Will Space X Be Your Next Ten Bagger?

I am constantly on the lookout for ten baggers, stocks that have the potential to rise tenfold over the long term.

Look at the great long-term track records compiled by the most outstanding money managers, and they always have a handful of these that account for the bulk of their out performance, or alpha, as it is known in the industry.

I?ve found another live one for you.

Elon Musk?s Space X is so forcefully pushing forward rocket technology that he is setting up one of the great investment opportunities of the century.

In the past decade, his start up has accomplished more breakthroughs in advanced rocket technology than have been seen in the last half century, since the golden age of the Apollo space program.

As a result, we are now on the threshold of another great leap forward into space. Musk?s ultimate goal is to make mankind an ?interplanetary species?.

There is only one catch.

Space X is not yet a public company, being owned by a handful of fortunate insiders and venture capital firms. But you should get a shot at the brass ring someday.

The rocket launch and satellite industry is the biggest business you have never heard of, accounting for $200 billion a year in global sales. This is probably because there are no pure stock market plays.

Only two major companies are public, Boeing (BA) and Lockheed Martin (LMT), and their rocket businesses are overwhelmed by other aerospace lines.

The high-value-added product here is satellite design and construction, with rocket launches completing the job.

Once dominated by the US, the market for launches has long since been ceded to foreign competitors. The business is now captured by Europe (the Ariane 5), China (the Long March 5), and Russia (the Angara A5).

Until recently, American rocket makers were unable to compete because decades of generous government contracts enabled costs to spiral wildly out of control.

Whenever I move from the private to the governmental sphere, I am always horrified by the gross indifference to costs. This is the world of the $10,000 coffee maker and the $20,000 toilet seat.

Until 2010, there was only a single US company building rockets, the United Launch Alliance (ULA), a joint venture of Boeing and Lockheed Martin. ULA builds the aging Delta IV and Atlas V rockets.

The vehicles are launched from Cape Canaveral, Florida and Vandenberg Air Force Base in California.? I had the privilege of witnessing one such launch. They look like huge roman candles that just keep on going until they disappear into the blackness of space.

Enter Space X.

Extreme entrepreneur Elon Musk has shown a keen interest in space travel throughout his life. The sale of his interest in PayPal, his invention, to Ebay (EBAY) in 2002 for $165 million, gave him the means to do something about it.

He then discovered Tom Mueller, a childhood rocket genius from remote Idaho, who built the largest ever amateur liquid fueled vehicle, with 13,000 pounds of thrust. Musk teamed up with Mueller to found Space X in 2002.

A decade of grinding hard work, bold experimentation, and heart rending testing ensued, made vastly more difficult by the 2008 Great Recession.

Space X?s Falcon 9 first flew in June, 2010 and successfully orbited earth. In December, 2010, it launched the Dragon space capsule and recovered it at sea. It was the first private company ever to accomplish this feat.

Dragon successfully docked with the International Space Station (ISS) in May, 2012. NASA has since provided $440 million to Space X for further Dragon development.

The result was the launch of the Dragon V2 (no doubt another historical reference) in May, 2014. It was large enough to carry seven astronauts.

Space X conducted the first successful flight test of the new Dragon capsule on May 6 of that year.

Then Musk really upped his game by successfully pulling off the first ever landing of a booster rocket on a platform at sea in April, 2016. This is crucial for his plan to dramatically cut the cost of space travel.

Commit all these names to memory. You are going to hear a lot more about them.

Musk?s spectacular success with Space X can be traced to several different innovations.

He has taken the Silicon Valley hyper competitive ethos and financial model and applied it to the aerospace industry:? the home of the bloated bureaucracy, the no bid contract, and the agonizingly long time frame.

For example, his initial avionics budget for the early Falcon 1 rocket was $10,000, and was spent on off-the-shelf consumer electronics. It turns out that their quality had improved so much in recent years they met military standards.

But no one ever bothered to test them. $10,000 wouldn?t have covered the food at the design meetings at Boeing or Lockheed-Martin which would have stretched over years.

Similarly, Musk sent out the specs for a third party valve actuator no more complicated than a garage door opener, and a $120,000, one-year bid came back. He ended up building it in house for $3,000. Musk now tries to build as many parts in house as possible, giving it additional design and competitive advantages.

This tightwad, full speed ahead and damn the torpedoes philosophy overrides every part that goes into Space X rockets.

Amazingly, the company is using 3-D printers to make rocket parts, instead of having them custom made.

Machines guided by computers carve rocket engines out of a single block of inconel nickel-chromium super alloy, foregoing the need for conventional welding, a frequent cause of engine failures.

Space X is using every launch to simultaneously test dozens of new parts on every flight, a huge cost saver that involves extra risks that NASA would never take. It also uses parts that are interchangeable on all its rocket types which is another substantial cost saver.

Space X has effectively combined three nine engine Falcon 9 rockets to create the 27 engine Falcon Heavy, the world?s largest operational rocket. It has a load capacity of a staggering 53 metric tons, the same as a fully loaded Boeing 737. It has half the thrust of the gargantuan Saturn V moon rocket that last flew in 1973.

Musk is able to capture synergies among his three companies not available to any competitor. Space X gets the manufacturing efficiencies of a mass production car maker. Tesla Motors has access to the futuristic space age technology of a rocket maker. Solar City (SCTY) provides cheap solar energy to all of the above.

And herein lies the play.

As a result of all these efforts, Space X today can deliver what ULA does for 76% less money with vastly superior technology and capability. Specifically, its Falcon Heavy can deliver a 116,600 pound payload into low earth orbit for only $90 million, compared to the $380 million price tag for a ULA Delta IV 57, 156 pound launch.

In other words, Space X can deliver cargo to space for $772 a pound, compared to the $7,515 a pound UAL charges the US government. That?s a hell of a price advantage.

You would wonder when the free enterprise system is going to kick in and why Space X doesn?t already own this market.

But selling rockets are not the same as shifting iPhones, laptops, watches, or cars. There is a large overlap with the national defense of every country involved.

Many of the satellite launches are military in nature and top secret. As the cargoes are so valuable, costing tens of millions of dollars each, reliability and long track records are big issues

.

Enter the wonderful world of Washington DC politics. UAL constructs its Delta IV rocket in Decatur, Alabama, the home state of Senator Richard Shelby, the powerful head of the Banking, Finance and Urban Affairs Committee.

The first Delta rocket was launched in 1960, and much of its original ancient designs persist in the modern variants. It is a major job creator in the state.

Shelby has criticized President Obama?s attempt to privatize and modernize the rocket business as ?a faith based initiative.? ULA is a major contributor to Shelby?s campaigns.

ULA has no rocket engine of its own. So it buys engines from Russia, complete with blue prints, hardly a reliable supplier. Magically, the engines have so far been exempted from the economic and trade sanctions enforced by the US against Russia for its invasion of the Ukraine.

ULA has since signed a contract with Amazon?s Jeff Bezos owned Blue Origin, which is also attempting to develop a private rocket business, but is miles behind Space X.

Musk testified in front of Congress in 2014 about the viability of Space X rockets as a financially attractive, cost saving option. His goal is to break the ULA monopoly and get the US government to buy American. You wouldn?t think this would be such a tough job, but it is.

Musk has since sued the US Air Force to open up the bidding.

Elon became a US citizen in 2002 primarily to qualify for bidding on government rocket contracts. This move was to address national security concerns.

NASA did hold open bidding to build a space capsule to ferry astronauts to the International Space Station. Boeing won a $4.2 billion contract while Space X received only $2.6 billion, despite superior technology and a lower price.

It is all part of a 50-year plan that Musk confidently outlined to a venture capital friend of mine two decades ago. So far, everything has played out as predicted.

The Holy Grail for the space industry has long been the building of reusable rockets, thought by many industry veterans to be impossible.

Imagine what the economics of the airline business would be if you threw away the airplane after every flight? It would cost $1 million for one person to fly from San Francisco to Los Angeles.

This is how the launch business has been conducted since the inception of the industry in the 1950s.

Space X is on the verge of accomplishing exactly that. It will do so by using its Super Draco engines and thrusters to land rockets on a platform at sea. Then you just reload propellant and relaunch.

The concept has so far been successfully tested to an altitude of 1,000 meters (click link for the YouTube video: https://www.youtube.com/watch?v=SBUtlOnNc5E .

Attempts to do this from a live launch have had some setbacks (click links for that video where they almost made it: https://www.youtube.com/watch?v=PT0xCSJbt88 and https://www.youtube.com/watch?v=ycLKqRDjoZA), but it was successfully pulled off? (click here:? https://www.youtube.com/watch?v=3G8GJQumBFs

Consequently, launch costs will plummet to pennies on the dollar. If Space X can chop payload costs to under $100, compared to ULAs $7,515, that is a savings which even Richard Shelby can?t argue against.

Talk about disruptive innovation with a turbocharger!

The company is building its own spaceport in Brownsville, Texas that will be able to launch multiple rockets a day.

The Hawthorne, CA factory (where I charge my own Tesla S-1 when in LA) now has the capacity to build 20 rockets a year. This will eventually be ramped up to hundreds.

Space X is the only organization that offers a launch price list on its website, much as Amazon sells its books (http://www.spacex.com/about/capabilities). The Falcon 9 will carry 28,930 pounds of cargo into low earth orbit for only $60.2 million. Sounds like a bargain to me.

Space X currently has $5 billion in contracts to fly over 50 missions for a variety of private and governmental entities, making the company cash flow positive. This includes a $1.6 billion NASA contract to supply the (ISS).

This no doubt includes an assortment of tax breaks which Musk has proven adept at harvesting. Elon has been a quick learner about the ways of Washington.

Customers have included the Thai telecommunications firm, Rupert Murdock?s Sky News Japan, an Israeli telecommunications group, and the US Air Force.

So, when do we mere mortals get to buy the stock? Musk estimates at 12 flights a year the company will earn a 10% return on capital, making it worth $4-5 billion.

The current exponential growth in broadband will lead to a similar growth in satellite orders and therefore rocket launches. So, the commercial future of the company looks especially bright.

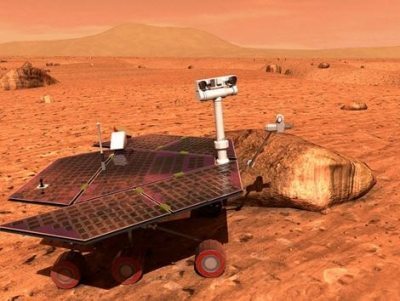

However, Musk is in no rush to go public. A permanent, viable, and sustainable colony on Mars has always been a fundamental goal of Space X. It would be a huge distraction for a publicly managed company. That makes it a tough sell to investors in the public markets.

You can well imagine that the next recession would bring cries from shareholders for cost cutting that would put the Mars program at the top of any list of projects to go on the chopping block. So Musk prefers to wait until the Mars project is well established before entertaining an IPO.

Musk expects to launch a trip to Mars by 2025 and establish a colony that will eventually grow to 80,000. Tickets will be sold for $500,000.

There are other considerations. Many employees and early venture capital investors wish to realize their gains and move on. Public ownership would also give the company extra ammunition for cutting through Washington red tape. These factors point to an IPO that is earlier than later.

On the other hand, Musk may not care. The last net worth estimate I saw for him was $13 billion. If his three companies increase in value by ten times over the next decade, as I expect, that would increase his wealth to $130 billion, making him the richest person in the world.

If an IPO does come, investors should jump in with both feet. While the value of the firm may have already increased tenfold by then, there may be another tenfold gain to come. Get on the Elon Musk train before it leaves the station.

To describe Elon as a larger than life figure would be something of an understatement. Musk is the person on which the fictional playboy/industrialist/technology genius, Tony Stark, in the Iron Man movies is based.

When the Disney movie, Tomorrowland,?was released,? a Tesla supercharging station featured prominently. Elon takes all of this in good humor. He loaned a Tesla roadster to the film producers.

Musk says he wishes to die on Mars, but not on impact. Perhaps, it would be the ideal retirement for him, say around 2045, when he will be 75.

To visit the Space X website, please click link: http://www.spacex.com . It offers very cool videos of rocket launches and a discussion with Elon Musk on the need for a Mars mission.