What's Behind the Tech Meltdown

Tech shares are on a knife’s edge.

The world finally cared about the coronavirus and this meant the spreading of it from Chinese soil to other regions of the world with meaningful foreign death tolls.

Tech shares, for a time, became the de facto safe haven for coronavirus investors to hide out until Iran and South Korea reported an explosion of cases on the same day.

Tech shares bore the brunt of the carnage in the markets and have experienced one of the worst 2-day performances in the history of the technology-dominated Nasdaq index.

Global supply chains are in a state of paralysis as the Middle Kingdom has turned into 1.4 billion homesitters.

Even worse, the rapid spread of the virus hits home the fact that other parts of the world could enter an imminent lockdown on business.

This is bearish for not only the standard tech multinational, but all global operations and economy.

Many tech traders were wiped out unable to sell in the frantic sell-off.

We will get the lowdown on how some tech-based hedge funds went bust shortly because more than a few bet on a quick coronavirus solution.

Well, this is not a 1-day fix and Mr. Market is always correct.

The truth is that this virus is sowing economic uncertainty across the globe and there are really 2 ways from here, will it get worse or better?

If further meaningful contagion is prevented in the next few days, there could be a massive rally in many of the best in show that tech has to offer.

However, that seems implausible.

If new cases vanish from the headlines for a few days, a relief rally will be on our hands, but there are reports as we speak from Austria, Spain, and Romania.

Investors are waiting for bullish crumbs like a Central Bank announcement or vaccine development to help, but that likely won’t stem the negative momentum or come in time.

The virus also destroys any potential tech IPOs this year such as Airbnb, and they will most likely shelve their IPO and wait for the virus and its fallout to dissipate.

The debt market will also be hesitant to give the benefit of the doubt to major loss-makers like Lyft and Uber who have poor unit economics.

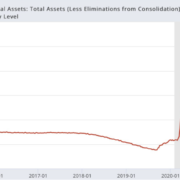

Apple, Facebook, Amazon, Microsoft and Google-parent Alphabet comprise over 20% of the S&P and lost a combined $250 billion in one trading day then backed that up with an even worse loss.

Then there is the pending situation of if the Chinese economy isn’t up and running soon, “millions” of local businesses could go bust in the second biggest economy.

So even if a consensus thesis of stock markets usually powering through pandemics is still valid, the economic damage could be too hideous to ignore sending markets even lower.

One of the ironic winners of this horrid virus has been Bitcoin which has seen a price rise 15% in the last one month.

A global pandemic strengthens the use case for this “digital gold” almost signaling that the current governing status quo and monetary system are unfit for operation.

Now is not the time to dive in and bet the ranch.

The likelihood of the coronavirus halting tech’s ability to operate grows higher by the hour.

Risks are currently skewed to the downside with the market pricing into tech shares that the coronavirus will spread inside the U.S. and affect tech firms’ profitability for the rest of 2020 and even perhaps bring forward a global tech recession.

A tech recession is not yet off the table, and the policy response will be vital if the contagion spirals out of control.

The Mad Hedge Technology Letter is 100% in cash and readers should wait for the dip to bottom out.