Volatility Melt Down Continues

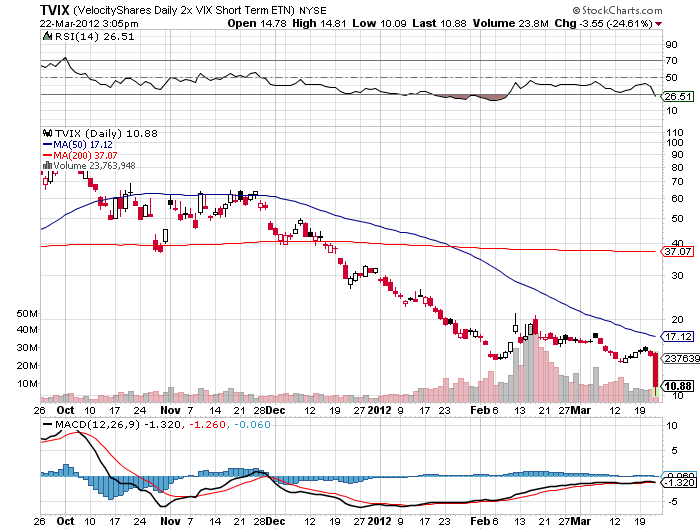

The market was buzzing today about the continued collapse of volatility and the significance thereof today. Today the chief whipping boy was the double leveraged Velocity Shares 2X Vix ETF (TVIX), which cratered 33% on the day, and down 90% from its October high.

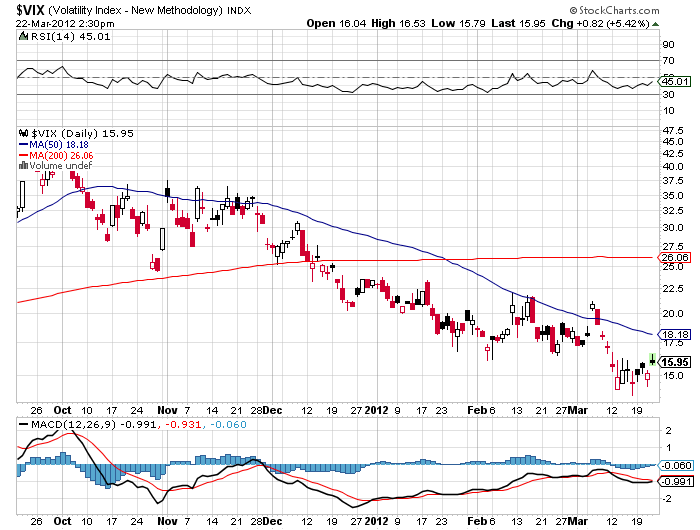

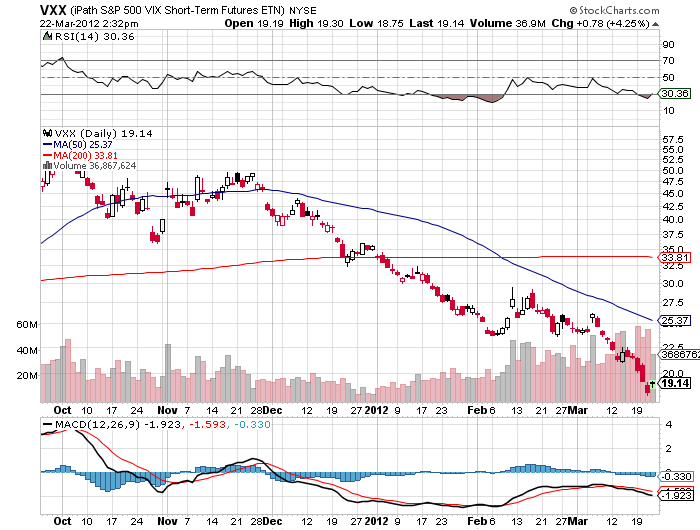

This was on a day when the ETF should have gone through the roof, with the Dow down 100 points and a rapidly deteriorating Chinese Purchasing Managers Index threatening of worse to come. Even the (VIX) and the (VXX) only brought in modest gains at best. Against this backdrop they should have been up much more.

Conspiracy theories abounded. Some speculated about margin calls on a major hedge fund triggering a forced liquidation. Other?s thought that complacency was peaking, creating spike bottoms in volatility products that could signify a final move. Certainly a buying opportunity is setting up here, but how do you determine where when the ETF is doing the exact opposite of what it is supposed to do.

Whatever the reason, investors? trust in these instrument has been permanently dented. A 33% one day drop certainly was not in the prospectus.