Upgrade Now to Beat the Mad Options Trader Price Increase

The $64,000 answer.

That was the reply I received from Mad Options Trader, Matt Buckley, known to his fellow traders as ?Whiz,? regarding my question about his two-month performance.

That is how much traders have made since the August 1 free trial started for our new Mad Options Trader service for each $100,000 of invested capital.

I knew Whiz had a hot hand. But when I heard those numbers, they blew me away.

I knew something big was happening when unsolicited testimonials started pouring in.

First, there was Frank in Dallas, Texas who said,

?I just wanted to tell you what a great find the Mad Options Trader was for you. I stumbled into two of his trades this week and made enough profit to pay for two years of his service. I know he may eventually cool off, but he is hot now.?

Then, I got another one from Bill in Richmond, Virginia who gushed, ?Trading with Whiz is like having a rich uncle. He cuts me a check once a week for $2,000. I've never been able to do this before.?

The last two weeks have been especially eye opening.

Whiz went into the September 17th Fed decision long volatility through the (VXX) and clocked a $12,000 winner in one week.

Then he flipped to the short side when Janet Yellen took no action on rates, picking up another $4,000.

He took a small hit going into the OPEC surprise Algiers deal with a short oil (USO) deal. He mitigated some of those losses with a long position in the S&P 500 (SPY).

What?s Whiz doing now?

He is scaling into ultra long dated positions in Goldman Sachs (GS) January, 2019 call options.

The bet is that sometime over the next two years, interest rates will rise, and Goldman shares will explode. He then trades against this position with weekly and monthly short positions.

It is all typical big hedge fund type stuff that the small individual retail trader never sees.

At the request of several readers, I have therefore conducted an audit of the long term trading performance of the Mad Options Trader.

The numbers blew my mind.

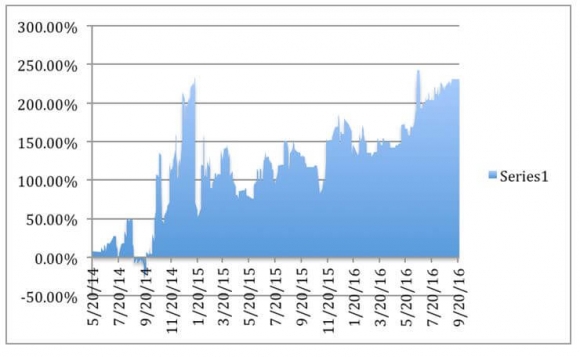

Since May 20, 2014, the Mad Options Trader has delivered A STUNNING 231.45% PROFIT, net of fees (see chart below).

This is during a period when the overall market performance was essentially zero.

As a result of this stellar performance, Whiz is raising his price for an upgrade to your existing Global Trading Dispatch from $1,500 to $2,000 a year.

And quite justifiably so.

It is only because we are fellow combat pilots that he is letting my regular subscribers get in at the old price one final time.

BUT ONLY IF YOU ACT THIS WEEK!

Nancy is taking orders now. You can email her directly with your request at support@madhedgefundtrader.com. Just put ?MOT UPGRADE? into the subject line.

The? Mad Options Trader service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will place in the S&P 500 (SPY), major industry ETFs like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt?s performance works out to an eye-popping average 7.92% a month, and annualizes out to an incredible 95.11% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famous Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader, and includes:

1) Instant Trade Alerts sent out at key technical levels, an average of one a day. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give followers active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking.

Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

I?ve never felt better about recommending a new product.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of the Diary of a Mad Hedge Fund Trader