Vietnam Has Been Hot

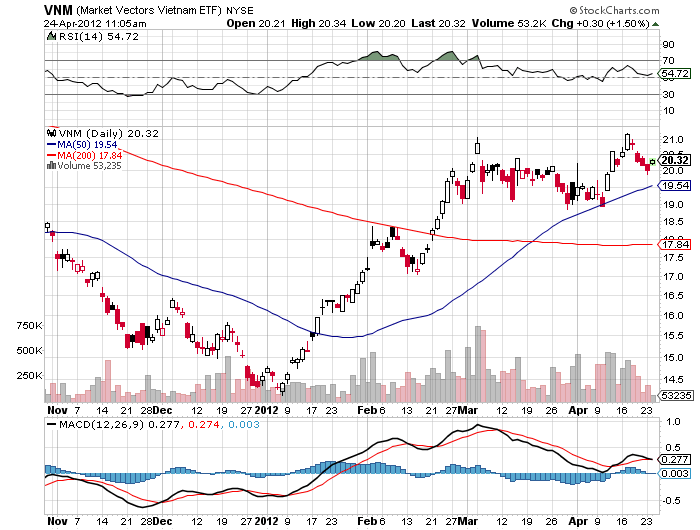

Vietnam has delivered one of the top performing stock markets so far in 2012. Take a look at the Market Vectors Vietnam ETF (VNM). The venture invests in companies that get 50% or more of their earnings from that country, with an anticipated 37% exposure in finance, and 19% in energy. This will get you easily tradable exposure in the country where China does its offshoring.

Vietnam was also one of the top performing stock markets in 2009. It was a real basket case in 2008, when zero growth and a 25% inflation rate took the main stock market index down 78%, from 1,160 to 250. This is definitely your E-ticket ride.

Vietnam is a classic emerging market play with a turbocharger. It offers lower labor costs than China, a growing middle class, and has been the target of large scale foreign direct investment. General Electric (GE) recently built a wind turbine factory there. You always want to follow the big, smart money. Its new membership in the World Trade Organization is definitely going to be a help. As my old friend, Carl Van Horn, the head of investment at JP Morgan taught me, watch direct investment, because the stock markets always follow.

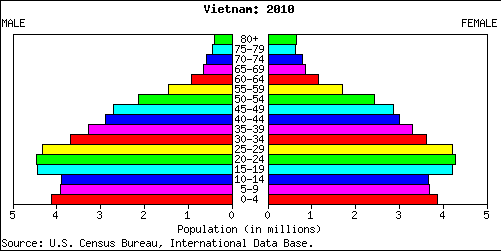

It also helps a lot that the country has one of the world?s more favorable demographic pyramids. That means it has a high percentage of young, free spending workers and relatively few older social service demanding retirees. That is partially because we killed so many off during 1960-1972.

I still set off metal detectors and my scars itch at night when the weather is turning, thanks to my last encounter with the Vietnamese, so it is with some trepidation that I revisit this enigmatic country. Throw this one into the hopper of ten year long plays you only buy on big dips, and go there on a long vacation. If we get a summer swoon in global risk assets as I expect, this would be a good name to pick up.

The green shoots are real. But watch out for the old land mines.

Pass Me a ?BUY? Ticket Please