Warren Buffet Boards the Apple Train

I have never been one to argue with the Oracle of Omaha Warren Buffet. The founding subscriber to the Diary of a Mad Hedge Fund Trader has been a follower of many of my Trade Alerts, including Bank of America (BAC), Burlington Northern (he bought the whole company), and American Express (AXP). But I could never get him into technology stocks.

Now, at last, you can add Apple (AAPL) to that list.

You know all of those panicky investors unloading Apple stock just over $150 apparently believing that the company's product cycle and innovation were at an end? That was Warren doing the buying.

Too bad I couldn't get him interested in the stock when Steve Jobs was still alive. Knowing Steve, maybe that was the reason he stayed away.

Still, I tried.

Still, looking at Apple's earnings this week, better late than never.

The analysts covering tech stocks are making a mockery of their work.

They are continually left to lick their wounds after a slew of inaccurate claims that will empty investors pockets faster than the speed of light.

Granted, Apple had the weakest position of the vaunted FANG group going into earnings because of a lack of a direct cloud play and the stale iPhone narrative.

However, Apple is still a force to be reckoned with and they proved the bears horribly wrong delivering an extraordinary performance in Q1 2018.

Katy L. Huberty, a tech analyst from Morgan Stanley, downgraded Apple citing weak demand in China. This was after Taiwan Semiconductor (TSM) released tepid future guidance, stoking fear into investors causing a short-term dip in shares for chip related stocks and Apple.

The first two months of the year saw a barrage of downgrades from KeyBanc, Bernstein, and BMO capital. It is the same story over and over again.

Analysts do their best to character assassinate Apple on the run up to earnings every time. This ritual has embarrassed the analyst community. I don't think I'll ever believe another analyst again.

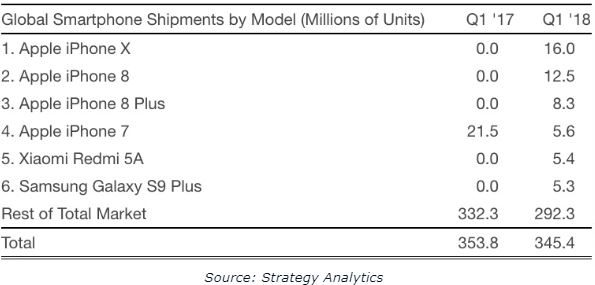

The iPhone X was the World's best-selling smartphone the last two quarters according to big data firm Strategy Analytics because it is the best smartphone in the World.

This logic might be too difficult for Wall Street analysts to comprehend with their hodgepodge of random data points that lead them to the wrong conclusions.

Apple has delivered earning beats on 20 of the last 21 quarters. The guidance was even on the high side of the range and the report was demonstrably better than expectations.

Services is now a material part of the company, blowing past estimates of $8.39 billion posting $9.19 billion in sales. This makes up 15% of the total revenue, and Apple will seek to solidify this segment going forward.

Apple will make a lot of headway if services become 25% of revenue. The optimal method to boost earnings is to develop a revolutionary product or extract additional incremental revenue from existing subscribers. Apple is going with the latter as the low hanging fruit is always easiest to pick.

The timing couldn't be more perfect for Apple. The World is on the cusp of new tech regulation that could lower margins and veering into a reoccurring subscription model is the perfect way to insulate themselves while growing the business.

The potential to increase the incremental revenue from China is strong because most of the iPhone earners in China originate from Tier 1 cities like Beijing and Shanghai and have the disposable income to pay for Apple's cocktail of services.

To dismiss the Chinese consumer is dangerous. Just look at the growth targets being smashed by Alibaba (BABA) and JD.com (JD) each quarter.

Japan and China contributed 20% growth to Apple's top line mainly due to the adoption of Apple Pay at many train and bus stations.

iPhone unit sales missed estimates by 340,000, but the analysts' bearish sentiment led many investors to believe the shortfall would be an unmitigated disaster.

The Average Selling Price (ASP) of $728 remained healthy as Apple has largely avoided the deterioration in margins that analysts routinely use as a pinata.

Apple continues to be the preeminent profit creator in the tech industry. They pocketed almost $50 billion in net profit in 2017. Public companies are in the business of making profits and returning capital to shareholders, and Apple does that better than anyone.

Apple's stock has been unfairly sabotaged by analysts and it almost seems they want the stock to capitulate and buy it for their own personal accounts.

Compare that to Amazon (AMZN) whose annual sales amounted to almost $180 billion but only $3 billion in net profit.

The market is penalizing Apple for a lack of a cash burn, land grab business. It is not Amazon and does not want to be Amazon. That is what the market pays for now.

It is ironic that Apple are penalized for making so much cash. They even hit an all-time high at $183 in a hazardous macro environment.

Saving the best for last, CEO Tim Cook pulled out his "trump" card. Apple announced an altruistic capital allocation program of $100 billion, the largest of any company in history. The dividend was hiked a further 16%.

Apple has given back $275 billion to shareholders since 2012 and this number should surpass $300 billion by 2019.

The unbridled expectations that Apple need to revolutionize the world with something better than an iPhone has reached the tipping point. Investors alike need to understand this is one company. And this company is doing very well.

Steve Jobs made an indelible impact on Silicon Valley, America, and the World. Tim Cook is not Steve Jobs. He will never be Steve Jobs.

Tim Cook is a safe pair of hands that knows how to captain this large ship.

Apple is turning into a service business and is still in the good graces of the Chinese communist government. If you consider that business attached to the iOS operating system has provided employment to a staggering five million local Chinese people. Creating problems for Apple as part of any widened trade war would create a huge loss to the Chinese economy.

I suspect that moving forward, Apple will increase operational margins due to a bigger contribution from the services segment which will dislodge the reliance on iPhone unit sales.

Buy Apple after the next atrocious analyst call and mini selloff.