Why Uber the IPO Failed

Do you want to invest in a company that loses $1 billion per quarter?

If you do, then Uber, the digital ride-sharing company, is the perfect match for you.

Uber couldn’t have chosen a worse time to go public, smack dab in the middle of a trade war almost as if an algorithm squeezed them into tariff headlines that are currently rocking the equity markets.

The tepid price action to Uber’s first period of being a public company has been nothing short of disastrous with the company tripping right out of the gate at $42.

The company that Travis Kalanick built would have been better served if they decided to go public in the middle of their growth sweet spot a few years ago.

Hindsight is 20/20.

Uber took in $2.58B last year during the same quarter and they followed that up with 20% growth to $3.1B, hardly suggesting they are delivering on hyper-growth an investor desire.

It will probably become the case of Uber hoping to manage growth deceleration as best as it can.

Infamously, the company has been busy putting out fires because of past poor leadership that threatened to blow up their business model.

The fall out was broad-based and current CEO of Uber Dara Khosrowshahi was brought in to subdue the chaos.

That worked out great in 2017 and damage control nullified further erosion in the company, but since then, management has not carved out an attractive narrative.

Just as bad, investors have no hope on the horizon that Uber can mutate into a profitable company.

It seems that costs could spiral out of control and even though the company is growing, the company is not a growth company anymore.

Investors must look themselves in the mirror and really question why they should invest in this company now.

In the short-term, positive catalysts are scarce.

The reaction to their first earnings report was slightly positive as management indicated that competition is easing up, spinning a negative issue into a positive light.

Remember that Uber bled market share after their management issues that I mentioned and Lyft (LYFT) has caught up significantly.

Lyft has also grappled with poor price action to their stock after they went public.

The result from both companies going private to public around the same time means that they will not be able to undercut each other on price because public investors will not give the same type of leash that private investors did.

This will cause losses to cauterize because subsidizing drivers will decelerate, and the pool of drivers will shrink.

In addition, passenger fares could rise because Uber will have no choice but to consider profitability when pricing rides meaning higher costs to the user.

What I am saying rings true for many tech companies and raising prices to satisfy shareholders is not a groundbreaking phenomenon.

As I see it, offering rides on the cheap could be coming to a screeching halt and nurturing margins could be the new order of the day.

The subsidizing effect can be found in the higher than normal gross bookings for the quarter of $14.65 billion, up 34% from the same period in 2018.

Cheaper fares will drive demand, and if Uber stopped helping out with the cost of rides, the 34% would fall to single digits in a heartbeat.

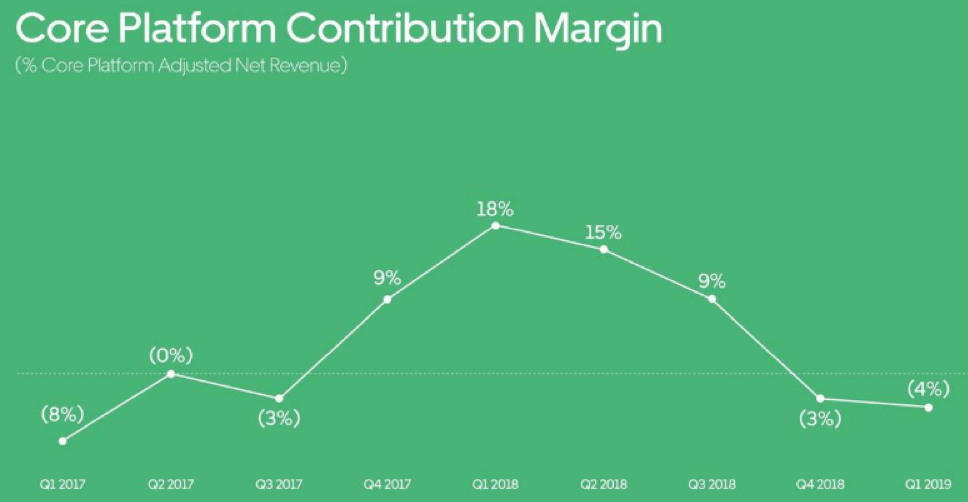

Even more worrying is the negative core platform contribution margin falling 4.5%, meaning the amount of profit it makes from its core platform business divided by adjusted net revenue is on the down.

Uber was able to post a positive 17.9% growth rate during the same period last year.

When the core business is reacting negatively, it’s time to go back to the drawing board.

I believe that the underlying problem with Uber is that they aren’t making any big moves to their business model that would put them in the position to foster hyper-growth.

Incremental changes like removing drivers who fail to collect a 4.6 or above rating and creating a subscription model for its higher growth Uber Eats division are just a drop in the bucket of what they could be doing with its brand and clout.

If investors were waiting for a big step forward with shiny announcements during the first earnings call as a public company, then they were left thirsting for more.

Uber gave us a mini baby step when they need leaps in 2019.

The bigger success might be that Uber had no monumental blow ups which is a telling sign that Uber has at least stabilized operations.

The downside with its food delivery business is that private businesses such as Postmates and DoorDash are private and can still tolerate even bigger losses which will put pressure on Uber Eats to endure the same type of losses.

As it stands, net revenue for its Uber Eats segment rose 31% to $239 million, but then investors must understand this business is scarily exposed and could be attacked by the venture capitalists boding ill for the stock.

Then considering that Uber’s fastest growing geographical segment is Latin America, last quarter was nothing short of abysmal with revenue cratering by 13% to $450 million.

Regulatory risks will cause American companies to take big write-downs the further away they operate from America, and Indian regulation is rearing its ugly head with e-commerce companies bearing the brunt of it.

Looking down the road, Uber has a faulty business model because of a lack of autonomous driving technology, and they will need to partner with a Waymo or Tesla which will destroy margins even more.

Uber has no chance of profitability in the near term, and the data suggests they have lost their growth charm.

Do not buy Uber here, it will become cheaper, and at some point, around $30, this name will be a good trade.

Management needs to up the ante in order to show investors why they are better than Lyft.