Why I Have Become So Boring

I have recently received a few complaints from readers that I have become boring. I have to confess that they are right.

I am not a person who boredom comes to easily. I’m the guy who climbed the Matterhorn, crossed the Sahara Desert on the back of a camel, and went to surfing school.

And that’s just what I did last year! Oh, and I’m also headed for the world’s hottest combat zone.

However, I do admit that I have become boring on the trading front.

If I get a request for one thing more than any other, it is for recommendations of stocks that will rise by at least ten times over the next ten years.

Readers want to know the names of shares of companies that they can just buy and forget about, and then retire rich as Croesus a decade down the road.

What could be more reasonable?

I happen to have sent out quite a few of these over the years.

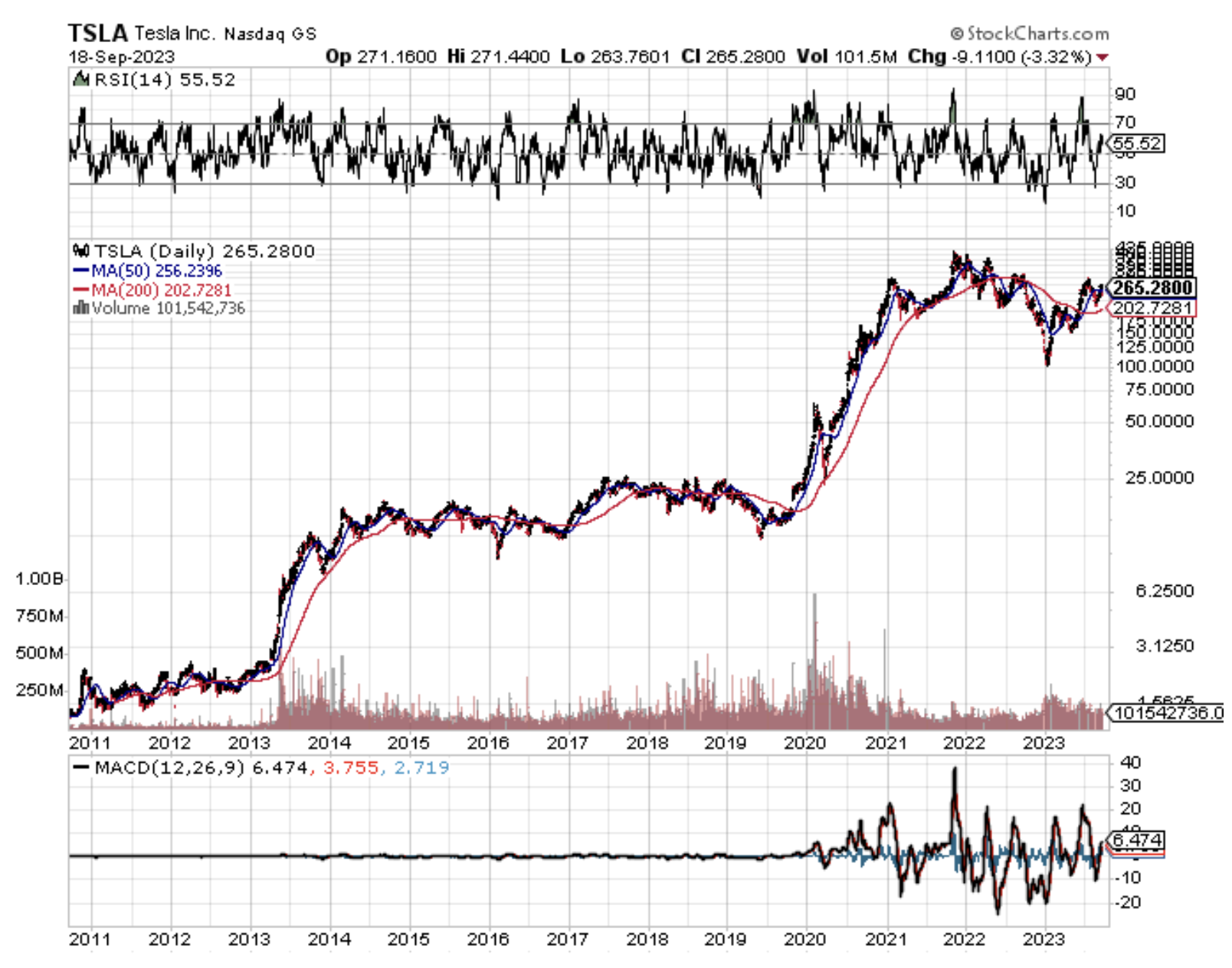

Whenever I attend my global strategy luncheons around the world, someone inevitably thanks me for my effort to cajole them into buying Tesla (TSLA) at a split-adjusted $2.50. Nothing seemed more questionable at the time (2010) in the wake of the Great Recession and financial crisis.

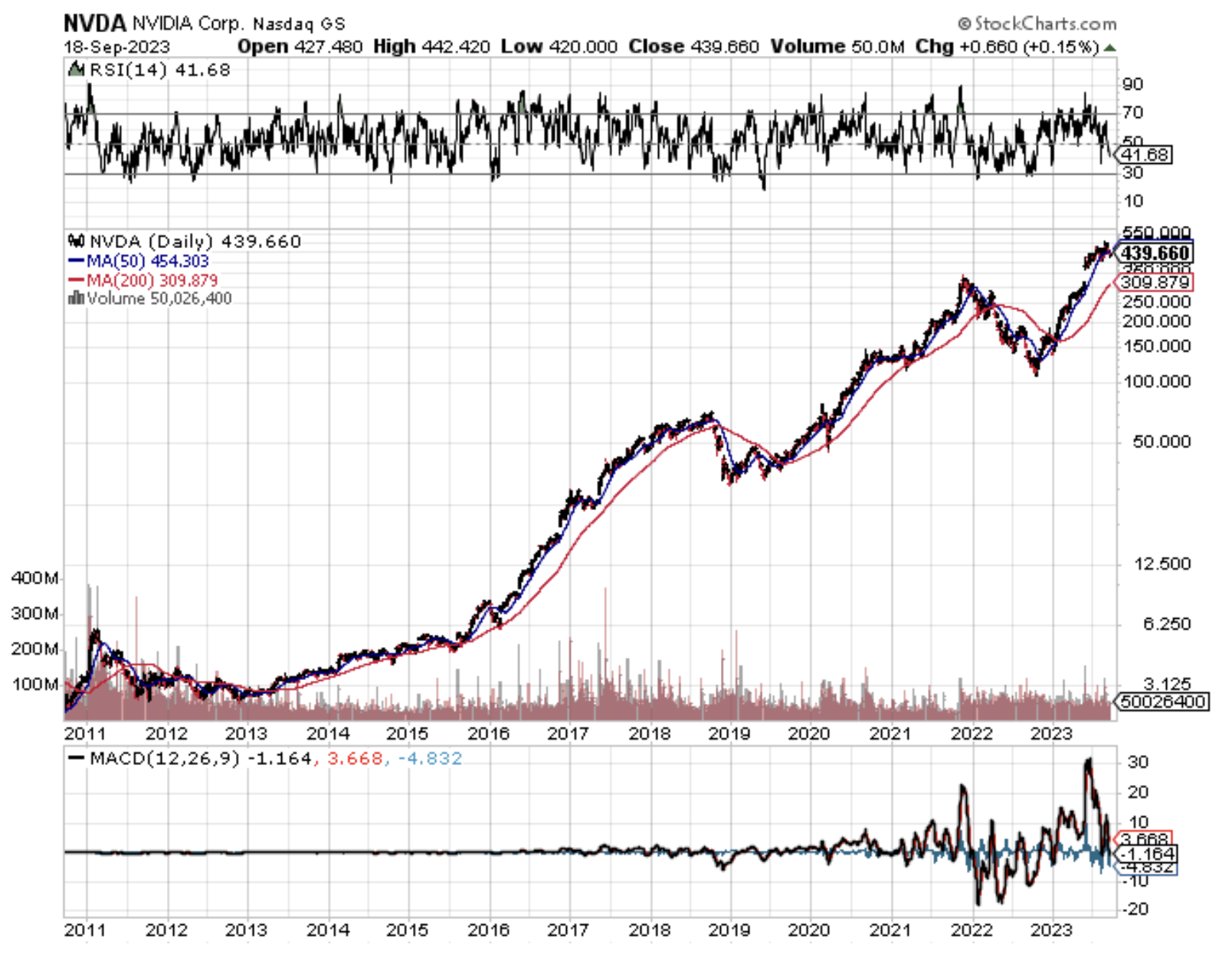

At my New York luncheon in June, a guest pressed a one-ounce American Gold Eagle into my hand and said thanks for NVIDIA (NVDA). He bought it at $15 and rode it all the way up to $450.

He then doubled his money by jumping into Apple (AAPL) at $56 (on a split-adjusted basis) and rode the express train to $200, again after my pleading.

Then there was the reader who offered me his mega yacht in the Mediterranean for a week for free because I virtually forced him to buy Moderna (MRNA) just before the pandemic before it rocketed 50X. It was nice cruising the Mediterranean last summer on his advice.

It’s not that I have suddenly become averse to dishing out ten-baggers. I have not grown weary in my old age either, although I confess to finding those erectile dysfunction and baldness ads on TV more fascinating by the month.

No, the real problem is that the stock markets are just not offering anything right now. And here is where I give you some great trading tips.

When stock markets are rising and financial assets are generally in “RISK ON” mode, you want to own single stocks.

Individual shares have “betas”, or a propensity to move, that is far greater than indexes. If an index rises 10%, some of its individual components can move anywhere from 15%-100%.

When stock markets are in correction (down) or consolidation (sideways) mode, as we are now, the higher betas of stocks work against you. They fall faster than the index.

Therefore, in flat and falling markets you want to trade indexes, like the S&P 500 big cap index (SPY), the NASDAQ technology index (QQQ), and the Russell 2000 small cap index (IWM). Better yet, don’t execute any trades at all, especially if you are already up 60% on the year.

Keep your powder dry. A dollar at a market bottom is worth $10 at a market top.

Your mistakes trading these relatively nonvolatile (read boring) instruments earn you less money. The risk/reward for short-term trading right now is terrible.

Therefore, by trading stocks in up markets and indexes only in down markets, you create an inbuilt bias in your portfolio that works in your favor.

A classic example of how this works was to see the market reactions to corporate earnings announcements in July. In these risk-averse times, winners were rewarded modestly, but losers were taken out to the woodshed and beaten senseless.

Look at the recent charts for Apple (AAPL), Tesla (TSLA), and Disney (DIS) and you’ll see what I mean. I bet the owners of these companies wish they had been trading indexes in August, which barely moved. Is 3% the new 10% correction?

These are all fundamentally great companies for the long term. But when people run for cash, they will often sell whatever has the most profit, and all three of these names met that standard. Investors were, in effect, raiding the piggy bank.

Of course, you can try and be clever and go long stocks in rising markets, and then sell them short in falling ones.

My half-century of experience tells me that this is easier said than done.

While many managers will promise you this bit of investing in gymnastics, very few can actually deliver. Most professionals are unable to time markets with this precision, let alone individuals.

Needless to say, don’t try this at home.