Welcome to the Pax Americana

1) A huge demographic tailwind has kicked in during the 2020’s

2) The last time this happened was during the 1980’s when stocks rose twentyfold

3) Don’t believe today’s doomsayers, America is the first place to invest and will remain so for decades

4) It all sets up a Pax Americana that could continue for the rest of the century.

Remember the 1980’s, when investing was as easy as falling off a log? If you indexed your portfolio rose twentyfold.

Well, have I got some great news for you. We are about to see a repeat.

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950s and 1980’s and which I still remember fondly.

This is not some pie-in-the-sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth during the 2000’s and 2010’s is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s.”

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets such as equities, and more buyers of assisted living facilities, health care, and “RISK OFF” assets such as bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to today when the reverse happens and the baby boomers are exiting the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “Millennial” generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage serious hikes.

The middle-class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

The stock market rockets in this scenario. Share prices may rise very gradually for the rest of this decade as long as above-average 3.25% growth persists. That will take the Dow to 120,000 by the 2030’s a mere triple from present levels.

Technology and Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well.

The 100-year supply of natural gas (UNG) we possess through the new “fracking” technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oilfields is also unlocking vast new supplies.

Since 1995, the United States Geological Survey's estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC’s share of global reserves is collapsing.

This is all happening while EV’s are taking an ever-growing share of the new car market, 7.6% in 2023, or some 1,189,043 vehicles, up from 5.9% in 2022. Total US gasoline consumption is now at a ten-year low. Alternative energy technologies will also contribute in an important way in states such as California, accounting for 60% by 2030 and 100% by 2045.

I now have an all-electric garage, a Tesla Model X (TSLA) powered by solar panels and Tesla Powerwalls, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It has already flipped the U.S. from a net importer to an exporter of energy in a huge way, with positive implications for America’s balance of payments. That eliminated our once-largest import and turned it into an important export, which is very dollar-bullish for the long term. A strong greenback further reinforces the bull case for stocks as it attracts more foreign buying.

The US is now the world’s largest oil producer at 13 million barrels a day and we are now fueling much of Europe with our natural gas exports, replacing Russia.

Accelerating AI technology will bring another continuing positive. Of course, it’s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos.

But at the enterprise level, this is enabling speedy improvements in productivity that are filtering down to every business in the U.S., lowering costs everywhere. Humans are being replaced with Chatbots at blinding speed. When was the last time you talked to an actual human in customer support?

This is why corporate earnings have been outperforming the economy as a whole by a large margin.

Profit margins are at an all-time high. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development.

When the winners emerge, they will have a big cross-leveraged effect on the economy.

New healthcare breakthroughs will make serious diseases a thing of the past, which are also being spearheaded in the San Francisco Bay area. I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday.

What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver’s seat on these innovations?

The USA.

There is a political element to the new golden age as well. Gridlock in Washington can’t last forever. Eventually, one side or another will prevail with a clear majority.

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now, but for which nobody wants to be blamed.

That means raising the retirement age from 66 to 70 where it belongs and means-testing recipients. Billionaires don’t need the maximum $36,156 annual supplement. Nor do I.

A Pax Americana would ensue.

That means China will have to defend its own oil supply, instead of relying on us to do it for them. That’s why they have recently bought a second used aircraft carrier. The Middle East is now their headache.

The national debt then comes under control, and we don’t end up like Greece.

The long-awaited Treasury bond (TLT) crash never happens.

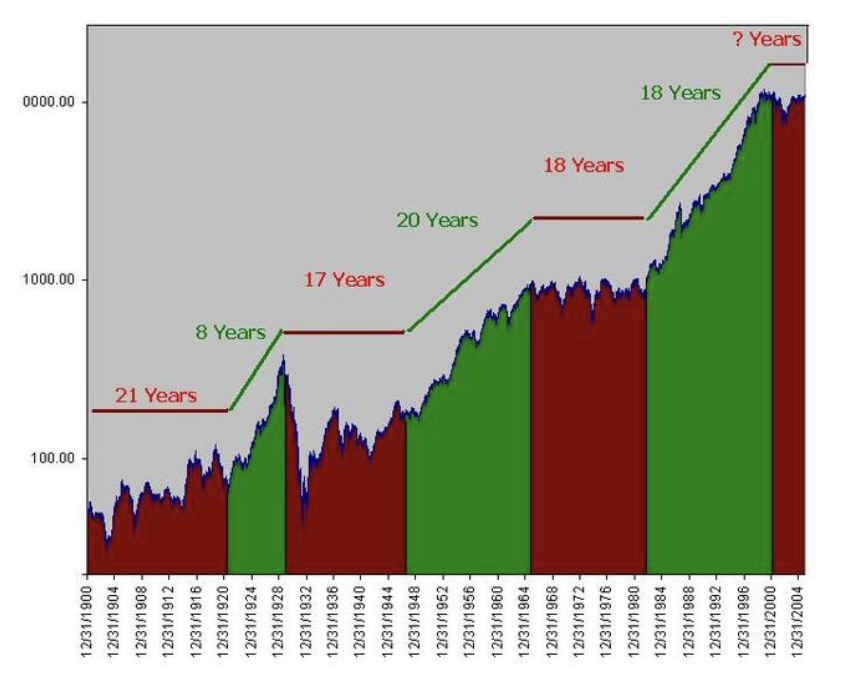

Sure, this is all very long-term, over-the-horizon stuff. My markets are discounting this now. That’s how we got to Dow 40,000, up from 600 when I first entered the US market 42 years ago.

Dow Average 1900-2024

Another American Golden Age is Here