What Ever Happened to the Great Depression Debt?

When I was a little kid during the early 1950s, my grandfather used to endlessly rail against Franklin Delano Roosevelt.

The WWI veteran, who was mustard gassed in the trenches of France and was a lifetime, died in the wool Republican, said the former president was a dictator and a traitor to his class, who trampled the constitution with complete disregard.

Republican presidential candidates Hoover, Landon, and Dewey would have done much better jobs.

What was worse, FDR had run up such enormous debts during the Great Depression that, not only would my life be ruined, so would my children’s lives.

As a six-year-old, this disturbed me deeply, as it appeared that just out of diapers, my life was already going to be dull, brutish, and pointless.

Grandpa continued his ranting until a three pack a day Lucky Strike non-filter habit finally killed him in 1977.

He insisted until the day he died that there was no definitive proof that cigarettes caused lung cancer, even though during his war, they referred to them as “coffin nails.”

He was stubborn as a mule to the end. And you wonder whom I got it from?

What my grandfather’s comments did do was spark in me a lifetime interest in the government bond market, not only ours, but everyone else’s around the world.

So, what ever happened to the despised, future destroying Roosevelt debt?

In short, it went to money heaven.

And here I like to use the old movie analogy. Remember, when someone walked into a diner in those old black and white flicks? Check out the prices on the menu on the wall. It says “Coffee: 5 cents, Hamburgers: 10 cents, Steak: 50 cents.”

That is where the Roosevelt debt went.

By the time the 20 and 30-year Treasury bonds issued in the 1930’\s came due, WWII, Korea, and Vietnam happened, and the great inflation that followed.

The purchasing power of the dollar cratered, falling roughly 90%. Coffee is now $1.00, a hamburger at McDonald’s is $5.00, and a cheap steak at Outback cost $12.00.

The government, in effect, only had to pay back 10 cents on the dollar in terms of current purchasing power on whatever it borrowed in the thirties.

Who paid for this free lunch?

Bond owners who received minimal and often negative real inflation-adjusted returns on fixed income investments for three decades.

In the end, it was the risk avoiders who picked up the tab. This is why bonds became known as “certificates of confiscation” during the seventies and eighties.

This is not a new thing. About 300 years ago, governments figured out there was easy money to be had by issuing paper money, borrowing massively, stimulating the local economy, creating inflation, and then repaying the debt in devalued future paper money.

This is one of the main reasons why we have governments, and why they have grown so big. Unsurprisingly, France was the first, followed by England and every other major country.

Ever wonder how the new, impoverished United States paid for the Revolutionary War?

It issued paper money by the bale, which dropped in purchasing power by two thirds by the end of conflict in 1783. The British helped too by flooding the country with counterfeit paper Continental money.

Bondholders can expect to receive a long series of rude awakenings sometime in the future.

No wonder Bill Gross, the former head of bond giant PIMCO, says he will get ashes in his stocking for Christmas next year.

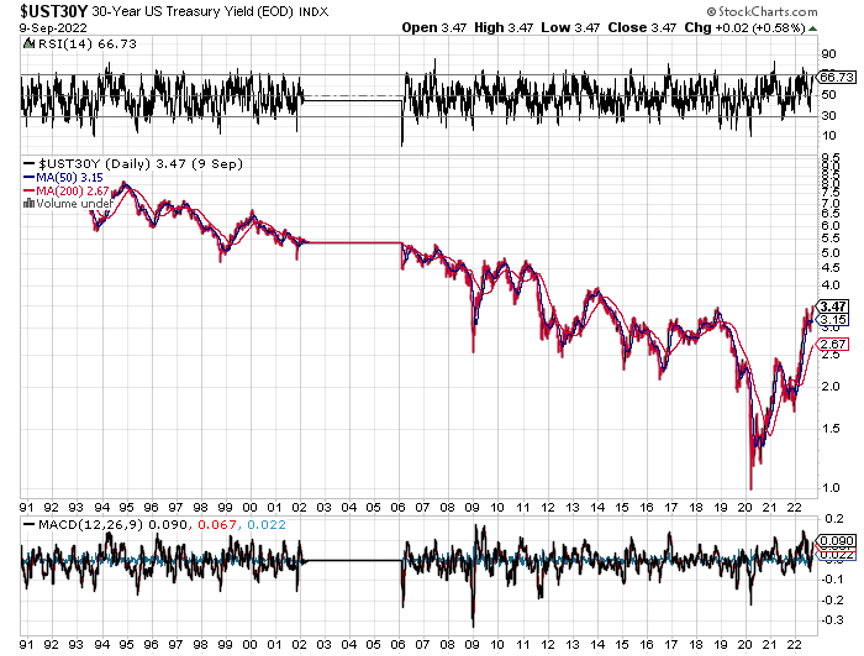

The scary thing is that eventually, we will enter a new 30-year bear market for bonds that lasts all the way until 2049. However, after last month’s frenetic spike up in bond prices and down in bond yields, that is looking more like a 2022 than a 2019 position.

This is certainly what the demographics are saying, which predicts an inflationary blow-off in decades to come that could take short term Treasury yields to a nosebleed 12% high once more.

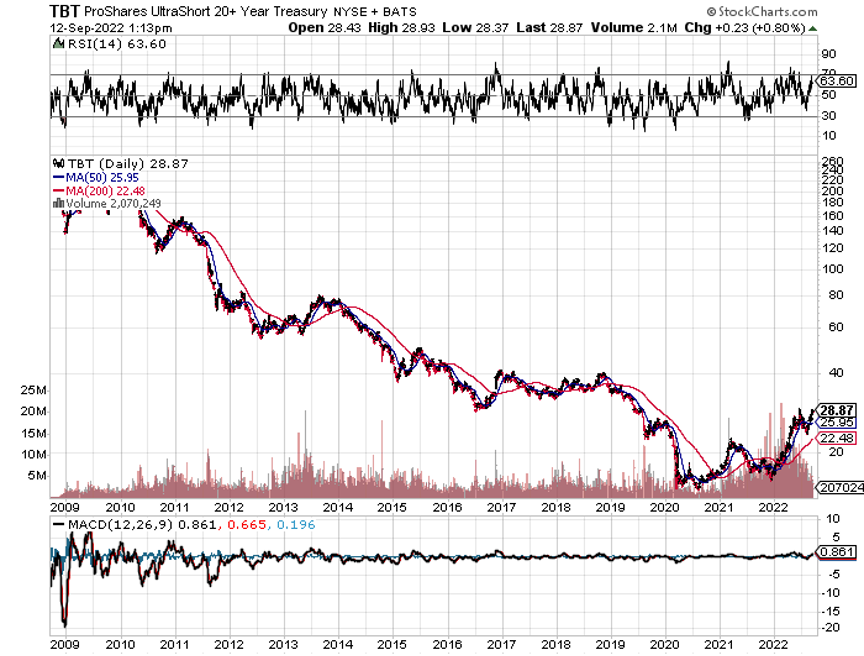

That scenario has the leveraged short Treasury bond ETF (TBT), which has just cratered down to $23, double to $46, and then soaring all the way to $200.

If you wonder how yields could get that high in a decade, consider one important fact.

The largest buyers of American bonds for the past three decades have been Japan and China. Between them, they have soaked up over $2 trillion worth of our debt, some 12% of the total outstanding.

Unfortunately, both countries have already entered very negative demographic pyramids, which will forestall any future large purchases of foreign bonds. They are going to need the money at home to care for burgeoning populations of old age pensioners.

So who becomes the buyer of last resort? No one, unless the Federal Reserve comes back with QE IV, V, and VI. QE IV, in fact, has already started.

There is a lesson to be learned today from the demise of the Roosevelt debt.

It tells us that the government should be borrowing as much as it can right now with the longest maturity possible at these ultra-low interest rates and spending it all.

With real, inflation adjusted 10-year Treasury bonds now posting negative yields, they have a free pass to do so.

In effect, the government never has to pay back the money. But they do have the ability to reap immediate benefits, such as through stimulating the economy with greatly increased infrastructure spending.

Heaven knows we need it.

If I were king of the world, I would borrow $5 trillion tomorrow and disburse it only in areas that create domestic US jobs. Not a penny should go to new social programs. Long-term capital investments should be the sole target.

Here is my shopping list:

$1 trillion – new Interstate freeway system

$1 trillion – additional infrastructure repairs and maintenance

$1 trillion – conversion of our energy system to solar

$1 trillion – construction of a rural broadband network

$1 trillion – investment in R&D for everything

The projects above would create 5 million new jobs quickly. Who would pay for all of this in terms of lost purchasing power? Today’s investors in government bonds, half of whom are foreigners, principally the Chinese and Japanese. Notice that I am not committing a single dollar in spending on any walls.

How did my life turn out? Was it ruined, as my grandfather predicted?

Actually, I did pretty well for myself, as did the rest of my generation, the baby boomers.

My kids did OK too. One son just got a $1 million, two year package at a new tech startup and he is only 30. Another is deeply involved in the tech industry, and my oldest daughter is working on a PhD at the University of California. My two youngest girls became the first ever female eagle scouts.

Not too shabby.

Grandpa was always a better historian than a forecaster. But he did have the last laugh. He made a fortune in real estate, betting correctly on the inflation that always follows big borrowing binges.

You know the five acres that sits under the Bellagio Hotel in Las Vegas today? That’s the land he bought in 1945 for $500. He sold it 32 years later for $10 million.

Not too shabby either.

32 Years of 30-Year Bond Yields

Not Too Shabby for $500