What’s the Matter With Apple?

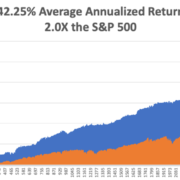

It was 38 years ago today that Apple (AAPL) went public and has generated a 43,000% return since its $22 IPO price. If you bought one share of Apple way back then for $22 it would be worth a breathtaking $95,000 today.

I waited until the next crash and then bought it at $4, and it sits in one of my “no touch” ultra-long-term retirement portfolios today.

Suddenly, the torture I endured taking Steve Jobs around to visit the New York institutional investors during the early 1980s was worth it.

The great rule of thumb I have learned after 50 years of investment is that if you hold a stock long enough, the dividend will exceed your original capital cost, giving you a 100% a year annual cash flow.

Three months ago, Apple was the Teflon stock of the entire market, the company that could do no wrong, the only “safe” stock that traded. Any selling met a wave of buying from Oracle of Omaha Warren Buffet and Apple itself, limiting corrections to a feeble 4%.

What a difference three months make!

Now the shares have become a market pariah, targeted by algorithms and hedge funds alike, and beaten like the proverbial red-headed stepchild. As a result, the shares have plunged an eye-popping 29.61%, vaporizing $311 billion in market capitalization.

Which begs one to ask the question, “What’s the matter with Apple?” How can things go from so right to so wrong?

Just like success has many fathers, failure is an orphan.

The harsh truth is that Apple became too much of a good thing to too many people. Expectations had become excessive and it had become too widely owned by traders with weak hands. In other words, people like me.

I had been cautious of Apple for a while because if its massive China exposure. You don’t want to own a company that relies entirely on Middle Kingdom production during a running trade war. Apple sold an incredible 216 million iPhones in 2017, and all of them are made at the Foxconn factories in southern China.

Apple has become the whipping boy for both sides in the trade conflict. The company has always run the risk of its Foxconn workers arriving at work late someday, or not showing up at all at the prodding of Beijing. Recently, Trump said iPhones imported from China could be subject to the current 10%, soon to be 25% tariff.

The final nail in the coffin came on Monday morning when we learned of a lower Chinese court’s ruling against Apple in a lawsuit from QUALCOMM (QCOM). Never mind that the suit was years old and applied only to the company’s older phones. With the shares in free fall, that is just what investors DIDN’T want to hear.

However, Apple is not dead, it is just resting. Or, call it ripening.

Not only could Apple recover strongly from these abysmal levels, IT COULD DOUBLE IN VALUE.

The core of my argument (no pun intended) is that Apple is in the process of fundamentally evolving its business model. It is rapidly morphing from a one-time sale only hardware company to a recurring subscription services company. And that is where the big money is in the future.

Microsoft (MSFT) is already doing it, so are Amazon (AMZN) and Netflix (NFLX). In fact, everyone is doing it, even the Diary of a Mad Hedge Fund Trader.

In fact, Apple's services revenue could balloon to $100 billion in five years, compared to its estimated total sales this year of $265 billion.

This accomplishes several important things. It moves the company out of a 30% gross margin business to a 70% gross margin. It converts Apple from a highly cyclical to stable earnings growth. Stable earnings growth companies are awarded much higher share price multiples.

Look no further than my next-door neighbor, Clorox (CLX), which trades at a much loftier 23X multiple and Coca-Cola (KO) which can be found at generous 19X multiple. Earnings visibility is worth its weight in gold. This could make Apple’s current 14X multiple a thing of the past.

Of course, we are not going to see a straight line move from one dominant business to another, and the road along the road could be bumpy. We could easily see one more meltdown which takes us to the subterranean $160 handle.

But $10 of downside risk versus $170 of upside? I’ll take that all day long. I bet you will too!