Why Crashing Yields Could be Signaling an End to the Stock Selloff

I believe that the entire leg down in the stock market we have seen since July has been driven by a global collapse in bonds yields, a reliable predictor of recessions.

In three weeks, ten-year US Treasury yields have collapsed from 2.15% to 1.46%, ten-year German bunds from -0.20% to -0.72, and Japanese ten-year government bonds have collapsed from -0.10% to -0.25%.

For a once in a half-century observer of the financial markets, I can assure you that these are once in a half-century moves.

Therefore, I can tell you with some news that we are coming to an end in these horrific moves, at least an interim one.

I have charted ten-year US Treasury yields for the five decades that I have been in the market below and we are rapidly approaching a crucial point. That would be the triple bottom at the all-time lows at 1.35%.

If yields bounce there, and they should, you can expect a substantial short-covering rally to ensue in the stock market. That’s why I have been using every dip this week to load up on long positions in the FANGS.

With German bunds at -0.75%, a US bottom at 1.35% may not be the final one. But it was certainly a sign for long players in the (TLT) to take their massive profits, which could take yields back up as high as 1.75%.

Investors around the world have been confused, befuddled, and surprised by the persistent, ultra-low level of long-term interest rates in the United States.

The ten-year all-time low yield of 1.33% is as rare as a dodo bird, last seen in the 19th century.

What’s more, yields across the entire fixed income spectrum have been plumbing new lows. Corporate bonds (LQD) have been fetching only 3.02%, tax-free municipal bonds (MUB) 1.60%, and the iShares IBoxx High Yield Corporate Bond ETF (HYG) a pittance at 5.27%.

Spreads over Treasuries are now inverted, with a two-year yield at 1.50% versus a ten-year yield at 1.46%. always a reliable recession indicator

Are investors being rewarded for taking on the debt of companies that are on the edge of bankruptcy, a tiny 2.0% premium? Or that State of Illinois at 3.0%? I think not.

It is a global trend.

Yikes!

These numbers indicate that there is a massive global capital glut. There is too much money chasing too few low-risk investments everywhere. Has the world suddenly become risk-averse? Is inflation gone forever?

Will deflation become a permanent aspect of our investing lives? Does the reach for yield know no bounds?

It wasn’t supposed to be like this.

Almost to a man, hedge fund managers everywhere were unloading debt instruments last year when ten-year yields peaked at 3.25%. They were looking for a year of rising interest rates (TLT), accelerating stock prices (QQQ), falling commodities (DBA), and dying emerging markets (EEM). Surging capital inflows were supposed to prompt the dollar (UUP) to take off like a rocket.

It all ended up being almost a perfect mirror image portfolio of what actually transpired since then. As a result, almost all mutual funds were down in 2018. Many hedge fund managers are tearing their hair out, suffering their worst year in recent memory.

What is wrong with this picture?

Interest rates like these are hinting that the global economy is about to endure a serious nose dive, possibly even re-entering recession territory….or it isn’t.

To understand why not, we have to delve into deep structural issues which are changing the nature of the debt markets beyond all recognition. This is not your father’s bond market.

I’ll start with what I call the “1% effect.”

Rich people are different than you and I. Once they finally make their billions, they quickly evolve from being risk-takers into wealth preservers. They don’t invest in start-ups, take fliers on stock tips, invest in the flavor of the day, or create jobs. In fact, many abandon shares completely, retreating to the safety of coupon clipping.

The problem for the rest of us is that this capital stagnates. It goes into the bond market where it stays forever. These people never sell, thus avoiding capital gains taxes and capturing a future step up in the cost basis whenever a spouse dies. Only the interest payments are taxable, and that at a lowly 1.46% rate.

This is the lesson I learned from servicing generations of Rothschild’s, Du Pont’s, Rockefellers, and Getty’s. Extremely wealthy families stay that way by becoming extremely conservative investors. Those that don’t, you’ve never heard of because they all eventually went broke.

This didn’t use to mean much before 1980, back when the wealthy only owned less than 10% of the bond market, except to financial historians and private wealth specialists of which I am one. Now they own a whopping 25%, and their behavior affects everyone.

Who has been the largest buyer of Treasury bonds for the last 30 years? Foreign central banks and other governmental entities, which count them among their country’s foreign exchange reserves.

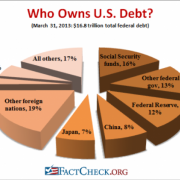

They own 36% of our national debt, with China in the lead at 8% (the Bush tax cut that was borrowed), and Japan close behind with 7% (the Reagan tax cut that was borrowed). These days they purchase about 50% of every Treasury auction.

They never sell either, unless there is some kind of foreign exchange or balance of payments crisis, which is rare. If anything, these holdings are still growing.

Who else has been soaking up bonds, deaf to repeated cries that prices are about to plunge? The Federal Reserve which, thanks to QE1, 2, 3, and 4, now owns 13.63% of our $22 trillion debt.

An assortment of other government entities possesses a further 29% of US government bonds, first and foremost the Social Security Administration, with a 16% holding. And they ain’t selling either, baby.

So what you have here is the overwhelming majority of Treasury bond owners with no intention to sell. Ever. Only hedge funds have been selling this year, and they have already done so, in spades.

Which sets up a frightening possibility for them, now that we have broken through the bottom of the past year’s trading range in yields. What happens if bond yields fall further? It will set off the mother of all short-covering squeezes and could take ten-year yield down to match 2012, 1.35% low, or lower.

Fasten your seat belts, batten the hatches, and down the Dramamine!

There are a few other reasons why rates will stay at subterranean levels for some time. If hyper-accelerating technology keeps cutting costs for the rest of the century, deflation basically never goes away (click here for “Peeking Into the Future With Ray Kurzweil.”

Hyper-accelerating corporate profits will also create a global cash glut further levitating bond prices. Companies are becoming so profitable they are throwing off more cash than they can reasonably use or pay out.

This is why these gigantic corporate cash hoards are piling up in Europe in tax-free jurisdictions, now over $2 trillion. Is the US heading for Japanese-style yields of zero for 10-year Treasuries?

The threat of a second Cold War is keeping the flight to safety bid alive and keeping the bull market for bonds percolating. You can count on that if the current president wins a second term.