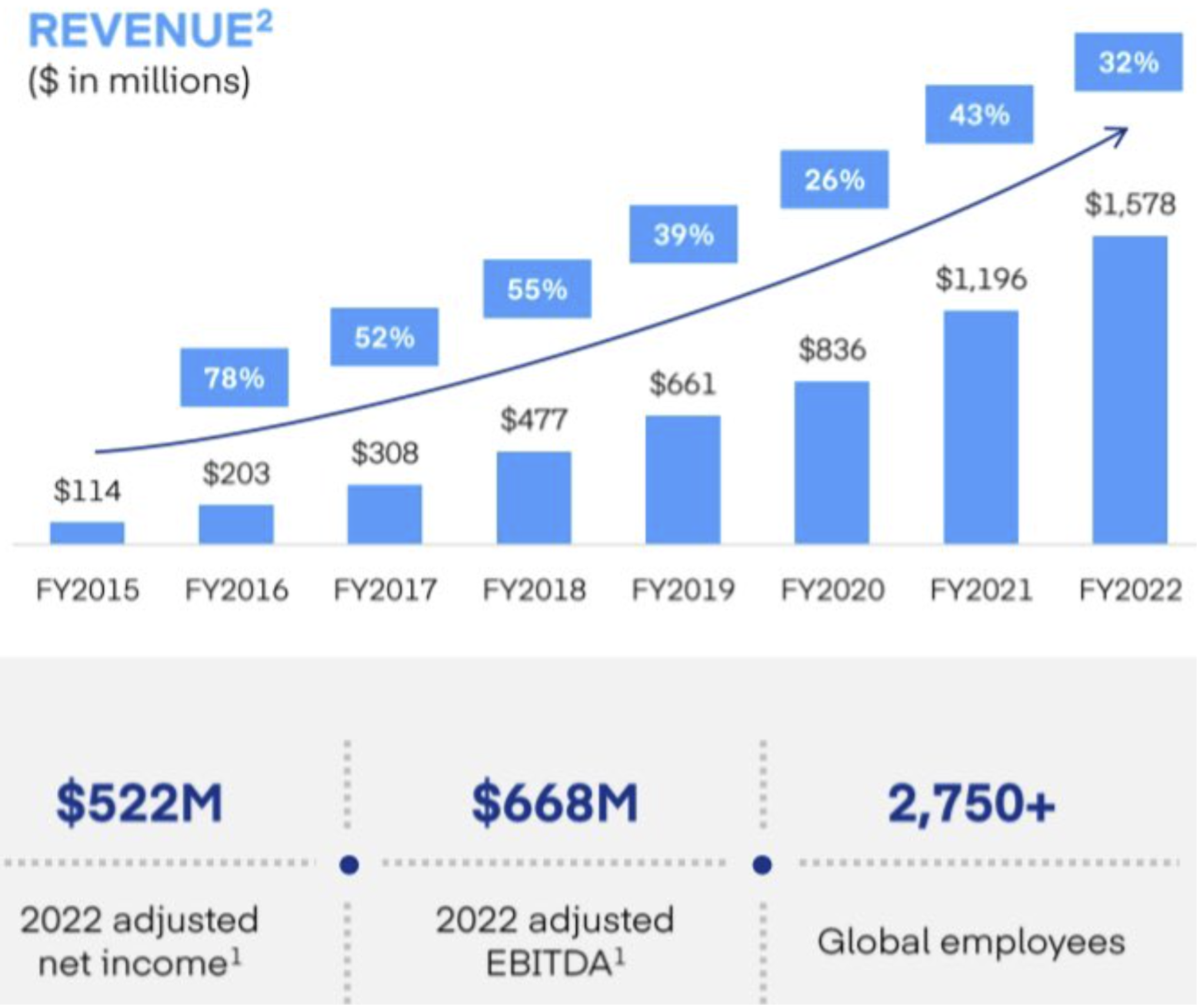

The Trade Desk outpaced nearly all areas of digital advertising in 2022, with 32% revenue growth year over year, and a record $491 million of revenue in the fourth quarter alone.

In addition, management at The Trade Desk made significant operational progress during the first quarter.

For example, Adobe was won as a partner that carries out real-time integration. But a first certified service partner has also been won with the Goodway Group. Growth in the area of programmatic advertising therefore continues.

I can confidently say that they delivered great earnings results once again and that’s a good habit to have in the public markets.

The company's top line didn't beat expectations, but was still impressive, especially considering a macroeconomic environment that weighed on the broader advertising industry.

Analyzing their company, I am confident that they are gaining market share and that their platform continues to gain traction with advertisers.

The numbers strongly back me up.

While the company's sales grew by 24% in the fourth quarter, some of The Trade Desk's biggest competitors were seeing their sales decline.

Another highlight from the quarter is The Trade Desk keeping its customer retention rate above 95%, which it has done for nine consecutive quarters.

The company also said that its Unified ID 2.0 - an online identifier that gives users more privacy than online trackers - continues to be accepted by more companies, including the addition of Paramount Advertising in the quarter.

Management expects Unified ID 2.0 to continue growing as online trackers (called cookies) "become less important" in the ad industry.

I can’t say it has been the golden year for digital ad tech.

The beating it took last year was quite horrendous, but as all rate hikes have mostly been priced into shares, we can expect a positive trajectory to the upside.

It’s quite positive that in the last two days, we received a hot CPI number and hot retail sales, but tech stocks have held up nicely.

I fully expect many growth tech stocks including TTD to become buy-the-dip candidates moving through the bulk of the year.

Sure, higher inflation remains the biggest risk to shares and after the latest numbers, we could go up to 5.25% on the Fed Funds rate but that has largely been quantified and sanitized by the market by now.