Uber's Dark and Dirty Secrets

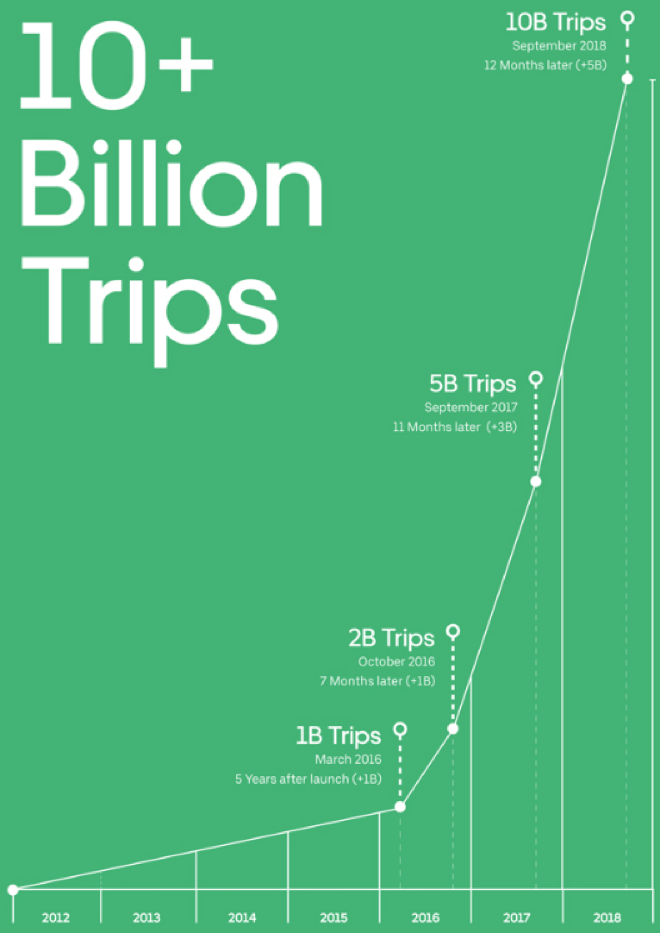

The granddaddy of IPOs awaits us – Uber has filed an S-1 with the SEC detailing plans to go public.

Uber can’t do this any sooner as they preside over a decelerating ride-share operation and its high margin Uber eats division, food delivery business, that has experienced slowing margins.

Once helmed by swashbuckling entrepreneur Travis Kalanick, Uber was infamous for its cultural problems that played out in real time in the media with sexual harassment accusations amongst other things.

They were castigated for its environment of testosterone overload that current CEO Dara Khosrowshahi has rooted out.

Khosrowshahi is pinning the blame on the past leadership in the S-1 filing explaining they are still fine-tuning these problems and its inherent risk could be detrimental to the growth model.

The Iranian-American CEO needs as many outs as he can find because Uber is a high-risk, high-reward model that has revealed no possible way to becoming profitable.

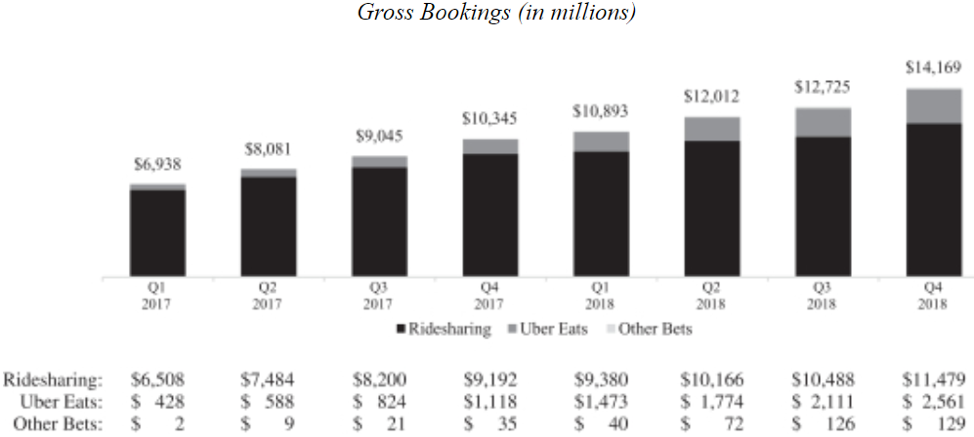

Sequentially, Uber’s core growth has stagnated with revenues last quarter of 2018 coming in at $2.314 billion, decelerating from $2.315 billion in the third quarter.

This is a sensitive spot for Uber because it correlates to 91% of its revenue.

Its Uber Eats division has also presided over two sequential quarters of deceleration indicating the low-hanging fruit has been picked.

The company is shifting towards higher volume, lower margin restaurants in more competitive locations hinting that the gangbuster years of high margin food delivery service growth is over.

The proposed $90 billion IPO also marks the high-water mark to the Silicon Valley IPO parade with only smaller fish from the sea debuting after them.

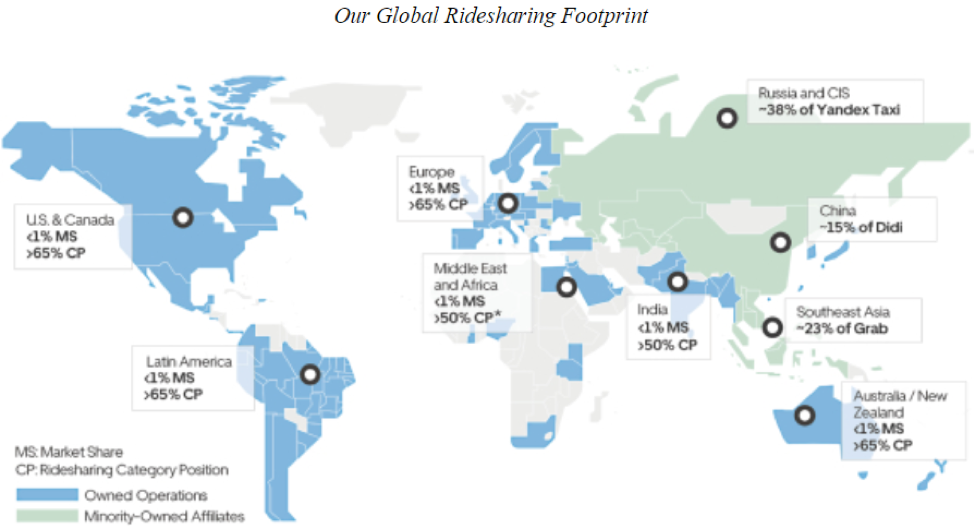

Uber has altered economic and consumer habits as we know it and the size of the business means it’s no Lyft (LYFT) – Uber is global, and its revenues are six times larger than its American competitor.

Becoming an enormous start-up also means heavier losses, the company had $3 billion in operating losses last year while its smaller competitor Lyft had only $911 million.

Lyft is solely focused on the ride-share industry capping upside potential while Uber has more gunpowder to load if it wants to ammo up in the business world.

One direction Uber hopes to explore is under the banner of Uber Freight which plans to monetize the deeply fragmented logistic industry.

It can take sometimes days for suppliers to deliver shipments with most of the process conducted over the phone or by fax.

Uber Freight mitigates logistical risks by providing an on-demand platform to automate and accelerate logistics transactions end-to-end.

The software smoothly connects carriers with the most appropriate shipments available, and offers carriers upfront, transparent pricing and the ability to book a shipment with the touch of a button.

As of the end of 2018, Uber Freight delivered $125 million in annual revenue and they hope to ameliorate many of the same logistical pain points that occur around the world.

This division of Uber is one that Lyft lacks, thus Uber should be granted a higher multiple when shares go public.

A huge addressable market awaits Uber Freight, but as many know, logistic routes have been formed over many years, and disruptors won’t be able to come in overnight and sign up new contracts.

Revenue should be slow but steady, and not the sugar high rush of revenue management is wishing for.

Uber’s heavy cash burning enterprise needs to offer some glimmer of hope of becoming profitable in the future whether it's five or twenty years out.

Without this x-factor of potential profitability, committed capital could become strained as investor will shy away knowing that a solid balance sheet might be a pie in the sky.

Since 2015, Uber has paid drivers $78.2 billion in renumeration - Uber will need to curtail heavy costs like these to raise operating margins.

One upside to its model is that its software platform possesses synergetic effects cutting costs for rolling out newer software for Uber Freight and Uber Eats.

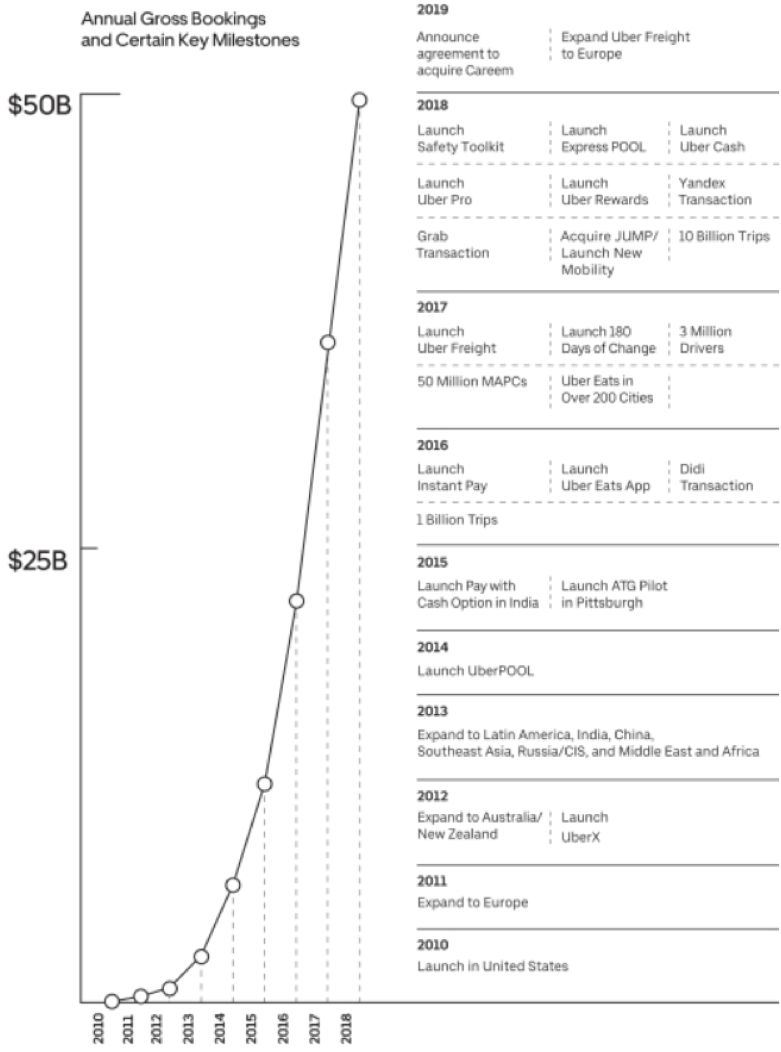

Uber is still growing, albeit at a slower rate, 2018 Gross Bookings grew to $49.8 billion, up 45% from $34.4 billion in 2017.

The growth contributed to revenues of $11.3 billion in 2018. While a mammoth number, Uber still needs to absorb capital hits from M&A when they acquired Careem, the Uber of Middle East, North Africa, and Pakistan, for $3.1 billion last year.

Uber clearly choreographed a future strategy in the S-1 filing saying, “Our strategy is to create the largest network in each market so that we can have the greatest liquidity network effect, which we believe leads to a margin advantage.”

Details of this strategy include more drivers, more riders, more rides per hour, lower fares, and smaller waiting times.

I believe Uber is biting off more than they can chew on this front.

To overcome the regulatory hurdles and the social backlash while offering cheaper fares and simultaneously increasing driver payout will be impossible unless drivers start shuttling around 5 or 6 people in one ride.

I do acknowledge that Uber has massive scale, first move advantage, and a handsome margin advantage working on their side.

But will this be enough if Uber adds more drivers and effectively piles more money into the same strategy?

I would say no and that could mean that growth rates could slip severely which leads me to suggest that Uber has a problem with the quality of growth.

On the bright side, the business model with be compensated by enhancements in the routing algorithms, payment technologies, in-car user experience, and user interface.

These incremental gains won’t help offset the relative weakness in the growth numbers that possess less and less quality in them.

The overarching theme of what to do when the low-hanging fruit is picked off the branch is a tough one, because any further incremental gain is negated by higher costs or competition.

Uber’s get out of jail free card is the eventual paradigm shift to aerial ride sharing, and if they are the leaders in that transition, it could offer another massive pay day and steeper growth trajectory that would propel the company into a realm of many more possibilities.

Whether Uber can complete this tectonic shift is too far away to predict, time could become a significant headwind in this case since mainstream adoption of autonomous driving has been relatively sluggish.

Expect heightened volatility as the main characteristics of Uber’s price action - it’s certain to be a bumpy ride.

Abstaining from Uber shares would be the smart play here while some more detective work can be deployed.