Who the Electric Car Helps and Hurts

With gasoline prices staying stubbornly high, the number of hybrid and electric cars manufactured is soaring skyward. Toyota Motors (TM) is far and away the biggest beneficiary as the world?s largest manufacturer of hybrid cars with its Prius family that now extends to five models. Nissan Motors (NSANY) is expected to complete construction of a Tennessee plant that will produce 150,000 all-electric Leafs a year in 2014.

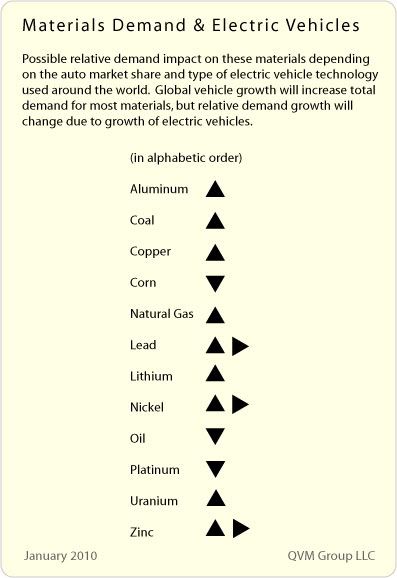

Beyond these obvious beneficiaries it gets a little more complicated. I found this interesting table from the QVM Group that listed the impact that electric cars, which will soon be produced at one million units a year, will have on the supply and demand for raw materials. Here are my comments:

Aluminum (AA): Lighter cars need more aluminum for bodies

Coal (KOL): Greater electricity needs increase demand from this cheapest of sources.

Copper (CU): Big increase in demand for copper wire from electric motors and the grid.

Corn (CORN): Kiss the pork barrel ethanol program goodbye. Demand falls.

Natural Gas (UNG): Some 100% of new power generation facilities are gas fueled.

Lead: Older technology batteries still use lots of lead.

Lithium (SQM): You can?t lose. If electric car demand doesn?t kick in, then fertilizer demand will.

Nickel: The same batteries use nickel

Oil (USO): Some analysts think gasoline demand could drop by 50% by 2020 because of electric cars, mileage improvements in conventional cars, and the discovery of huge new fields in the US with fracking technology.

Platinum (PPLT): Demand falls from fewer catalytic converters, but this will be offset by growing monetary demand for the white metal.

Uranium (NLR) : More power demand means more nukes everywhere.

Zinc: Battery demand again

Who Am I Helping?