What the Heck is ESG Investing?

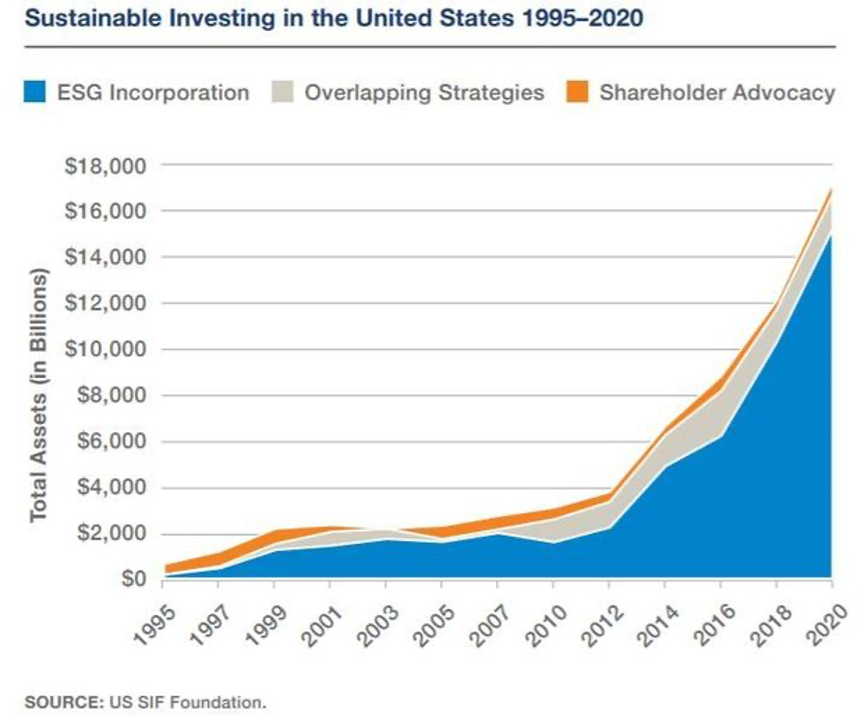

Looking at the New Year equity allocations, it’s truly astonishing how much money is pouring into ESG investing. Maybe it was another year of blistering head worldwide that did it. It now accounts for one-third of all US equity investment.

Last year, BlackRock, one of the largest fund managers in the country, made a major new commitment to ESG investment by rolling out several new ETFs. I thought I’d better take him seriously, as his firm is one of the largest money managers in the world with $7 trillion in assets.

So what the heck is ESG investing?

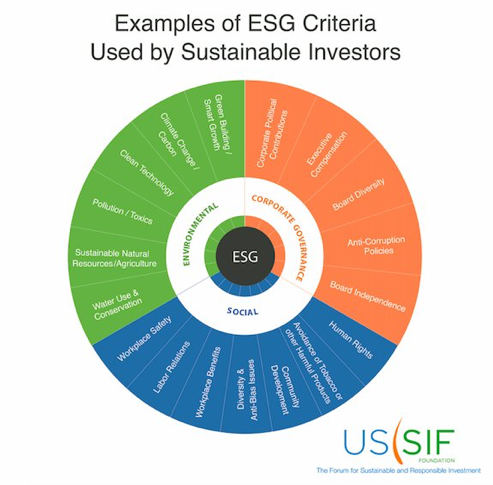

Environmental, Social, and Governance investing (ESG) seeks to address climate change in any way, shape, or form possible. Its goal is to move the economy and capital away from carbon-based energy forms, like oil (USO), natural gas (UNG), and coal (KOL), to any kind of alternative.

I am always suspicious of investment themes that are politically correct and ideologically directed, as they usually end in tears. I can’t tell you how many people I know who invested their life savings in solar companies to save the world, like Solyndra, Sungevity, American Solar Direct, and Suniva, only to get wiped out when they went under.

As laudable as the goals of these companies may have been, they were unable to deal with collapsing prices, Chinese dumping, and the harsh realities of doing business in a cutthroat competitive world.

As a venture capital friend of mine once told me, “Technology is a bakery business”. If you can’t sell your products immediately, you go broke. Technology always drops prices dramatically and if you can’t stay ahead of the curve you don’t stand a chance.

Still, what I believe is not important. The fastest growing group of new investors in the market today are Millennials, and they happen to take ESG investing very seriously.

There does seem to be a method to BlackRock’s madness. Over the past year, ESG-influenced funds have grown from 1% to 3.6% of total investment. Other major fund families like Vanguard have already jumped on the bandwagon.

ESG can include a panoply of activities, including recycling, climate change mitigation, carbon footprint reduction, water purification, green infrastructure, environmental benefits for employees, and greenhouse gas reduction. There are many more.

There is even an ESG rating system for funds and companies produced by firms like Refinitiv, which scores 7,000 companies around the world based on their environmental sensitivity. Companies like United Utilities Group PLC, the UK’s largest water company, get an A+, while China’s Guangdong Investment Ltd, which supplies water and energy to Hong Kong, gets a D-.

It goes without saying that companies from emerging nations tend to score very poorly. So do manufacturing companies relative to service ones, and energy companies versus non-energy ones.

The ESG concept began in 2005, when UN Secretary General Kofi Annan wrote to 50 global CEOs urging them to take climate change seriously. A major report by Ivor Knoepfel followed a year later entitled “Who Cares Wins.” The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. The snowball has been rolling ever since.

Themed investing is not new. “Sin” stocks have long been investment pariahs, including alcohol and tobacco companies. As a result, these companies trade at permanently low multiples. The newest investment ban is on firearms-related companies.

ESG investment may be about to get a major tailwind. The laws of supply and demand have oil prices disappearing up their own exhaust pipe. Overproduction by US fracking companies has caused supply gluts that will lead to chronically lower prices. The US happens to have a new 200-year supply of oil and gas, thanks to the fracking revolution.

Saudi Arabia just floated their oil monopoly, Saudi ARAMCO, raising a record $26 billion. When Saudi Arabia wants to get out of the oil and gas business, so should you. It’s not because they can’t think of new ways to spending money that they’re unloading it.

That’s why I have been advising followers to avoid energy investments like the plague for the past decade. My recent trade alerts for oil have been on the short side. It’s just a matter of time before alternatives rule the world.

Who is the greenest company in America? That would be electric car and autonomous driving firm Tesla (TSLA). Perhaps ESG investing helps explain the tripling of the share price since June.

What is the top-performing listed stock of the last 30 years? Tobacco company Altria Group (MO), the old Philip Morris.

It’s proof that investment shaming doesn’t always work.