What is America’s True National Debt?

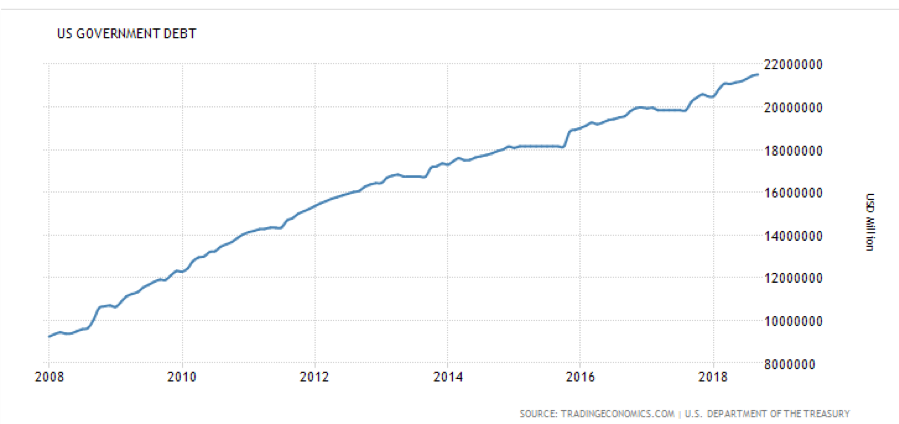

Not a day goes by without someone carping about the national debt to me which now stands at $21.6 trillion.

Since President Obama came into office on January 20, 2010, it skyrocketed.

Are we all going to hell in a handbasket? Eventually, yes.

While it is true that the national debt has increased by some $10 trillion over the past ten years, there is less than meets the eye.

Much less.

That includes the $4 trillion purchased by the Federal Reserve as part of its aggressive five-year monetary policy known as “quantitative easing”.

It also includes another $1 trillion of Treasury holdings by dozens of other federal agencies such as Fannie Mae, Freddie Mac, and Sallie Mae.

So, the net federal debt actually issued during Obama’s two terms is not $9 trillion, but $4 trillion.

That’s a big difference.

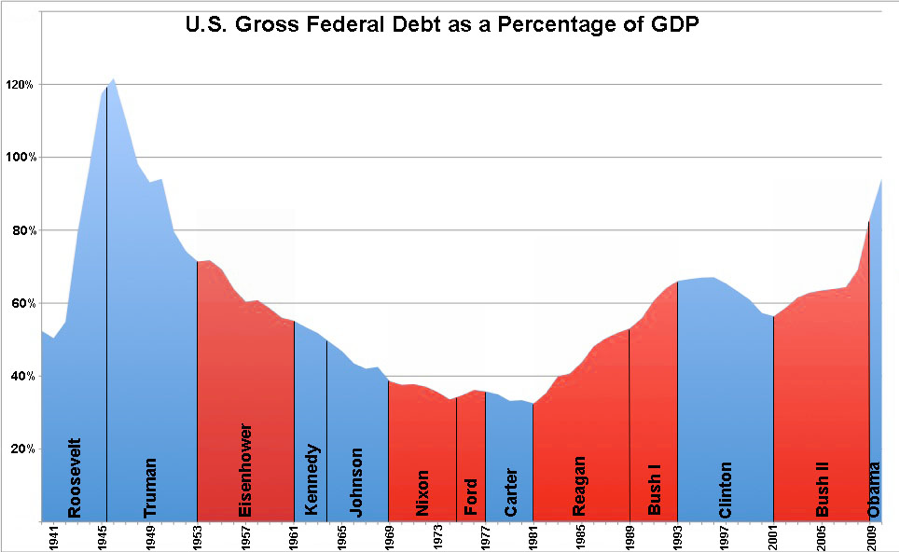

These numbers would make Obama one of the most fiscally conservative presidents in US history (see tables below).

And he pulled off this neat trick despite US tax revenues utterly collapsing in the aftermath of the Great Recession.

What the Treasury has in effect done is taken one dollar out of one pocket and put it in the other, 5 trillion times.

There has been no change in the nation’s true indebtedness or net worth as a result of these transactions.

In fact, these bonds were never even really issued. They only exist on a spreadsheet, on a server, on a mainframe, somewhere at 1500 Pennsylvania Avenue, NW, Washington DC.

And here is the real shocker.

The Treasury can cancel this debt at any time.

They can just decide to use one set of figures on the plus side of the balance sheet to offset an equal amount on the negative side, and poof, the debt is gone forever, and the national debt is suddenly only $16 trillion.

It wouldn’t even require an act of Congress. It could simply be carried out through a presidential order.

And we have seen a lot of those lately.

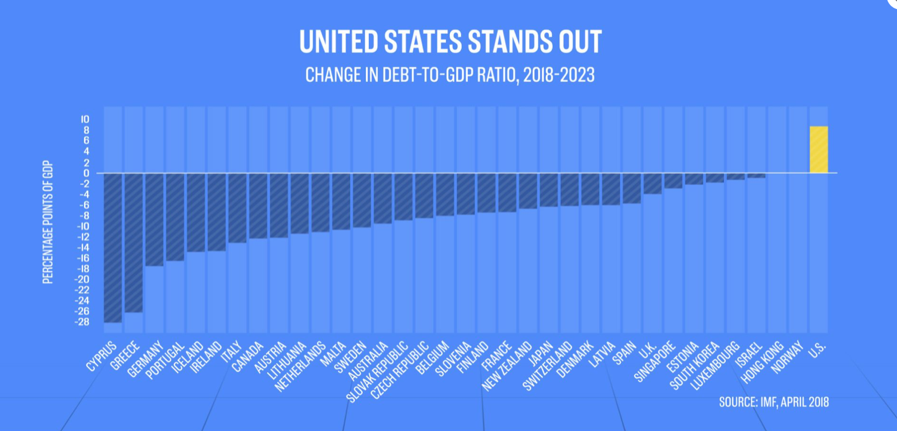

That would give America one of the lowest debt to GDP ratios in the industrialized world.

I actually recommended that the White House use this ploy to get around the last debt ceiling crisis.

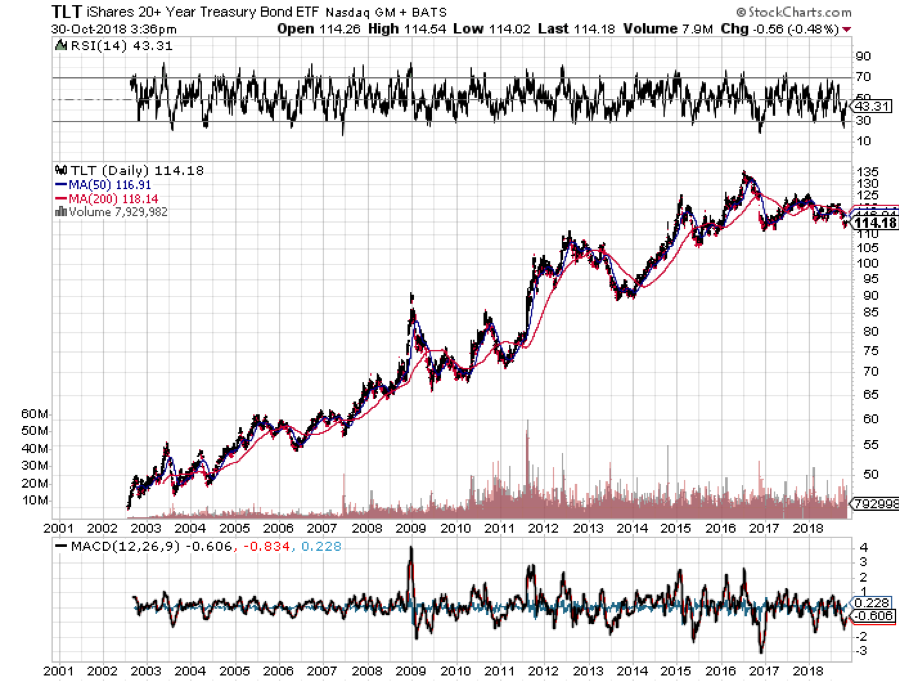

All of this sounds nice in theory. But how would markets respond if this were the true state of affairs in the debt markets?

Ten-year US Treasury bond yields would stay stubbornly low around $3.10%.

Prices for marginal debt securities in emerging markets (ELD) would boom.

Am I ringing any bells here people? Do these sound like debt markets you know and love?

A half-century of trading has taught me to never argue with Mr. Market. He is always right.

By keeping its bonds, the Fed has a valuable tool to employ if it ever senses that real inflation is about to make a comeback without having to raise the overnight deposit rate.

It simply can raise bond market rates by selling some of its still considerable holdings.

“FED SELLS BOND HOARD.”

How do you think risk markets would take that headline? Not well, not well at all.

There are other reasons to keep the $5 trillion in phantom Treasury bonds around.

It assures that the secondary market maintains the breadth and depth to accommodate future large-scale borrowing demanded by another financial crisis, Great Recession, or war.

Yes, believe it or not, governments think like this.

I remember that these were the issues that were discussed the last time closing the bond market was considered.

That was at the end of the Clinton administration in 1999 when paying off the entire national debt was only a few years off.

But close down the bond market and fire the few hundred thousand people who work there, and it could take decades to restart.

This is what Japan learned in the 1960’s.

It took the Japanese nearly a half-century to build the bond infrastructure needed to accommodate their massive borrowings of today.

The Chinese are learning the same thing as they strive to construct modern debt markets from whole cloth. It is not an overnight job.

One of the most common questions I get from foreign governments, institutional investors, and wealthy individuals in my international travels is “What will come of America’s debt problem?”

The answer is easy. It will all go to debt heaven. It will disappear.

US government finances are now worsening at a pretty dramatic pace (see more charts and tables below).

The budget deficit has doubled from the Obama low of $450 billion to $900 billion in only two years. Debt has exceeded GDP for the first time since WWII. New government bond issuance is rocketing and will crush the market any day now.

However, there is a way out of the looming financial disaster.

A massive demographic tailwind kicks in during the 2020s as 85 million Millennials grow up to become big-time taxpayers.

In the meantime, the last of the benefit-hungry baby boomers finally die off, eliminating an enormous fiscal drag.

“Depends” and “Ensure” prices will crater.

The national debt should disappear by 2030, or 2035 at the latest. The same is true for the Social Security deficit. That’s when we next have to consider firing the entire bond market once more.

That is what happened to the gargantuan debt run up by the Great Depression, the Civil War, and the Revolutionary War.

Government debt always goes to debt Heaven either through repayment during the period of demographic expansion and economic strength, or via diminution of purchasing power caused by inflation.

That’s why we have governments to pull forward economic growth during the soft periods in order to even out economic growth and job creation over the very long term to accommodate population growth. Pulling forward growth during strong economies as the administration is now doing only ends in tears.

The French were the first to figure all this out in the 17th century. They were not the last.

History doesn’t repeat itself, but it certainly rhymes.