Trump's Gift to Traders

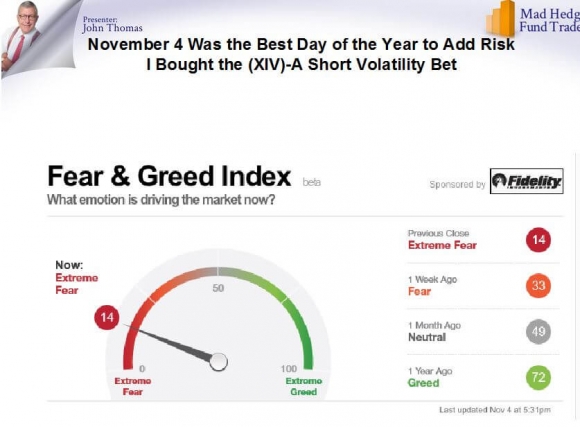

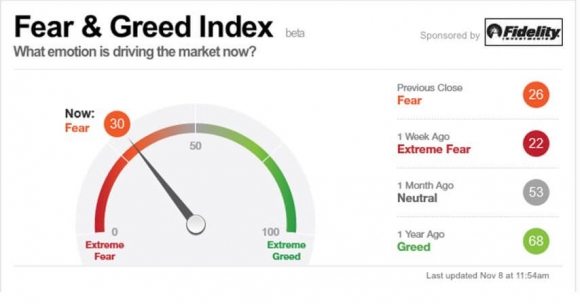

In 50 years of trading, I have never seen markets turn on a dime as they did last week. As a result, they have created some of the best trading opportunities of the century.

The sector rotation has been fast and furious. And trading volumes across all asset classes exploded to their highest levels in years.

Of course, they were responding to the biggest election upset in history which flipped the direction of the global economy 180 degrees in a heartbeat.

I am suddenly reminded of economist John Maynard Keynes' famous quote: "When the facts change, I change my mind. What do you do, sir"?

My ancestors hailed from Missouri, before they moved to California during the 1849 gold rush. Their black and white tintypes adorn the walls of my Lake Tahoe estate.

Every time I cross Donner Pass on Interstate 80, I remember their gaunt grim faces.

And you know what the motto of the state Missouri is?

SHOW ME!

Incredible as it may seem, I am already in touch with several senior officials of the Trump administration, thanks to my ancient Wall Street ties.

That will give me an early read on which Trump policies are campaign fluff, which will be seriously watered down, and the few that will actually be implemented.

AS EVERYONE IN THE FINANCIAL MARKETS KNOWS, THIS IT TRADING GOLD!

Early indications are that the incoming economic policies will be Reagan 2.0.

I remember well the jovial, backslapping president, who served from 1982-1990. I knew him too well for 25 years.

For three decades, he campaigned from the far right, championing McCarthyism, bemoaning Rowe versus Wade, demanding a balanced budget, and constantly warning of the communist threat.

The day he got into office he forgot all of this, negotiating huge arms reduction treaties with the Russians, and never lifting a finger to curtail women's rights.

We know how Reagan 1.0 ended. Thanks to large tax cuts and massive spending increases, the national debt skyrocketed 400%, from $1 trillion to $4 trillion. The bond market got killed.

And despite all his saber rattling on the campaign trail, Reagan never ensnared America in a single serious war.

Trump could well do the same. The big shock of the decade would be how fast Trump rushes to the middle.

But he has to "SHOW ME" first.

I am expecting a similar result with Reagan 2.0. Certainly the bond market thinks so, the ten-year Treasury yield adding a hair-raising 40 basis points in yield in a mere three days.

What we do know for sure is virtually the entire investment industry has been caught seriously wrong footed by the Trump win.

They were all, to a person, perfectly positioned for a Clinton win, and owned a heavily-weighted Clinton portfolio.

What they got was a Trump wild card.

IT WILL TAKE YEARS FOR INSTITUTIONS TO ROTATE SECTORS AND REPOSITION FOR THE NEW WORLD ORDER.

THIS IS NOTHING LESS THAN THE GREATEST GIFT TO TRADERS OF ALL TIME.

There is one great structural tailwind to this unbelievable sector rotation.

It takes you out of over owned, expensive sectors close to all time highs, like technology, that have been leading the market for most of this decade.

It moves you into under owned, cheap sectors, such as financials, heath care, commodities, and energy, that have been despised for years .

That's fine with me. I was getting tired of chasing technology for small incremental gains at the risk of gigantic one-day crashes, some four in the last 15 months.

You can make a lot more money buying stocks off of five-year bottoms than seven-year tops.

Maybe I can squeeze a few thousands basis points of performance out in 2016?

I have presented four Emergency Strategy Webinars for major hedge funds, clients, and the Online Trader's Summit in as many days.

Financial advisors tell me they are finding the points contained enormously helpful in explaining the New World Order to their clients.

So I am giving them to you in full below:

THE NEW WORLD ORDER:

Control of the Presidency, the House of Representatives, the Senate, and the Supreme Court mean the Republicans have a free hand

Republicans blocked fiscal spending for eight years, but will now move forward full steam ahead

$1 trillion in new infrastructure spending in the Midwest amounts to Quantitative Easing 5.0

Massive Keynesian stimulus could double US economic growth in the short term

Inflation will make an earlier return

It all adds up to a big RISK ON and BUY!

THE NEW BIG TRENDS:

OUT WITH THE NEW & IN WITH THE OLD

WINNERS:

Value

The Economy

Deregulation

Taxpayers

Domestic US Stocks

Defense Stocks

Inflation

Oil & Gas

Commodity Stocks

Bridges and Freeways

The Midwest Rust Belt

The US Dollar

Savers

Homeowners

Cheap Stocks

THE NEW STOCK PLAYS:

Get These Right and You'll Retire Early

Caterpillar (CAT) - Infrastructure

US Steel (X) - Infrastructure

Nucor (NUE) - Steel

Pfizer (PFE) - Big Pharma

Ely Lily (LLY) - Big Pharma

Lockheed Martin (LMT) - Defense

Freeport-McMoRan (FCX) - Commodities

Exxon Mobil (XOM) - Big Oil

Occidental Petroleum (OXY) - Energy

Bank of America (BAC) - Financials

Goldman Sachs (GS) - Financials

Lennar Homes (LEN) - Homebuilding

LOSERS:

Growth

Globalization

Regulation

Multinational Stocks

Telecom and Utilities

Emerging Markets

The Budget Deficit

Solar Energy

Bonds

Yield Plays

The Euro

The Japanese Yen

Borrowers

Renters

Expensive Stocks

THE OLD STOCK PLAYS:

Time to Say "Thank You Very Much" and Unload:

Alphabet (GOOG) - Technology

Apple (AAPL) - Technology

Facebook (FB) -Technology

Amazon (AMZN) - Technology

Tesl

a (TSLA) - Electric Cars

First Solar (FSLR) - Solar Panels

Sun Power (SPWR) - Solar Panels

General Motors (GM) - Globalization

AT&T (T) - Telecommunications

Mexico (EWW) - Mexico ETF

China (FXI) - China ETF

Euro (FXE) - Euro ETF

Yen (FXY) - Yen ETF

Gold (GLD) - Gold

THE BOND MARKET: THE FAT LADY IS SINGING:

Sell Short every Five Point Rally in the 20+ Year Treasury Bond ETF (TLT) for the next Ten Years

Bonds are Toast

The first fiscal stimulus in eight years will pour $1 trillion into infrastructure spending

Taxes will be cut across the board, concentrated for the wealthy and business

Replenishing of the military adds further spending demands

All of this adds $10 trillion to the national debt in eight years

Throw in a new war and that doubles it to $20 trillion

Is a replay of the 400% rise in national debt under Reagan during 1982-1990, when Treasury bond yields hit 12%

Interest rates will rocket

Buy the Ultrashort 20+ Year Treasury Bond ETF (TBT)

FOREIGN CURRENCIES: DOLLAR RALLY CONTINUES

Rising interest rates have the US dollar rocketing against all other currencies

Interest rate differentials are the biggest driver of foreign exchange rates

Buy the US Dollar Index ETF (UUP), calls, call spreads, and futures on dips

Yen fundamentals are as bad as ever, the Japanese will be the last to raise interest rates, if ever, expect a long-term decline, sell short Japanese Yen Trust (FXY), or buy the Ultrashort Yen (YCS)

Future of Euro is dependent on whether or not the EC breaks up

ENERGY: THE DOUBLE-EDGED SWORD

Stronger economy is oil positive

But a trade war with China, the world's largest new marginal consumer, could cause demand to slow there

Any run up to $60 will see new US fracking production pour into the market

Sell rallies up to $52, buy dips to $40

PRECIOUS METALS: TRUMPED!

Spiking interest rates are hugely negative for gold (GLD)

Current selloff creates a great entry point for long term investors

When inflation really shows up, that is when you want to pile back into gold

China and emerging nations have to buy several thousand tonnes to bring their holdings up to western level

Should take prices from $1,250 to $5,000 an ounce in 15 years

REAL ESTATE: A 20-YEAR BOOM

Millennial demographic wave is about to drive US home prices northward for the next 20 years

Only 2.4 million homes are for sale, down -6.8% YOY, creating a severe shortage; normally, homes for sale rise in the fall which predicts a very hot market in the spring

US home building is proceeding at less than half the peaks seen in the 2000s, despite rapidly rising demand, creating a structural shortage

Home equity has been the top-performing, individually owned asset class for the past 5 years

All this makes homebuilders a big long term ?BUY?

TRADE SHEET:? SO WHAT DO WE DO ABOUT ALL THIS?

Stocks- Buy

Bonds-Sell

Commodities-Buy

Currencies- Sell

Precious Metals ?Buy

Real Estate-Buy

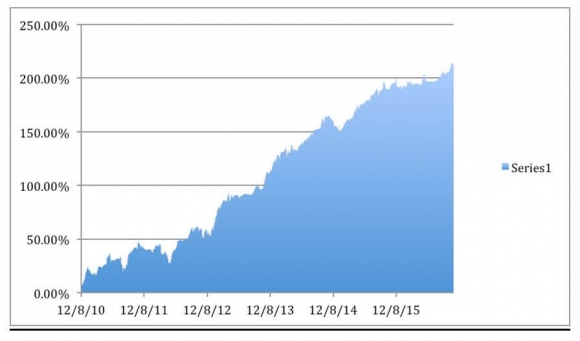

The Only Audited Trading Performance Online

The Only Audited Trading Performance Online

?Average Annual Return +37.18%

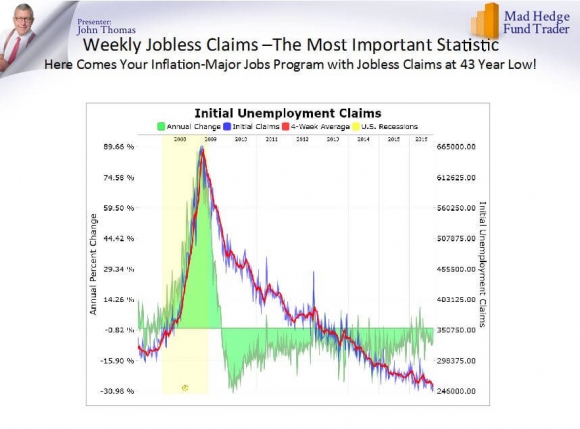

Major Stimulus with Jobless Claims at a 43-Year Low? Hugely Inflationary

What a Difference a Day Makes!

The Only Audited Trading Performance Online

The Only Audited Trading Performance Online