Why the "Midterm Effect" Rules the Markets

If I had a dime for every trading nostrum I have heard over the past 50 years I would be as rich as Croesus by now. And here's a whopper for you.

A 20% corporate growth rate, a 2% inflation rate, and a 0% stock market: These are numbers you never would expect to see in the same sentence.

Yet, that is what we have at the close today, believe it or not.

And what's worse, this condition could last for another five months. It is clear that something is going on here.

For the past six months, my trading has been wildly successful betting that the stock market would go nowhere until the November 6 midterm elections.

While we have covered an awful lot of ground during this time with a very wide 3,300-point range in the Dow Average (INDU), we have gone absolutely nowhere. As a result, the Mad Hedge Trade Alert Service stands with a 19.83% so far in 2018.

It turns out that trading around midterm congressional elections is far more successful than any other market traditions, like "Sell in May and go Away." Call it the Midterm Effect.

Since the Dow Average was first created on May 26, 1896, the six months going into a midterm produced a feeble 1.4% gain, while the six months after hauled in a whopping 21.8% increase.

In fact, "Sell in May and go away" only works because of the enormous cyclicality of the Midterm Effect, which takes place only every four years. The other three years of that cycle are usually pretty wishy-washy or go the opposite way. Here we are in mid-May, and so far, the Midterm Effect looks pretty good.

The effect only works for midterm elections. It is much less predictive than the Presidential Election Cycle, another popular piece of folk wisdom.

The reason the Midterm Effect works so well is because of human psychology. Investors absolutely hate uncertainty. They are much more inclined to sit on their hands and do nothing ahead of a major market moving event even one 10 months away, when we entered the current range.

They would much rather pay a premium after an event for any securities they might buy rather than being wrong. Money managers tend to be a conservative lot, and this is how conservatism works.

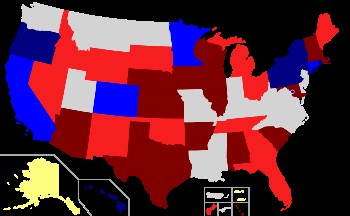

The outcome of the election would have an enormous effect on corporate earnings. According to PredictIt, an online betting site, there is a 67% chance that the Democrats will take the House in November.

If that occurs, no major changes to the economy nor laws pass for at least two years. If that doesn't occur, the president will have a free hand to pursue his existing policies unfettered. However, the election is not for another five months, and in politics that could be five lifetimes.

So range trading it is. Buy the small dips and sell the small rallies for the foreseeable future. Wake me up around Halloween.