Winging My Way Back From China

I am writing TO you from my first class seat on Singapore Airlines, winging my way the 12 hours from Hong Kong to San Francisco. While most airlines jettisoned their first class sections years ago as a cost saving measure, Singapore carried on to maintain its reputation as the best airline in the world. The small section at the front of the bus is populated with a few Chinese billionaires, Taipans, and CEO?s flying at shareholder expense. They are transported in untold luxury with a fully flat bed almost the size of a regular single and a 24 inch high HDTV with a vast movie library. The plane carries double the number of stewardesses on American airliners.

They say a change is as good as a vacation, and this trip certainly fit the bill. I covered 23,000 miles in 17 days, which is really a trip around the world, touching down in New Zealand, Australia, Singapore, Hong Kong, and mainland China. The people I met were fascinating, and included a Maori chieftain, an Australian media mogul, gold miners from Queensland, sheep farmers in New South Wales, Chinese bankers, a Singaporean F-5 combat pilot, and senior officials from the People?s Republic of China. I even managed to track down a Chinese renegade rare earth miner on his day off, and the good news is that he didn?t shoot me, as long as I didn?t take pictures.

I heard some amazing stories and gained some first class intelligence, which I will translate into killer trading opportunities. I will be feeding these out as fast as these old, arthritic and scarred fingers can type them. Alas, I can only knock out about 1,500 words a day before it starts to turn to mush and my back gives out. I will be publishing a series of Pacific country reports over the next four Fridays.

The market? Ohhhh, you want me to talk about the market! Let me give you my quickie read here. My fall rally kicked in right on schedule, my call to cover all shorts coming within a point of the actual bottom in the (SPX). This is the closest I have ever come picking an absolute bottom. After that, it was off to the races with a ?RISK ON? trade with a vengeance. Corporate earnings are coming in much better than anticipated.

This has triggered a buying stampede for all risk assets as hedge fund traders rush to cover shorts and conventional managers frenetically readjust substantial underweight positions they only recently achieved. This has truly been the year from hell, and the word is that 40% of active managers are underperforming their benchmarks by 250 basis points or more.

Having discounted a double dip recession that was never going to happen, Mr. Market is now backing that possibility out again. The net result of all this was to take the S&P 500 from a 1,075 bottom up 17% to just short of my target at the 200 day moving average of 1,275. The entire script unfolded exactly as I expected. Followers of my Macro Millionaire trading service got the memo in my October 8 webinar, The Short Game is Over, and have been laughing all the way to the bank since then. Their year to trade performance now stands at a new high of 42.13%.

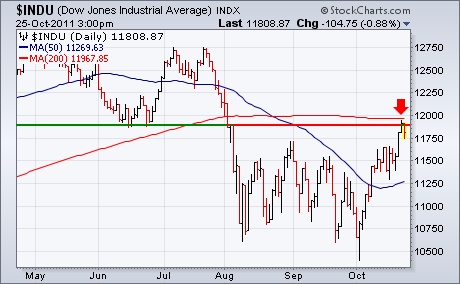

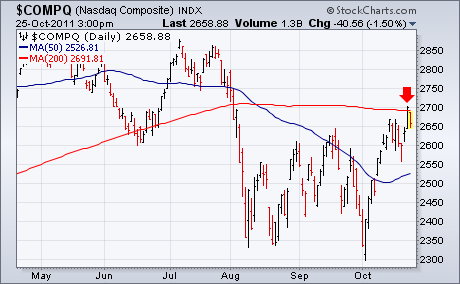

The easy money in this move has been made, and we are now bumping up against 200 day moving averages across all equity classes. Expect a prolonged battle to be fought here. So this is not a great place to initiate new positions. Bonds have died, but yields have not risen as much as I would have thought, given the ebullience of the price action.

The (TBT) is the sole position I currently have in my portfolio, and it has only picked up a measly 23% in this move. I would have expected more.

Expect the rally to fail several times at these levels before they make further progress. There is a lot of hot money to flush out here before they can mount a break out to the upside. Take a look at the chart for crude oil and the (USO), which is telling you that this risk on will have longer legs than most expect. What will be the trigger? Surprise progress on the European sovereign debt crisis, or even a deliberate kicking of the can down the road.

One additional note. You have noticed some modifications to the website. No, it has not had a sex change operation to get even with me for my absence. I am launching a major upgrade, redesign, and improvement in functionality, plowing in new capital that thousands of new subscribers have afforded me. The final version will be up and running in a couple of days. But like all great birthing events, this was has not without surprises, difficulties, and setbacks.

Rather than willingly give up its toys to the new kid on the block, our hosting service has chosen to break them instead. In addition, moving over two War and Peace?s on the Internet, the extent of the content I have written over the past four years, is no piece of cake. It took Tolstoy seven years just to write it once, but that was in long hand with a quill pen, so I?ll forgive the old man.

For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put ?Macro Millionaire? in the subject line, as we are getting buried in emails.