Why the Chinese Yuan is Done Falling

There is absolutely no doubt in my mind that the surprise five point spike up in the bond market last week is entirely due to the shocking devaluation of the Chinese Yuan.

Prior to that, fixed income markets were discounting the inevitable rise in US interest rates and fall in the bond market. It is really irrelevant whether Janet makes her move in September, December, or sometime in 2016. The writing is on the wall.

Bonds should start feeling the heat about now.

Yesterday, the Beijing government reduced support for the Yuan for a third time, and then swore on a stack of Chairman Mao?s Little Red Books that this was the last one.

I take them at their word, even though my Mandarin is sparse, to say the least, and I am not inclined to believe anyone.

To continue devaluating would risk importing substantial inflation into the Middle Kingdom. They can get away with this now because the price of their largest import, oil, is in free fall.

It would risk a real currency war with the United States, which is unhappy about seeing all of the past year?s Yuan appreciation undone in a heartbeat.

If China pushes any further, they may see the trading sanctions and anti dumping duties rain down upon them, like a summer typhoon. If you thought the kerfuffle over solar panels, tires, and chicken feet were bad, wait until you see the next batch.

They would also see what little credibility they still have in international markets fall into tatters. No one ever said building a domestic financial system was going to be easy.

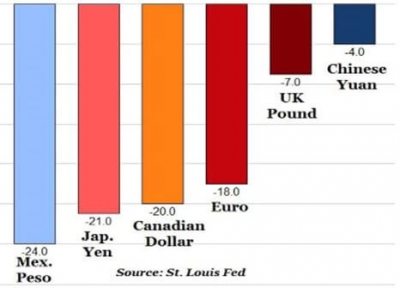

In any case, the Yuan drop we have seen so far is still small bear compared to the much more dramatic declines of other major currencies over the past year, most notably again the Euro (-18%) and the yen (-21%) (see chart below).

Better to keep it that way.

Keeping all this in mind, I am more than happy to take on a new short position in the Treasury bond market through buying the iShares Barclays 20+ Year Treasury Bond Fund (TLT) September, 2015 $128-$131 in-the-money vertical bear put spread.

You can pay up to $2.70 for the spread and still make a decent profit. If you can?t do options, then buy the ProShares Ultra Short 20+ Year Treasury 2X ETF (TBT) outright.

We can take four more points of upside heat if we have to, which would take ten year Treasury yields below 2.00%. I?m happy to bet that is not going to happen.

If the Yuan is truly bottoming out here, it also makes sense to renew my short position in the Euro.

That?s what I did on Monday, buying the Currency Shares Euro Trust (FXE) September, 2015 $112-$115 in-the-money vertical bear put spread at $2.55 or best. You should have gotten the text alert at the opening.

For more depth on the Chinese currency crisis, please click here for ?China?s Firecracker Surprise?.