Why Warren Buffet Hates Gold

The 'Oracle of Omaha' expounded at length today on why he despises the barbarous relic. The sage doesn't really care about the yellow metal, whatever the price. He sees it primarily as a bet on fear.

If investors are more afraid in a year than they are today, then you make money. If they aren't, then you lose money. If you took all the gold in the world, it would form a cube 67 feet on a side, worth $7 trillion. For that same amount of money, you could own other assets with far greater productive power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Seven Apple?s (AAPL), the largest capitalized company in the world.

*You would still have $2 trillion in walking around money left over.

Instead of producing any income or dividends, gold just sits there and shines, letting you feel like you are King Midas.

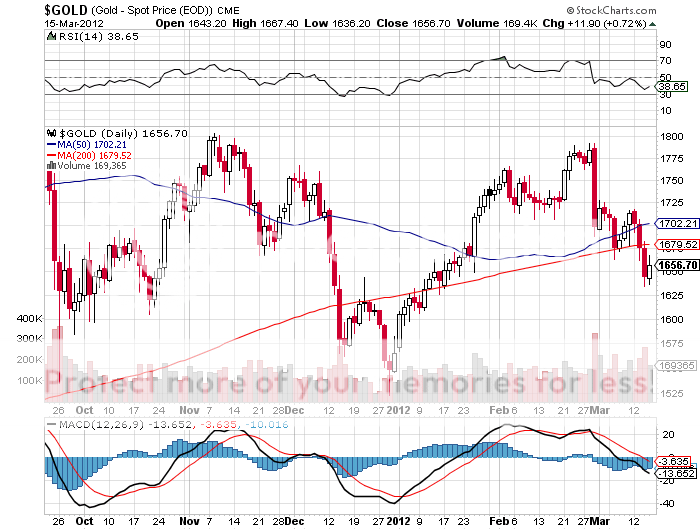

I don't know. With the stock market peaking around here, and oil trading at $105/barrel, a bet on fear looks pretty good to me right now. I'm still sticking with my long term forecast of the old inflation adjusted high of $2,300/ounce. But we may have to visit $1,500 on the way there first.

Maybe Feeling Like King Midas is Not So Bad