Trading the Blue Wave Stock Market

At this point, it is possible that the president may lose the November election.

He is 14 points behind Democratic candidate Joe Biden in the polls. The odds at the London betting polls have him losing by a similar amount. My old employer The Economist magazine in London gives him a 10% chance of winning using a mix of economic and polling data.

And this assumes the election is held today. The fact is that the president is digging himself into a deeper hole every day, taking the wrong side of every issue confronting the country today. He seems to be refighting the Civil War….and taking the Confederate side when even the State of Mississippi is taking its symbol off its flag.

So, what will the post-Trump world look like? Will taxes go through the roof? Will the market crash? Is it time to go 100% cash, change our names, and move to a country with no US extradition treaty?

I don’t think so. In fact, with stocks soaring to meteoric new highs every day, the market expects that a Biden administration will be great news for stocks, perhaps the best ever.

Taxes will certainly go up. Favorable tax treatment of the energy, real estate, and private equity funds will get axed. Carried interest will finally become history. Marginal tax rate on net income over $1 billion could get hiked to the Roosevelt levels of 80-90%.

Biden has already announced an increase in the corporate tax rate from 21% to 28%. That will cut earnings for the S&P 500 by $9 a share. But the stock market is not the economy, with S&P earnings only accounting for 10% of US GDP.

And the $9 companies lose in taxes they will make back and more from new government spending, which isn’t slowing down any time soon. Some 14,000 American bridges need to be rebuilt. The Interstate Highway System is a shambles. High-speed broadband needs to go rural. The electrification of the US needs to accelerate to accommodate the millions of electric cars headed our way.

I believe that eventually, 51 million Americans will lose their jobs as a result of the pandemic. Perhaps a third of those are never coming back because the future has been so accelerated. That will leave the broader U-6 Unemployment rate stuck in double digits for years, maybe for decades.

So, we’re going to need some kind of Roosevelt style programs like the Works Progress Administration (WPA) and the Civilian Conservation Corps (CCC) who built much of the monolithic infrastructure that we all enjoy today.

At least 300,000 educated workers could immediately be put to work in contact tracing. Millions more could be employed in national infrastructure programs. One thing is certain. A new administration won’t stop massive government spending, it will simply redirect it.

And let's face it. A Biden win would bring a big expansion of Obamacare. With the best healthcare technology in the world, private industry has done the world’s worst job controlling the pandemic.

Countries with well-run national healthcare systems like Australia, New Zealand, Japan, and Singapore have almost wiped out the disease. This is why I am avoiding the healthcare sector for the foreseeable future.

Who are the big winners of all this? Big tech (FB), (AAPL), (MSFT), (AMZN), medium tech (ADBE), fintech (SQ), (PYPL), the cloud (CRM), and biotech (SGEN), (REGN), and (ILMN).

Cybersecurity will always be in demand (FEYE), (PANW). The global chip shortage will continue to worsen (AMD), (MU), (NVDA).

And Tesla (TSLA)? What can I say? It is already up nearly 100-fold from my initial $16.50 recommendation in 2010, and I’ve bought three Tesla’s (two S’s and an X).

Followers of the Mad Hedge Trade Alert service know that I am already long these names up the wazoo, and is why I am up 26% in 2020. It’s simply a matter of all pre-pandemic trends hyper-accelerating, which we were already tapped into.

If you have to add a purely domestic sector, a gigantic Millennial tailwind will keep homebuilders bubbling for years like (LEN), (PHM), and (KBH).

And while you won’t find me as a player here, retail will recover. The sector has not prospered during the current administration, thanks to a trade war with China and the pandemic.

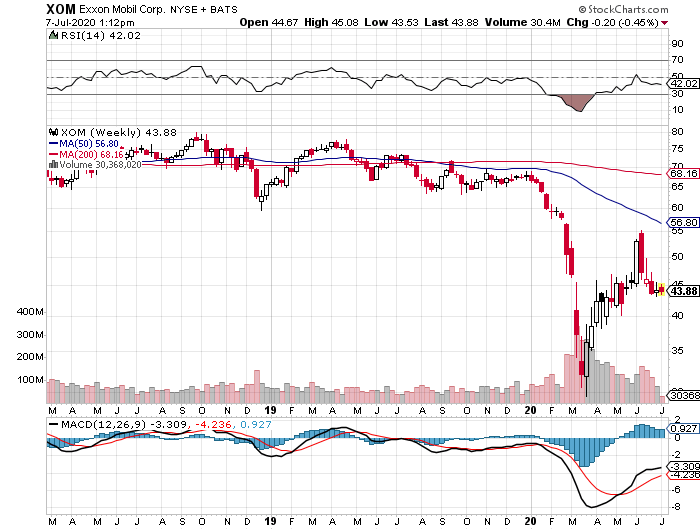

And the losers? There is a classification of “Trump” stocks you don’t want to be anywhere near. Energy will do terribly (XOM), (CVX), (XOM), with Texas tea possibly revisiting negative numbers. If you take away the tax breaks, energy hasn’t really made money in decades.

Defense stocks (RTN), (NOC), (LMT) will take a big hit from budget cutbacks and fewer wars. Coal (KOL) will finally get shut down for good, probably sold to China in bankruptcy proceedings. Industrials will continue to lag (X), (GE), with no more free handouts from the government and no technology advantage.

So if Biden wins, you don’t need to slit your wrists, hang yourself from the showerhead, or cease investing completely. Just take your stock market winnings and go out and get drunk instead.