Trimming Down the Book for Year-end

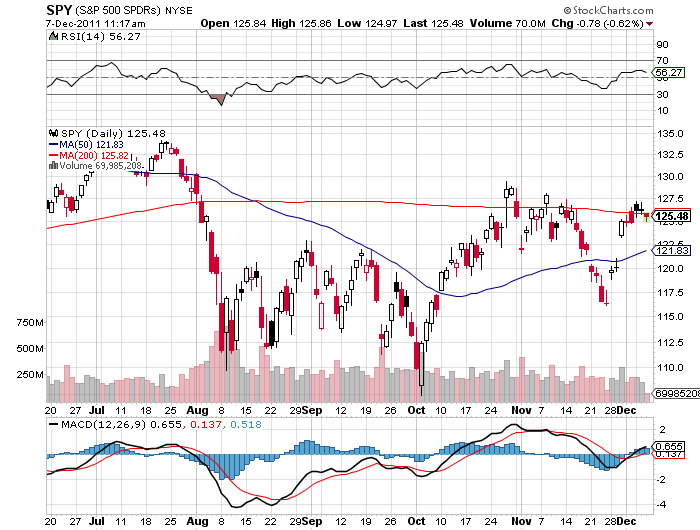

Given the failure of the ?RISK OFF? trade to develop any serious downside momentum this week, I am using the dip this morning to take a small profit on my S&P 500 ETF (SPY) puts.

We had every reason to go down, given the Standard and Poor?s threatened European debt downgrade on Monday night. If this despised and deeply flawed ratings agency had made this announcement in September or October it would have been worth at least ten (SPY) points to the downside.

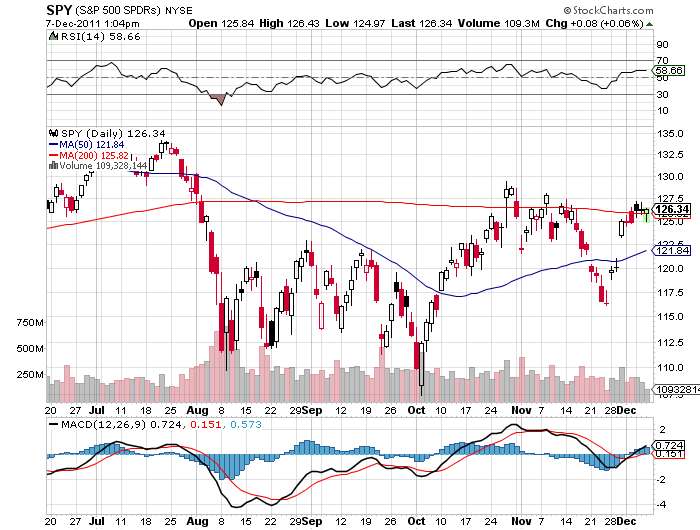

But they didn?t announce it then, they announced it now, and in the post Armageddon world this gets you only a modest two point dip. It?s an old trader?s adage that if you throw bad news on a market and it doesn?t go down, then you buy it. The risks have just risen that the Santa Claus rally continues for a few more weeks. Plus, if I can duck a major headline risk this weekend and still keep some change in my pocket, like the European ministers meeting, I am going to take it.

As it is way too late to buy, this means cover your shorts. This is doubly true for options holders who have a heavy price to pay in time decay and falling volatility over the holidays.

On top of this, we are looking at retail holiday sales that are coming in better than expected and a seasonal liquidity push to year end. Although consumers are depressed about the outlook for the economy in 2012, they are apparently dealing with their sorrows through buying a big screen TV, an Apple iPad, an Xbox 360, or a Snuggie.

There is another factor at work here. Any hedge fund manager who has had a great 2011 tends to step out of the market now and go flat. This locks in their gains until their 20% performance bonuses are paid out in January. Any profits in hand now get paid out in cash in 30 days. With a 42% year to date return, I certainly fall into that category.

My profit on this trade came to (9 contracts X 100 X $.32) = $288. For the model $100,000 virtual portfolio this adds 29 basis points to the total return. It?s better than a poke in the eye than a sharp stock, and will afford me some silver eagles to toss in the Salvation Army pot next time I go to the mall.

For those who wish to participate in my Trade Alert Service, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put ?Trade Alert Service? in the subject line, as we are getting buried in emails.