Will Bitcoins Replace the $10,000 Bill?

The conspiracy theorists will love this one.

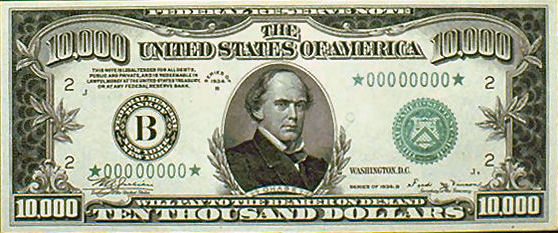

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

In fact, the goal was to flush out income from the rest of us.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

Now organized crime, terrorists, and tax cheats have another means with which to sidestep the IRS: Bitcoin.

When India dumped its high denomination banknotes in 2016, to where did everyone flee? To Bitcoins.

When China clamped down on individuals desperate to get their savings out of the country, what means did they use? Bitcoin.

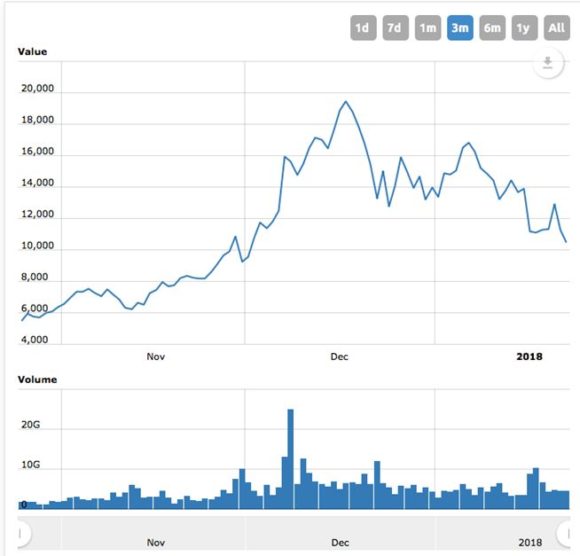

As a result, the price of Bitcoins exploded some 110% to $1,100 over the past six months, and then crashed.

It is an old nostrum that if you block one means to avoid taxes, new ones will spring up to replace them.

This is a classic case.