Upgrade Now to Mad Options Trader

I had planned on formally launching our new Mad Options Trader service at the end of August.

But why wait?

Matt has delivered such blowout results so far this month, up a stunning 20%, that to delay might unfairly deprive subscribers from future profits.

So, as of today, Nancy, in customer support, is taking Mad Options Trader orders. Just put "MOT Upgrade" in the subject line, and she will get back to you shortly.

This is how the upgrade works.

For example, let?s say you have nine months remaining on your existing $3,000 Global Trading Dispatch subscription. You will get a credit for $2,250. Nancy will then bill you $4,500 against this.

That brings the upfront cost for the upgrade to $2,250, but your subscriptions for the GTD + MOT combo now have a full year to run together.

This means that Nancy is going to have to manually calculate the price for each new upgrade to MOT for each of you individually, and then give you a precise amount you can send to us by PayPal or check.

Early action will be rewarded.

Regardless, your free MOT "test flight" will continue until the end of August, as promised, and the new paid MOT subscription will start on September 1st.

The month end coincides with the Labor Day weekend, so the time we can deal with the incoming crush of orders is thus further shortened.

Nancy warned me that I better start processing orders now, or her ?head would explode.?

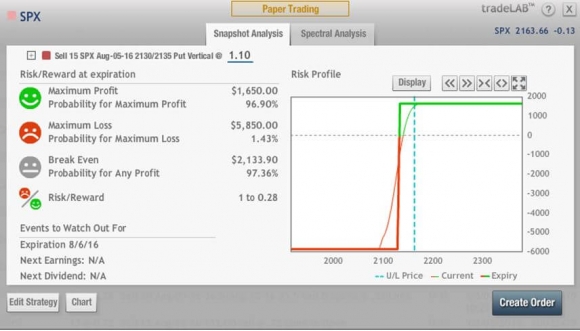

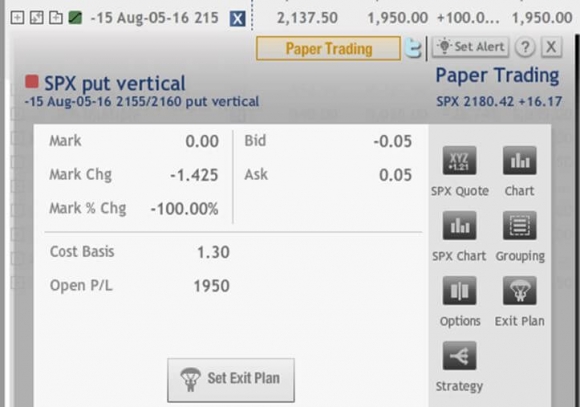

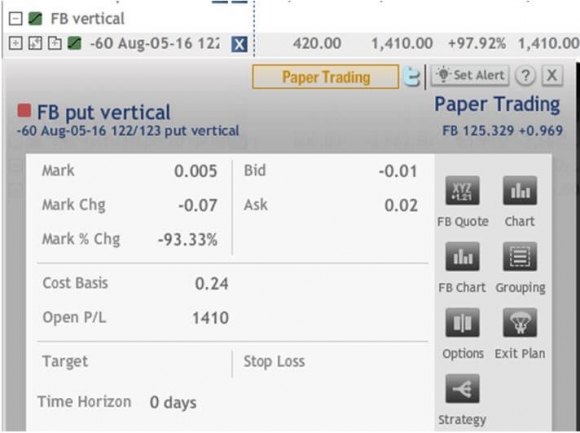

Matt?s unique service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt is my old friend and fellow comrade in arms of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

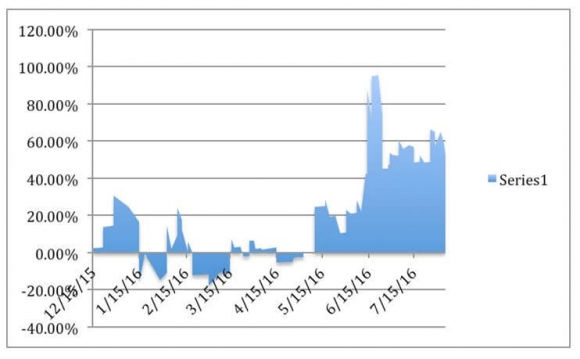

Matt knows what he is talking about. An independent audit shows that he has racked up an incredible 53.03% performance, net of commissions and fees, so far in 2016, one of the most difficult years in trading history.

That works out to an average 7.92% a month, or an incredible 95.09% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader and will include:

1) Instant Trade Alerts texted out at key technical levels. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give members active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking. Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

To see how he has performed so far in 2016, please check out the daily chart below.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

Mad Options Trader 2016 YTD Independently Audited Performance