Why There Won’t be a Housing Crash

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the recent bubble and if they should panic and sell their homes.

They have a lot to protect.

Since prices hit rock bottom in 2011 and foreclosures crested, the national real estate market has risen by 100%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 200%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. In February, the data were the hottest on record across the board:

* Housing prices are still exploding to the upside with S&P Case Shiller Rising 21%, the one-month biggest spike in history

*Your Check is in the Mail, with the passage of the $1.9 trillion rescue package. A big chunk of this went into housing upgrades

* Goldman Sachs is Forecasting a Jobs Boom, that will take the headline Unemployment Rate down to 3.5% by yearend. Employed people buy houses.

*Workforce at home will double post-pandemic, maintaining demand for large homes. One-third of new stay-at-home workers are never going back.

*We are all now mortgage prisoners, trapped by our 2.75% fixed rate mortgages refied last year. Selling your home and rolling into a 7.5% mortgage isn’t that appealing. Selling so far has been minimal, the markets just shut down.

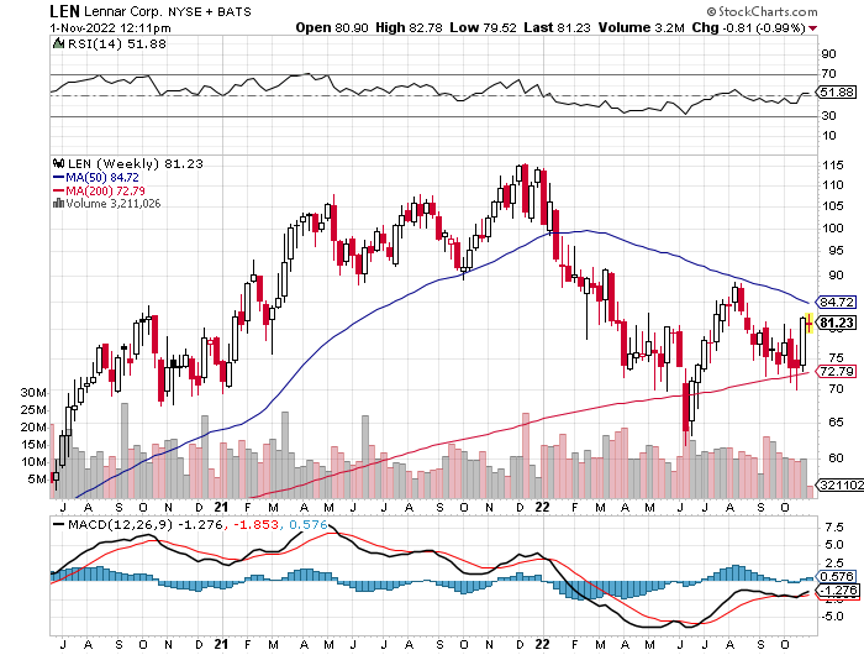

I have a much better indicator of future housing prices than the depressing numbers above. With the way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading since June, I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 35% since then, beating the market by far.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we have just endured two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xers”. When you are losing 20 million consumers, economies don’t grow very fast. For more about millennial investing habits, please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds. That’s what got us to a 0.32% yield in the ten-year at the low.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xers being chased by 85 million of the “Millennial” generation trying to buy their assets!

By then, we will not have built new homes in appreciable numbers for 15 years and a severe scarcity of housing starts. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past many years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that the current administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis, and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

Not to Worry