What The Economist “Big Mac” Index is Telling Us Now

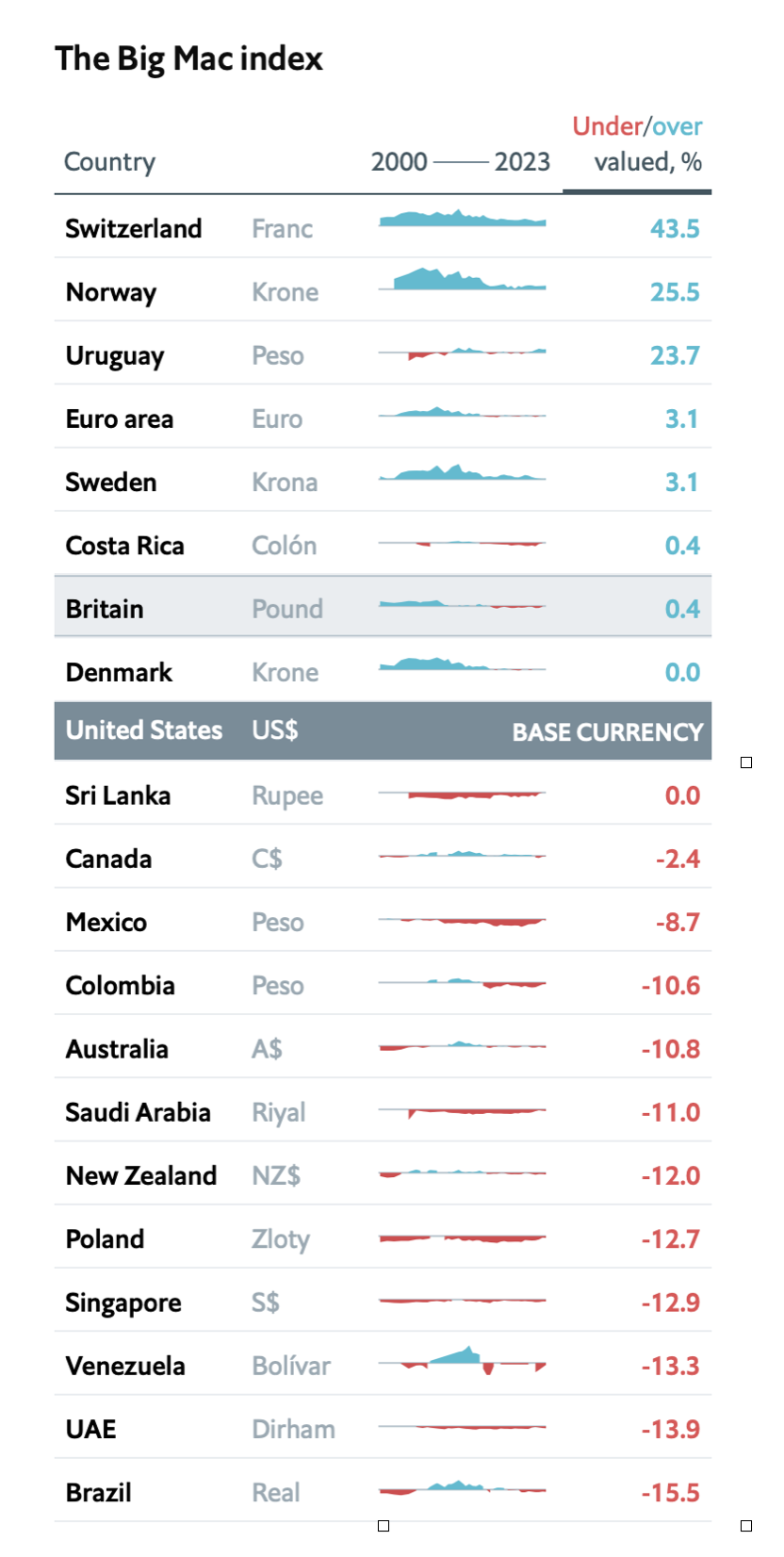

The Swiss franc is wildly overvalued, as are the Norwegian kroner and the Uruguayan peso. On the other hand, the Venezuelan bolivar, UAE dirham, and the Brazilian real off real value.

Who has the cheapest currency in the world? The Ukrainian hryvnia, which at 25 cents to the US dollar offers the cheapest Big Mac in the world. I had one in October, and they taste just the same, but is a bargain at $5.00. That explains the proliferation of McDonald's hamburger stands in the capital city of Kiev. They are always packed.

With interest rates and inflation the urgent topics of the day, everyone has their favorite inflation indicator. The Fed has money supply growth, you have yours, and well, I have mine.

My former employer, The Economist, once the ever-tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), released its “Big Mac” index of international currency valuations in 1987.

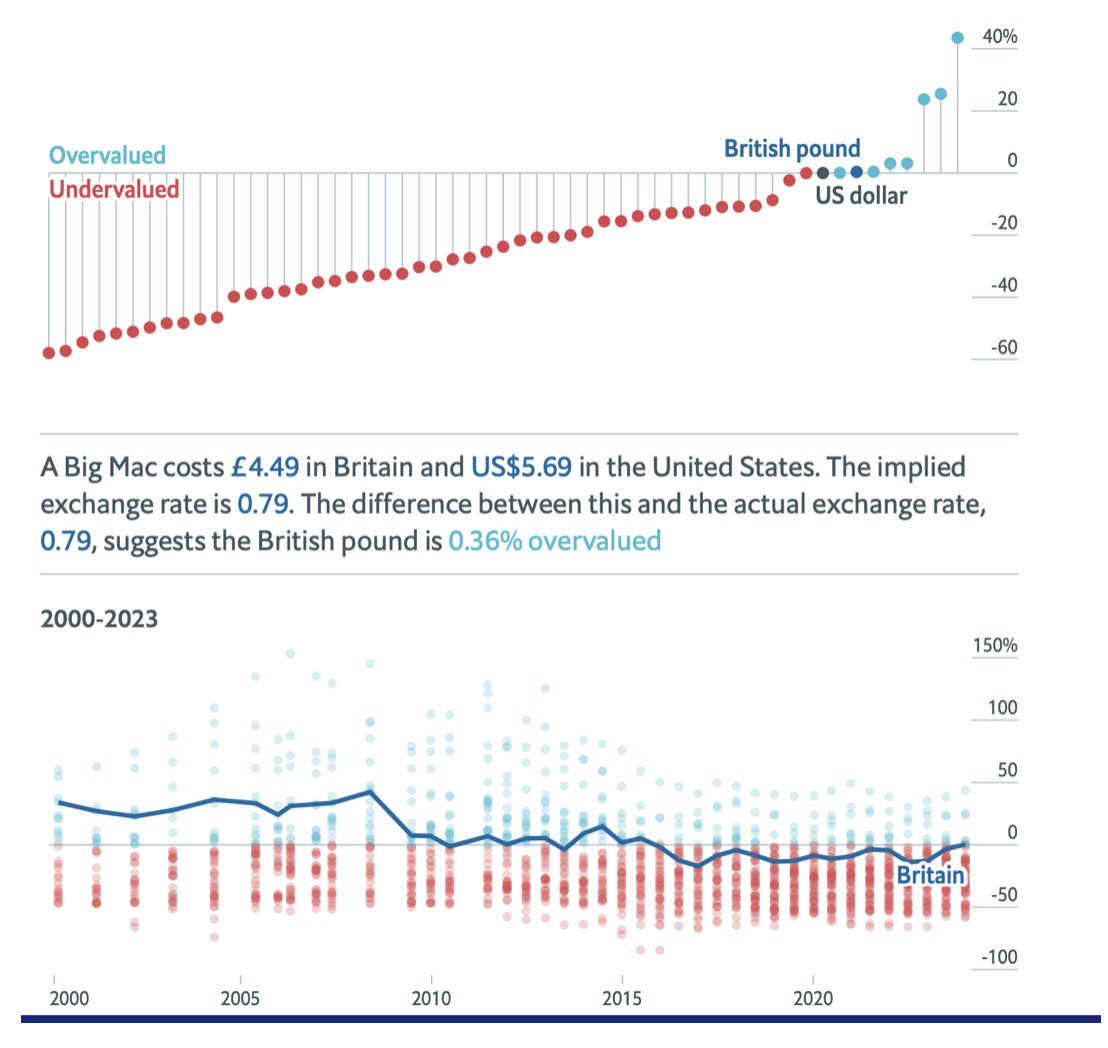

Although initially launched as a joke, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The heart attack on a plate costs $5.69 in most of the US.

The Economist index counts the cost of McDonald’s (MCD) premium sandwiches around the world, ranging from 142% the cost of an American Big Mac in Switzerland to only 84.5% in Brazil, and comes up with a measure of currency under and overvaluation.

I couldn’t agree more with many of these conclusions. It’s as if the August weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas.

I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it directly to my middle. Better to use it as an economic forecasting tool, than a speedy lunch.

Having followed this index religiously for 37 years, I am able to make some astute long-term observations. For a start, the US dollar has been at the top of the range for most of its life. This is because the US has had the best major economic growth rate over the last four decades, averaging a real 3.0%.

Another factor is that America has also had the world’s highest large economy interest rates, thanks to a very tough inflation-fighting Federal Reserve. I doubt Jay Powell eats Big Macs. He’s too thin.

You will also find that the cheap end of the range is always populated by the same countries year in and year out. These are poorly governed, money-printing, economically chaotic countries with little regard for their currencies. Don’t cry for me Argentina and throw in Venezuela. They will always be cheap. Invest there at your peril.

And yes, making your currency calls based on the price of hamburgers has its risks. But it does give me a wonderful excuse to travel around the world taking pictures of fast-food stands.

The Big Mac in Swiss francs is Definitely Not a Buy

But it’s the Deal of the Century in Kiev