Use Apple Timing to Short Bank of America Stock

There is a method to my madness.

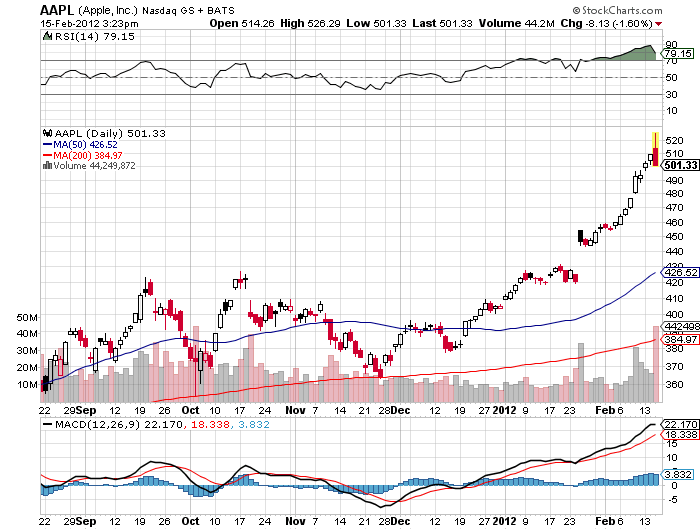

It?s all about Apple (AAPL). A disproportionate share of the market volume has been pouring into Apple shares for the past two weeks. The higher it went, the more people wanted to buy. Just in the past week, the company has tacked on a staggering $75 billion in market capitalization. The action in the call options has been absolutely explosive.

The focus of the US stock market distilled down to not just a single sector, but a single stock. This kind of concentrated price action is a classic indicator of a market top. When Apple rolls over, the rest of the market will follow it down. Apple has pulled this off while virtually every other asset class is showing their own topping formations, including most other stocks, the euro, the yen, copper, gold, silver, and even the ags.

When I started my February 15 webinar at 12:00 noon EST, Apple was going gangbusters, up $15 to $525. By the time I finished, it had plunged $15, suggesting the short term top is in for the sizzling, innovative company. A rumor swept the market that Apple?s weighting in the NASDAQ would be diluted once again, which would be highly negative for the share price.

So am I going to sell short Apple stock? Heavens no! I love Steve Jobs? creation. I still think it will hit my long term target of $1,000 sooner than later. In fact, I just bought a new solid state MacBook Pro with all the specs maxed out and I am picking up my IPhone 4s on Friday.

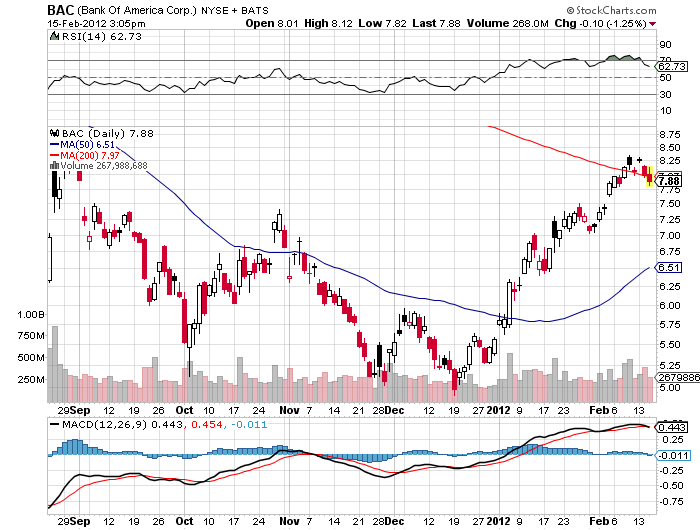

Instead, I am going to use Apple as the signal for my cross market timing, and then short a stock I hate, Bank of America (BAC). This is one of the top performing stocks of 2012, soaring some 50%, in six weeks. Despite that move, it is still trading at a huge discount to book, meaning that traders think the company is lying through its teeth about the true extent of its loan losses.? Its shares are beating Apple by an almost 2:1 ratio this year, which has jumped only 28%. How perverse is that? The two companies are almost mirror images of each other. Think future versus past, booming versus broke, good versus evil, $525 versus $8.

The best run hedge funds use this type of cross market signaling all the time. I saw it constantly on the trading floor of Morgan Stanley. It is a great way to capture laggards and move into the highest beta names when a market reversal is imminent.

When I am in a selling mood, I want to sell the most expensive stock in the market that has had the most blistering recent gains. That describes (BAC) to a tee, which is nowhere near solving its structural problems and still has a declining real estate market to deal with.

I chose to buy puts on (BAC) instead of the (SPY) because you always get much greater volatility in individual names than an index has a whole. Look at (BAC)?s performance this year. A 7% rise in the (SPY) brought a 50% gain in (BAC). That kind of volatility works on the downside too. A single stock will outperform a basket every time. That?s how you maximize your bang per buck on the put options.

Check Out Bank Of America?s New Logo