Why Apple May Go Ballistic.

I went into my local Apple store last week to buy an iPhone 5 to replace my aging iPhone 4s. The sales girl looked at me like I was out of my mind. She gave me a website address where I could pre-order and said good luck. I found out later that the company sold a stunning 2 million units in pre-orders in 24 hours. That?s nearly a billion dollars in revenue. Wow!

I went back into the store yesterday and talked to the manager. I asked when iPhones would be physically available in the store. He said this Friday, but there will be lines around the block. I asked when I could just come in and just buy one without a long wait. He answered mid-week in the afternoon sometime at the end of October. Double wow! It is clear to me that the only limitation on the sales of this incredible product for the rest of the year is the number of units they can physically get out the door.

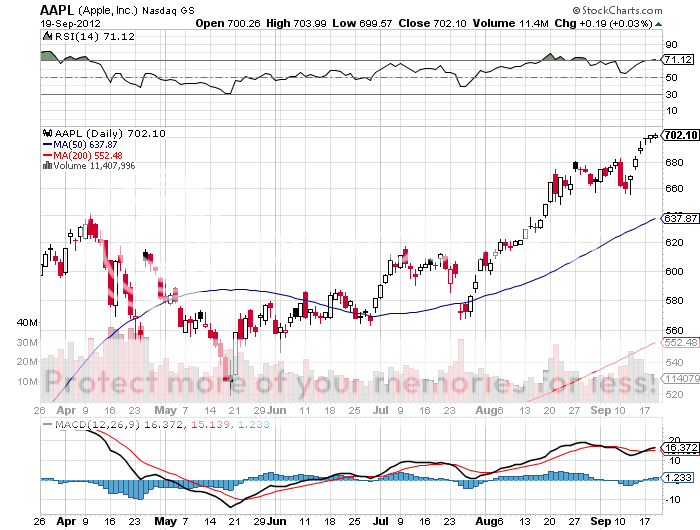

The stock is now up 75% year-to-date. Any money manager found missing Apple from their portfolio at year end will get fired. So a gigantic performance chase has begun, with thousands of institutions throwing in the towel and paying up at these lofty levels just to get the name on their books.

The truly bizarre thing is that the higher Apple shares go, the cheaper they get on an earnings multiple basis, because the market can?t keep up with surging profit growth. This is proof, yet again, that if you live long enough, you get to see everything.

There is one stock that is certainly not going to announce an earnings disappointment in the coming quarterly cycle, and that is Apple. The roll out of the iPhone 5 is occurring much faster than previous models. It will be offered for sale in 100 countries by yearend compared to only 53 for the iPhone 4s during the same period.

So unit sales could reach 8 million by the end of Q3 and a staggering 50 million by Q4. This will create an unprecedented surge in Apple?s reported quarterly earnings. Those waiting to buy on the next big dip could end up missing one of the most impressive multi-decade growth stories in history.

CEO Tim Cook is not finished with us with the iPhone 5 launch. My sources in the company tell me that other generational changing products will be released in the months to come which could trigger another leg up in the stock. I think it is possible for the share price to tack on another $100 by year end.

For additional research on why you should buy shares in this amazing company, please go to my website at www.madhedgefundtrader.com and do a search for ?Apple?. There you will find a zillion pieces begging you to buy the stock from $250 on up. Last week, I raised my final target for the shares to $1,600, which we could see in a couple of years. I will continue to drink from this well as long as the water is fresh and sweet.

Last week Apple?s legendary product designer, Sir Johnny Ive, bought a $17 million, 7,279 square foot mansion on San Francisco?s tony Gold Coast in Pacific Heights, an abode first built by a famous gold miner. He?s the guy who came up with the look of the iPhone, iPad, and iPhone to Steve?s Jobs? exacting standards. I want a piece of that action.

Johnny's New Kitchen