Why SPACs are a Scam

Every investment bubble creates its own special instruments of self-destruction and this one is no different.

There were highly touted leveraged commodity and gold funds during the seventies, portfolio insurance during the eighties, money-losing tech companies with lots of “eyeballs” in the nineties, and subprime lending in the 2000s.

In this cycle, we have the Special Purpose Acquisition Companies, otherwise known as “SPACs.”

The goal of a SPAC is to raise money first on some generalized investment theme and then merge with a target company to achieve those goals.

SPACs have their advantages for some people. It enables start-up companies with no track record to go public faster without the costs and regulatory scrutiny of the burdensome public IPO process. Promoters promise to get investors into the next Amazon (AMZN) or Facebook (FB) early.

Easier said than done.

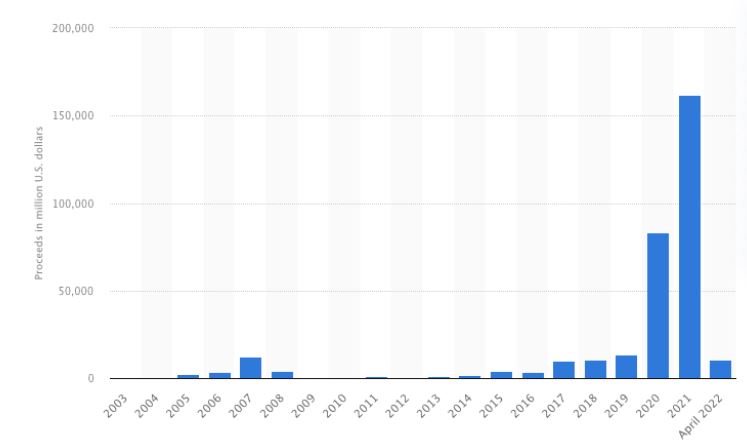

Some $162 billion was raised for SPACs in 2021 followed by a much more modest $15 billion so far in $2022. The largest has been hedge fund manager Bill Ackman’s Pershing Square Tontine Holdings Ltd. (PSTH) at $4 billion. There is even a SPAC for SPACs, the Defiance Gen SPAC Derived ETF (SPAK).

The performance of SPACs so far has been dismal. There have been 915 SPACs created since 2015. Only 93 managed to invest their funds in a target company and only 29 of those have produced a profit. This was during one of the greatest runaway bull markets of all time.

You would have done better to simply buy the cheapest Vanguard index fund. In the meantime, the issuers of SPACs for the most part became wealthy.

The quality of the management who had stepped forward to run SPACs has been mixed at best, including Ackman himself, who recently ran two gargantuan money-losing years back to back. They include former House Speaker Paul Ryan and NBA Hall of Famer Shaquille O’Neil, not exactly known as financial wizards.

Then there’s Nikola (NKLA), an electric/hydrogen vehicle company that has promised to take on Elon Musk, unfazed by the complete lack of a functioning vehicle. These shares have cratered by 92% since their market peak among multiple fraud allegations aimed at the founder.

The risks and limitations of SPACs are legion. You are essentially betting on the good faith and judgment of a single individual unmoored by any filings with the SEC. There are no guarantees they can achieve anything. These disclosures to the government are there to protect you. Without them, you are dancing naked.

The conflicts of interest are enormous. SPAC issuers get to buy the equivalent of call options on their funds at deep discounts prior to issue. When issuers make fortunes overnight with little money upfront you want to run a mile.

And here is the big problem with SPACs. They are essentially roach motel investments, easy to check in but impossible to check out. Liquidity going in is unlimited but coming out is nil. You can often only redeem your investment at a huge discount, or if another buyer is willing to take it out at any price. That makes marks to market challenging at best.

Suffice it to say that if PT Barnum were working in the financial markets, he’d be up to his eyeballs in SPACs.

Personally, I’ll give them a pass. You should too.

The Problem is that it’s a Dummy