Why I?m Covering My Stock Shorts

I?ll take the home run, thank you very much. Ten handles in the (SPY) on the downside in ten days totally works for me. We have milked this trade for all it?s worth, so it?s hasta la vista baby! Thank you Vladimir Putin!

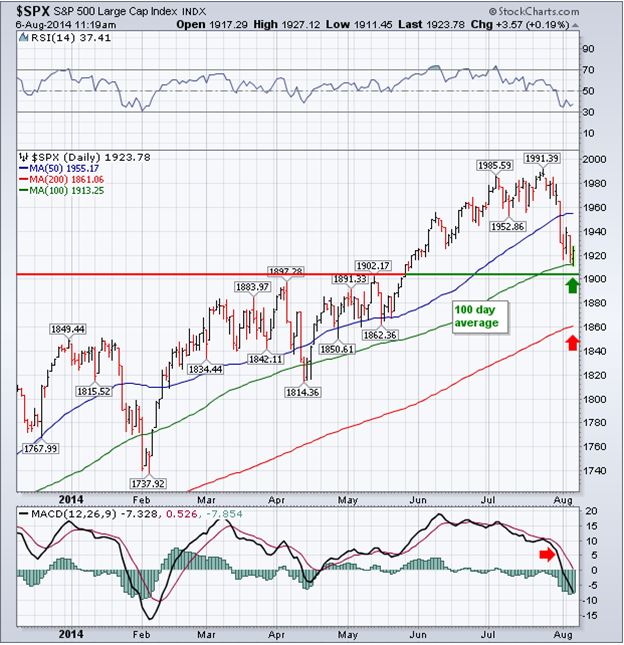

This is not a bad place to de-risk on the short side in stocks. Take a look at the charts below, and you will see a convergence of 100 day and 200 day support levels across several asset classes.

Check out the rock solid support level in the (SPY) at $191, and all of a sudden, buying back shorts here at $191.50 looks like a stroke of brilliance.

It is also interesting to see the suddenly despised junk bond ETF (HYG) hold at the 200 day moving average. Stocks and junk bond price movements are very highly correlated. It makes sense that after showing the most bubbleicious price action, high yield corporate debt led the change on the downside.

By the way, this could also mean that Treasury bonds are about to take a big dump off this morning?s 2.43% yield for the ten year, which is why I?m hanging on to all my short positions there.

We could still see more pain in risk assets. My favorite downside target in the (SPY) is the 200 day moving average at $186. That would give us a top to bottom correction of 6.5% in this cycle, in line with the pullback we saw earlier this year.

That?s where you want to load the boat one more time. When the BSD?s come back from their summer vacations in the Hamptons, Cannes or Portofino, they are going to quickly realize that stocks have been falling, while earnings have been rising.

That means they are going to be cheaper than they have been at any time in 2014. In a world where there is little else to buy, that is a big deal.

We have just entered a period when the seasonals strongly favor investment in equities. That sets up a yearend rally in the indexes that will not be as big as the melt up we saw in 2013, but will be just as welcome. My 2014 (SPY) target of $210, or $2,100 in the (SPX), may not be so Mad after all.

Yes, I know that geopolitics is still a factor. But it looks like both sides in the Gaza conflict have depleted their stockpiles of stupidity for the time being, so things are about to go quiet there.

Vladimir Putin is also likely to back down in the Ukraine because of that throbbing he is increasingly feeling in his pocketbook. The growing leverage and rising costs in the Russian oil industry mean that the recent $11, or 10%, drop in the price of crude cuts Russia?s revenues by 25%. The recession this will eventually bring could be bad enough to lose a future election.

In the end, that is what this is really all about.

I am already starting to draw up short lists to buy on the next turnaround. I?ll shoot out the Trade Alerts when I think the time is right.

Jim Parker! Get your ass back from Rome, per favore! The gelato can?t be that good!